Source: PaxForex Premium Analytics Portal, Fundamental Insight

New Zealand Electronic Retail Card Spending for September increased by 5.4% monthly and by 7.3% annualized. Forex traders can compare this to New Zealand Electronic Retail Card Spending for August, which decreased by 8.9% monthly and by 0.8% annualized. New Zealand Food Prices for September decreased by 1.0% monthly. Forex traders can compare this to New Zealand Food Prices for August, which increased by 0.7% monthly.

The Chinese Trade Balance for September was reported at $37.00B. Economists predicted a figure of $58.00B. Forex traders can compare this to the Chinese Trade Balance for August, reported at $58.93B. Exports for September increased by 9.9% annualized, and Imports increased by 13.2% annualized. Economists predicted an increase of 10.0% and 0.3%. Forex traders can compare this to Exports for August, which increased by 9.5% annualized, and to Imports, which decreased by 2.1% annualized.

The UK Jobless Claims Change for September was reported at 28.0K. Economists predicted a figure of 78.8K. Forex traders can compare this to the UK Jobless Claims Change for August, reported at 73.7K. The UK Employment Change for the tri-monthly period ending in August was reported at -153K, and the ILO Unemployment Rate was reported at 4.5%. Economists predicted a reading of -30K and 4.3%. Forex traders can compare this to the UK Employment Change for July, reported at -12K and to the ILO Unemployment Rate, reported at 4.1%. Average Weekly Earnings for the tri-monthly period ending in August were reported flat at 0.0% annualized, and Average Weekly Earnings Excluding Bonuses increased by 0.8% annualized. Economists predicted a decrease of 0.6% and an increase of 0.6%. Forex traders can compare this to Average Weekly Earnings for July, which decreased by 1.0%, and to Average Weekly Earnings Excluding Bonuses, which increased by 0.2%.

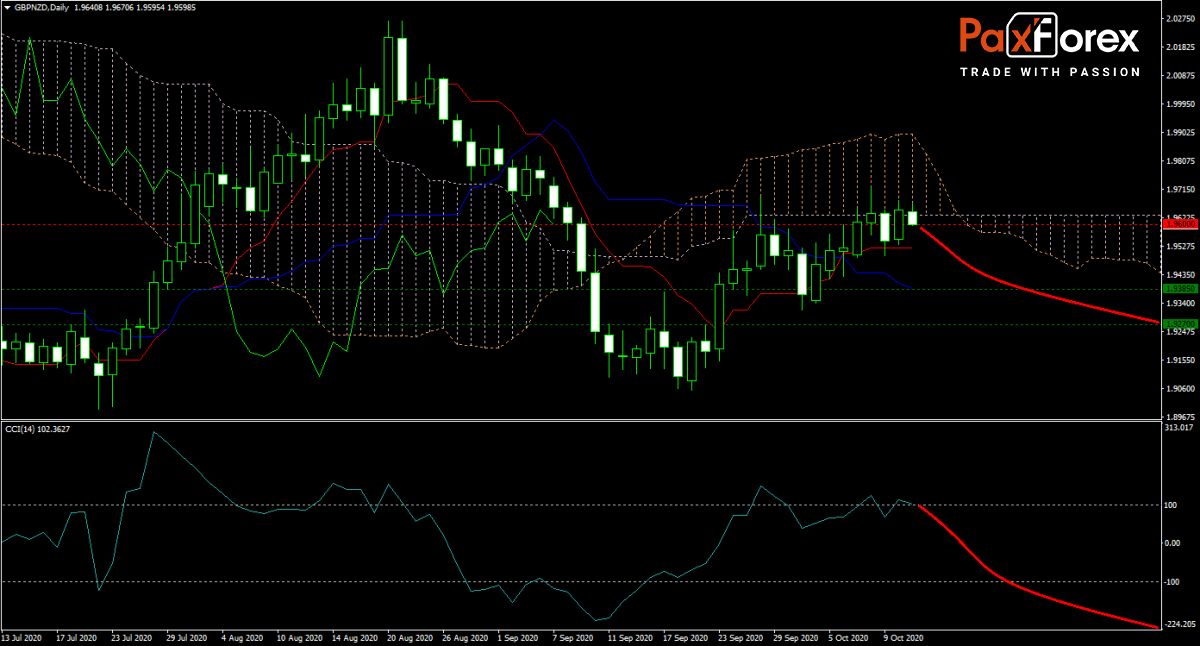

The forecast for the GBP/NZD turned bearish in the short-term, with the CCI in extreme overbought conditions. Price action was rejected by its Ichimoku Kinko Hyo Cloud, but remains above the flatlining Tenkan-sen. The Kijun-sen is descending and has reached the upper band of its horizontal support area. British PM Johnson announced a new 3-Tier Covid-19 response system, aimed at balancing restrictions with economic activity. Will bears be able to pressure this currency pair into a minor sell-off, or will bulls push for more upside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/NZD remain inside the or breakdown below the 1.9565 to 1.9680 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.9600

- Take Profit Zone: 1.9270 – 1.9385

- Stop Loss Level: 1.9725

Should price action for the GBP/NZD breakout above 1.9680 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.9725

- Take Profit Zone: 1.9925 – 2.0000

- Stop Loss Level: 1.9680

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.