Source: PaxForex Premium Analytics Portal, Fundamental Insight

Within the previous couple of years, General Electric has been continually selling assets trying to streamline the business, withdraw less beneficial business divisions, and optimize its weakened financial performance.

GE's Power division has been a key focus of this restructuring since the segment's revenues and profits plunged a few years ago. GE has made significant progress over the past few years in streamlining its power business, which has led to enhanced results. Furthermore, the business may be about to announce one more significant step: the sale of its nuclear turbine business.

In 2016, General Electric's energy business produced $5.1 billion in operating profits on revenues of $36.8 billion, with a subsequent change in the definition of business divisions. Only a couple of years succeeding, revenue had fallen to $27.3 billion, and the division had a loss of $808 million.

That steep collapse - combined with GE's growing pension deficit and huge declines in the company's insurance operations - urged the company to reevaluate its power business from the very scratch.

The essence of GE Power is the construction and maintenance of gas turbines. This part of the business has powerful collaboration with the industrial conglomerate's aviation business.

What's more, it is already recovering. At the beginning of 2021, management assessed that the gas power business would bring high single-digit operating margins and free cash flow growth in 2021.

The rest of the electric power segments may offer GE less. As a result, the company is scaling back its operations in that segment. In late 2017, it decided to sell its industrial solutions business (which made power grid equipment) to ABB for $2.6 billion. Less than a year later, the company beat a $3.25 billion deal to sell its distributed energy business to private equity firm Advent International.

Finally, last September, GE announced that it would "exit the new-build coal-fired power market" as it switches its business to lower-carbon technologies. The company anticipates completing most of its existing new coal-fired power plant projects by the end of next year.

Gas power generated $12.7 billion of GE Power's $17.6 billion in revenue last year. Most of the remaining revenue, $3.7 billion, came from GE's steam-power division. That included nearly $1.4 billion from the new coal business, which GE is winding down, about $300 million from new steam turbines for nuclear power plants, and about $2 billion from services for existing coal and nuclear power plants.

Earlier this year, GE forecasted that revenues from new nuclear turbines would rise to $900 million by 2023, while services revenues would remain about the same. But now, GE is thinking of selling its nuclear turbine business to French utility giant EDF for $1.2 billion.

GE's interest in such a deal should come as no surprise. In early 2020, Bloomberg reported that the company wanted to sell its entire steam-power division. Since GE has already exited new-build coal power, selling the nuclear turbine business would essentially accomplish that goal by reducing the steam power business to services for old customers, especially in coal-fired power.

Years of restructuring attempts are paying off for GE's gas power business, which will reach high single-digit segment margins this year. Management sees opportunities for further margin enhancement over the next few years and a 90%+ free cash flow conversion.

In contrast, the rest of GE Power - including the steam power division - appears to be losing money and burning cash. GE could probably get the steam-power division back to profitability within a few years, but it represents an unnecessary distraction. With projected revenue of only $3 billion in 2023 (including services and new nuclear turbines), low profitability, and minimal long-term growth potential, the steam-power division represents an unnecessary distraction relative to its value.

If GE can sell its nuclear turbine business, the company will get a small cash infusion to help it continue to reduce its debt load. At the same time, the company would get rid of an exit project with modest growth potential, allowing management to concentrate more on GE's core long-term growth drivers. It looks like a win-win.

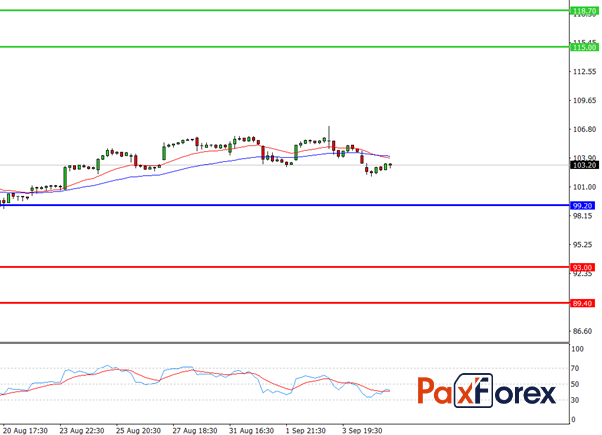

As long as the price is above the 99.20 level, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 103.20

- Take Profit 1: 115.00

- Take Profit 2: 118.70

Alternative scenario:

If the level of 99.20 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 99.20

- Take Profit 1: 93.00

- Take Profit 2: 89.40