Source: PaxForex Premium Analytics Portal, Fundamental Insight

The UK Construction PMI for June is predicted at 63.8. Forex traders can compare this to the UK Construction PMI for May, reported at 64.2.

The US Final Markit Services PMI for June is predicted at 64.8, and the US Final Markit Composite PMI is predicted at 63.9. Forex traders can compare this to the US Markit Services PMI for May, reported at 70.4, and to the US Markit Composite PMI, reported at 68.7. The US ISM Non-Manufacturing PMI for June is predicted at 63.5, and the ISM Non-Manufacturing Business Activity Index at 66.3. Forex traders can compare this to the US ISM Non-Manufacturing PMI for May, reported at 64.0, and to the ISM Non-Manufacturing Business Activity Index, reported at 66.2.

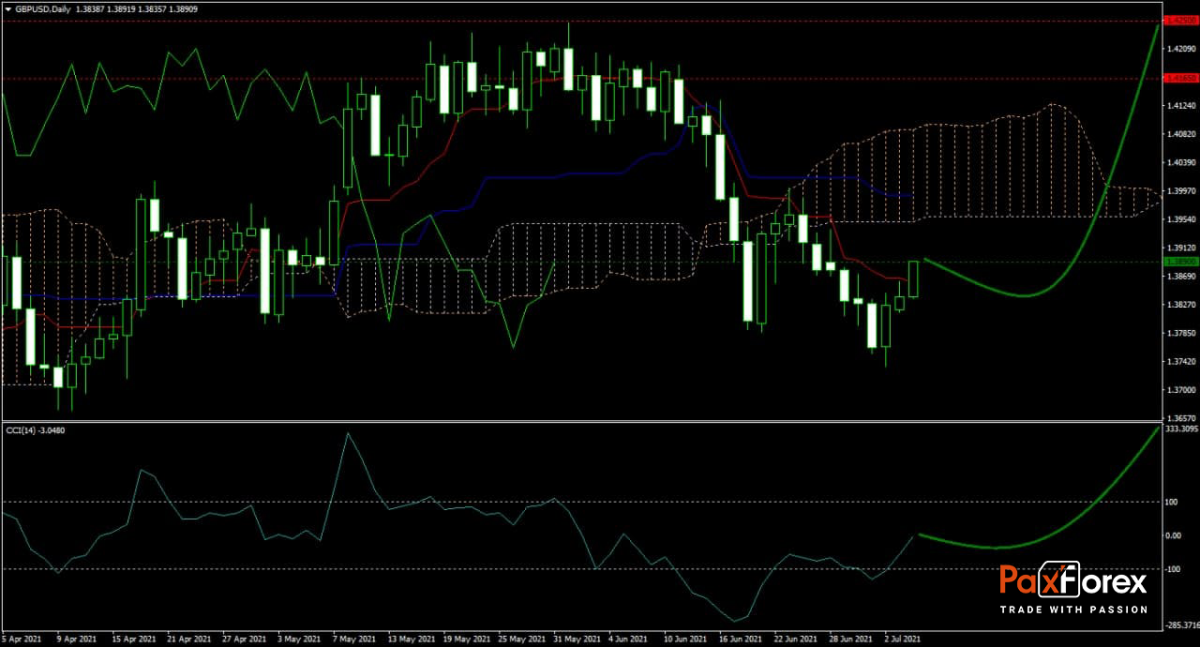

The forecast for the GBP/USD continues to gain bullish momentum after reversing its most recent correction. While the Tenkan-sen is descending, the Kijun-sen turned sideways, and the Ichimoku Kinko Hyo Cloud maintains its bullish bias. Short-term volatility may remain, but the overall trend favors more upside. The CCI completed a breakout from extreme oversold territory and has plenty of upside potential. Can bulls continue to push price action higher until the GBP/USD reaches its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.3865 to 1.3950 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3890

- Take Profit Zone: 1.4165 – 1.4250

- Stop Loss Level: 1.3815

Should price action for the GBP/USD breakdown below 1.3865, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3815

- Take Profit Zone: 1.3700 – 1.3735

- Stop Loss Level: 1.3865

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.