Source: PaxForex Premium Analytics Portal, Fundamental Insight

UK GfK Consumer Confidence for October was reported at -31. Economists predicted a figure of -28. Forex traders can compare this to UK GfK Consumer Confidence for September, reported at -30. UK Retail Sales for September increased by 1.5% monthly and by 4.7% annualized. Economists predicted an increase of 0.4% and 3.7%. Forex traders can compare this to UK Retail Sales for August, which increased by 0.9% monthly and by 2.7% annualized. UK Core Retail Sales for September increased by 1.6% monthly and by 6.4% annualized. Economists predicted an increase of 0.5% and 5.0%. Forex traders can compare this to UK Core Retail Sales for August, which increased by 0.6% monthly and by 4.3% annualized.

The Preliminary UK Markit Manufacturing PMI for October is predicted at 54.3. Forex traders can compare this to the UK Markit Manufacturing PMI for September, reported at 54.1. The Preliminary UK Markit Services PMI for October is predicted at 55.0. Forex traders can compare this to the UK Markit Services PMI for September, reported at 56.1. The Preliminary UK Markit Composite PMI for October is predicted at 55.6. Forex traders can compare this to the UK Markit Composite PMI for September, reported at 55.7.

The Preliminary US Markit Manufacturing PMI for October is predicted at 53.4. Forex traders can compare this to the US Markit Manufacturing PMI for September, reported at 53.2. The Preliminary US Markit Services PMI for October is predicted at 54.6. Forex traders can compare this to the US Markit Services PMI for September, reported at 54.6.

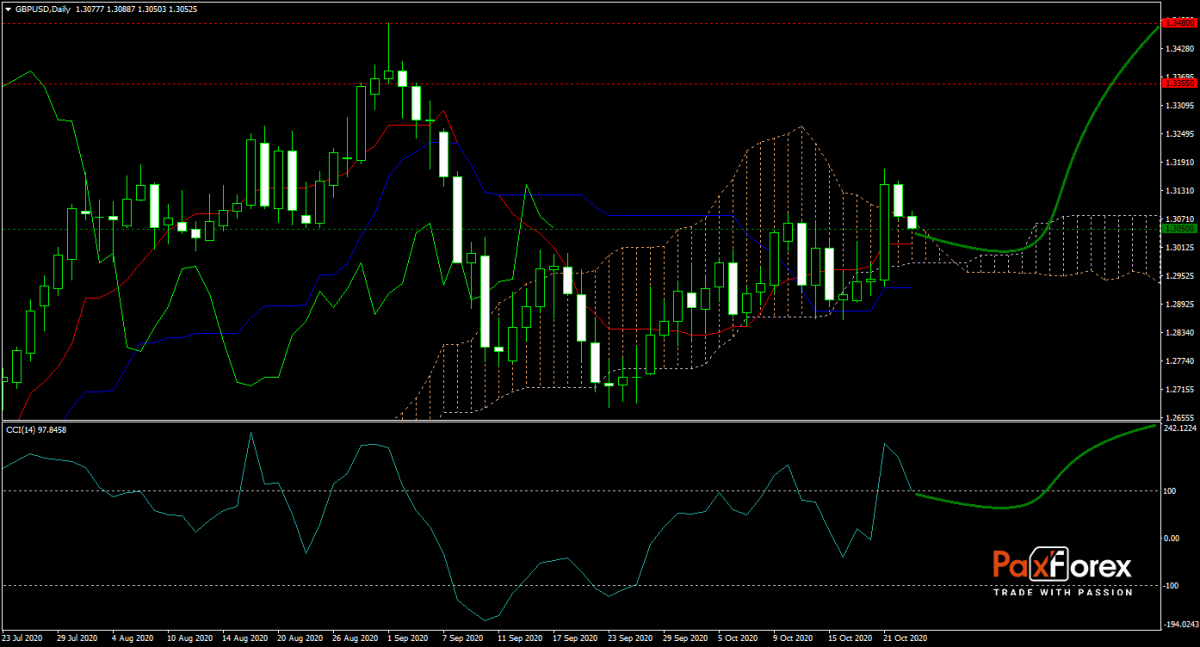

The forecast for the GBP/USD remains bullish after a small retracement. Today’s retail sales data surprised to the upside, and price action continues to trade above its Ichimoku Kinko Hyo Cloud. The Kijun-sen and Tenkan-sen are trending sideways, and the CCI is in extreme overbought territory but is off its peak with plenty of upside potential. A minor dip will allow this currency pair to resume its rally. Will bulls deliver today? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.3020 to 1.3090 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3055

- Take Profit Zone: 1.3355 – 1.3480

- Stop Loss Level: 1.2950

Should price action for the GBP/USD breakdown below 1.3020 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2950

- Take Profit Zone: 1.2820 – 1.2865

- Stop Loss Level: 1.3020

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.