Source: PaxForex Premium Analytics Portal, Fundamental Insight

UK Nationwide House Prices for December to increase by 0.4% monthly and by 6.7% annualized. Forex traders can compare this to UK Nationwide House Prices for November, which increased by 0.9% monthly and by 6.5% annualized. The US Chicago PMI for December is predicted at 57.0. Forex traders can compare this to the US Chicago PMI for November, reported at 58.2. US Pending Home Sales for November are predicted to increase by 0.2% monthly. Forex traders can compare this to US Pending Home Sales for October, which decreased by 1.1% monthly.

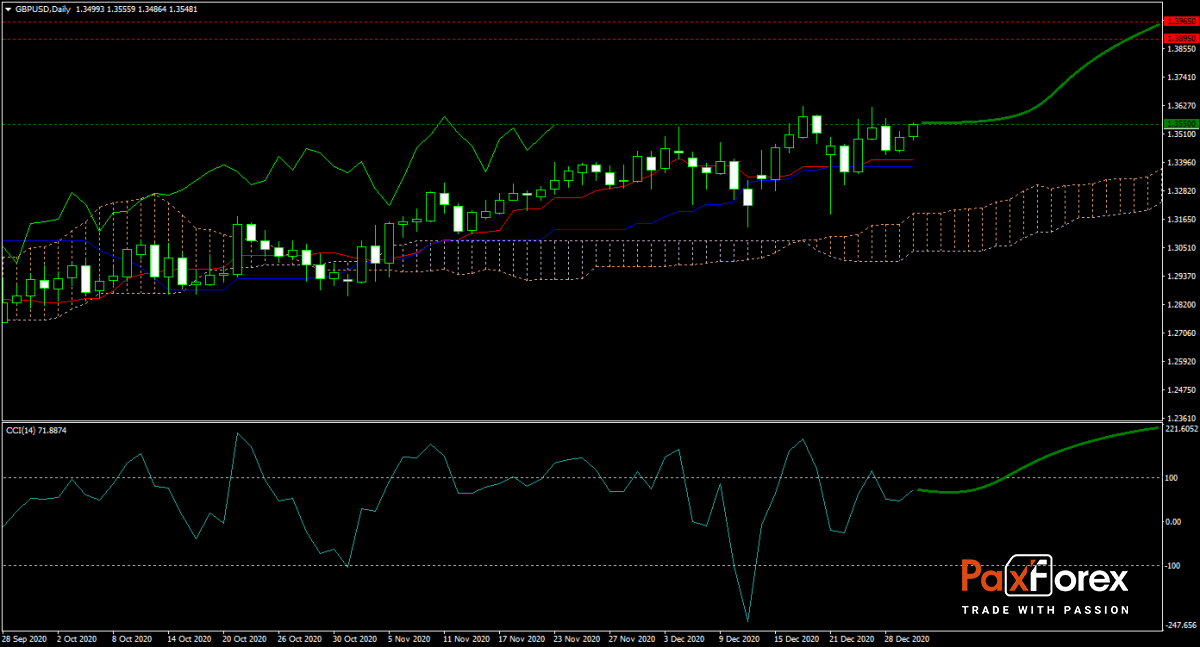

The forecast for the GBP/USD remains bullish and gathers pace. With the UK free of the EU in less than 48 hours, the upside potential expands. Adding to bullish momentum is ongoing weakness out of the US, with financial markets braced for lower returns during the pending Biden presidency. Price action moved above the Kijun-sen and Tenkan-sen, but both entered a sideways trend, suggesting a minor pause before the next push higher. The GBP/USD is above its ascending Ichimoku Kinko Hyo Cloud, and the CCI moved out of extreme overbought conditions with more upside potential. Can bulls take advantage of it and pressure this currency pair into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.3485 to 1.3620 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3550

- Take Profit Zone: 1.3895 – 1.3965

- Stop Loss Level: 1.3435

Should price action for the GBP/USD breakdown below 1.3485 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3435

- Take Profit Zone: 1.3190– 1.3235

- Stop Loss Level: 1.3485

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.