The UK Jobless Claims Change for February is predicted at 21.4K, and the Claimant Count Rate is predicted at 3.4%. Forex traders can compare this to the UK Jobless Claims Change for January, which was reported at 5.5K and to the Claimant Count Rate, which was reported at 3.4%. The UK Employment Change for the tri-monthly period ending in January is predicted at 140K, and the ILO Unemployment Rate is predicted at 3.8%. Forex traders can compare this to the UK Employment Change for December, which was reported at 180K and to the ILO Unemployment Rate, which was reported at 3.8%. Average Weekly Earnings for the tri-monthly period ending in January are predicted to increase by 3.0% annualized, and Average Weekly Earnings Excluding Bonuses are predicted to increase by 3.2% annualized. Forex traders can compare this to Average Weekly Earnings for December, which increased by 2.9% and Average Weekly Earnings Excluding Bonuses, which increased by 3.2%.

US Advanced Retail Sales for February are predicted to increase by 0.2% monthly, and Retail Sales Less Autos are predicted to increase by 0.1% monthly. Forex traders can compare this to US Advanced Retail Sales for January, which increased by 0.3% monthly and to Retail Sales Less Autos, which increased by 0.3% monthly. Retail Sales Less Autos and Gas for February are predicted to increase by 0.4% monthly, and Retail Sales Control Group are predicted to increase by 0.4% monthly. Forex traders can compare this to Retail Sales Less Autos and Gas for January, which increased by 0.4% monthly and to Retail Sales Control Group, which were reported flat at 0.0% monthly.

US Industrial Production for February is predicted to increase by 0.4% monthly, and Manufacturing Production is predicted to increase by 0.3% monthly. Forex traders can compare this to US Industrial Production for January, which decreased by 0.3% monthly and to Manufacturing Production which decreased by 0.1% monthly. Capacity Utilization for February is predicted at 77.1%. Forex traders can compare this to Capacity Utilization for January, which was reported at 76.8%. US Business Inventories for January are predicted to decrease by 0.1% monthly. Forex traders can compare this to US Business Inventories for December, which increased by 0.1% monthly.

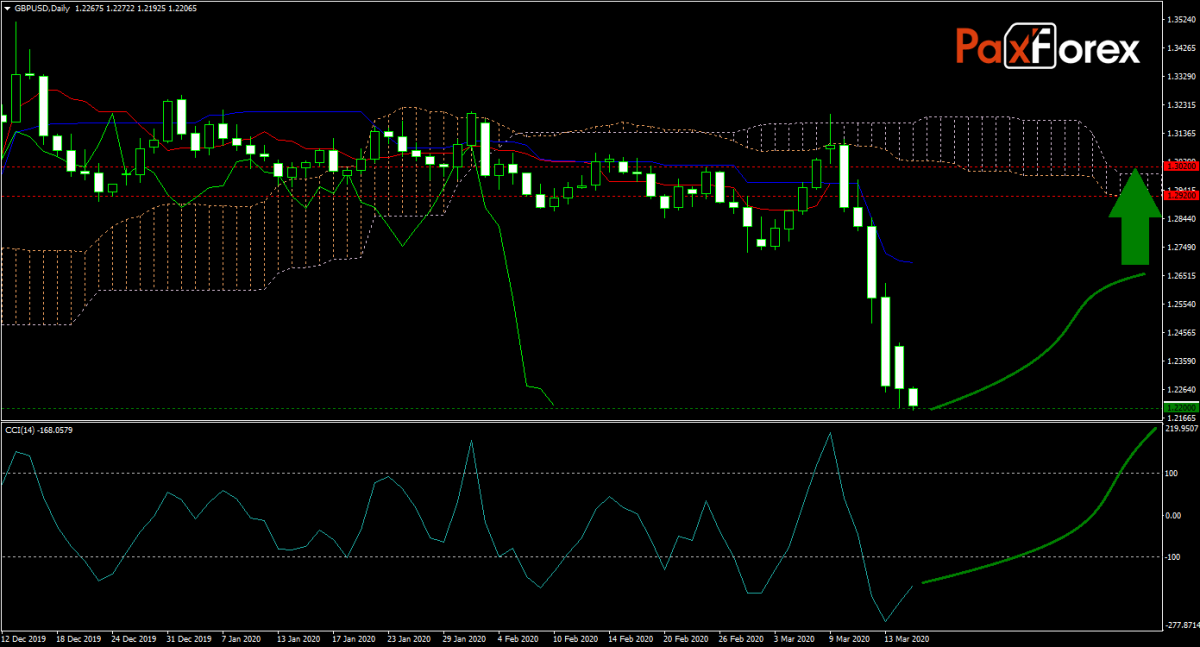

The US NAHB Housing Market Index for March is predicted at 74. Forex traders can compare this to the US NAHB Housing Market Index for February, which was reported at 74. US JOLTS Job Openings for January are predicted at 6.402M. Forex traders can compare this to US JOLTS Job Openings for December, which were reported at 6.423M. After the GBP/USD plunged, the forecast is turning bullish again. Will today’s data allow for a recovery to take place? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.2150 to 1.2275 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2200

- Take Profit Zone: 1.2920 – 1.3020

- Stop Loss Level: 1.2100

Should price action for the GBP/USD breakdown below 1.2150 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2100

- Take Profit Zone: 1.1960 – 1.2035

- Stop Loss Level: 1.2150

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.