Source: PaxForex Premium Analytics Portal, Fundamental Insight

The UK Employment Change for the tri-monthly period ending in November is predicted at -100K, and the ILO Unemployment Rate is predicted at 5.1%. Forex traders can compare this to the UK Employment Change for November, reported at -144K, and to the ILO Unemployment Rate, reported at 4.9%. Average Weekly Earnings for the tri-monthly period ending in November are predicted to increase by 2.9% annualized, and Average Weekly Earnings Excluding Bonuses are predicted to increase by 3.2% annualized. Forex traders can compare this to Average Weekly Earnings for October, which increased by 2.7%, and Average Weekly Earnings Excluding Bonuses, which increased by 2.8%.

The UK Jobless Claims Change for December is predicted at 35.0K. Forex traders can compare this to the UK Jobless Claims Change for November, reported at 64.3K. The UK CBI Distributive Sales Survey for January is predicted at -28. Forex traders can compare this to the UK CBI Distributive Sales Survey for December, reported at -3.

The US S&P/Case-Shiller Composite 20 for November is predicted to increase by 1.00% monthly and 8.60% annualized. Forex traders can compare this to the US S&P/Case-Shiller Composite 20 for October, which increased by 1.60% monthly and 7.90% annualized. US Consumer Confidence for January is predicted at 89.0. Forex traders can compare this to US Consumer Confidence for December, reported at 88.6.

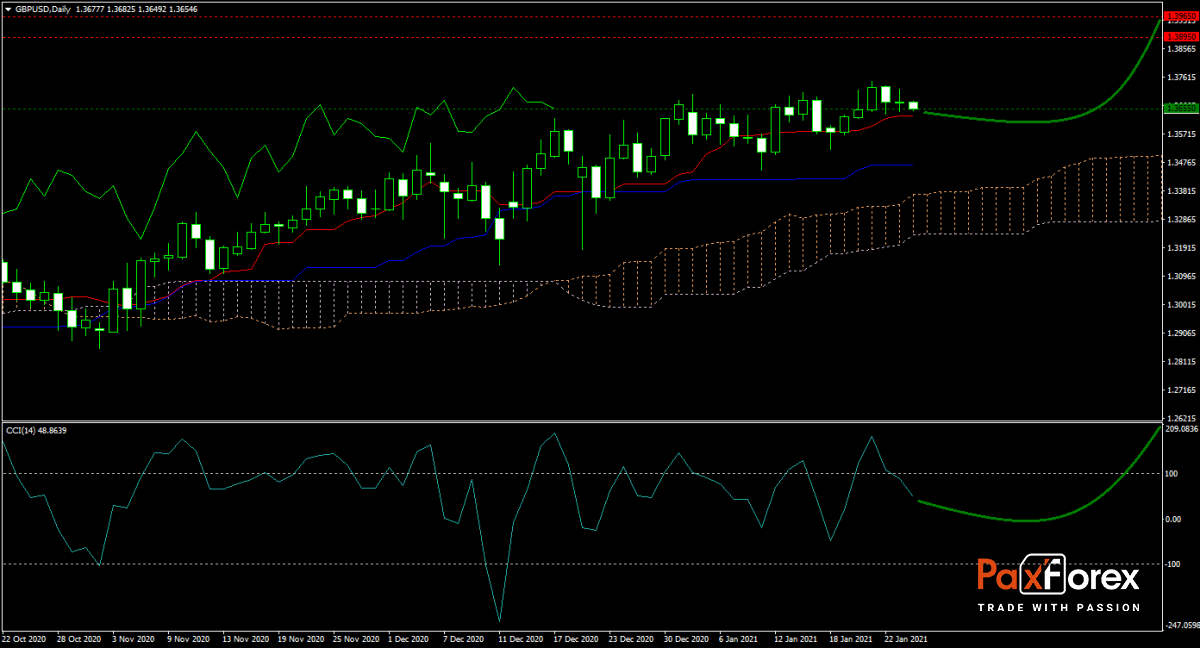

The forecast for the GBP/USD remains bullish after it moved above its Tenkan-sen. Traders should brace for a rise in volatility as both the Tenkan-sen and Kijun-sen entered a sideways trend. Fundamental developments for the UK favor more upside, while bearish pressures on the US Dollar are dominant. The CCI retreated from extreme overbought territory and is likely to accelerate higher from current levels. Adding to the bullish outlook is the slowly ascending Ichimoku Kinko Hyo Cloud. Can bulls overrun bear until they reach the next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.3635 to 1.3720 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3655

- Take Profit Zone: 1.3895 – 1.3965

- Stop Loss Level: 1.3580

Should price action for the GBP/USD breakdown below 1.3635 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3580

- Take Profit Zone: 1.3390– 1.3465

- Stop Loss Level: 1.3635

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.