Source: PaxForex Premium Analytics Portal, Fundamental Insight

New Zealand Credit Card Spending for November decreased by 5.6% annualized. Forex traders can compare this to New Zealand Credit Card Spending for October, which decreased by 6.0% annualized. The UK CBI Distributive Sales Survey for December is predicted at -35, and UK CBI Industrial Trends Orders for December are predicted at -39. Forex traders can compare this to the UK CBI Distributive Sales Survey for November, reported at -25, and to CBI Industrial Trends Orders, reported at -40.

After the UK identified a mutation of the Covid-19 virus, a variant that spreads faster and became the dominant string, Prime Minister Boris Johnson announced an update to the three-tier lockdown system by adding a fourth one. It is unclear if the virus mutated enough to render the vaccine useless, but it offers a reminder that the fight against Covid-19 is ongoing and not close to the end. The UK is set to receive a Brexit boost in 2021 and beyond, adding bullishness to the British Pound after the world’s sixth-largest economy frees itself from the European Union to embark on a business-friendly economic path.

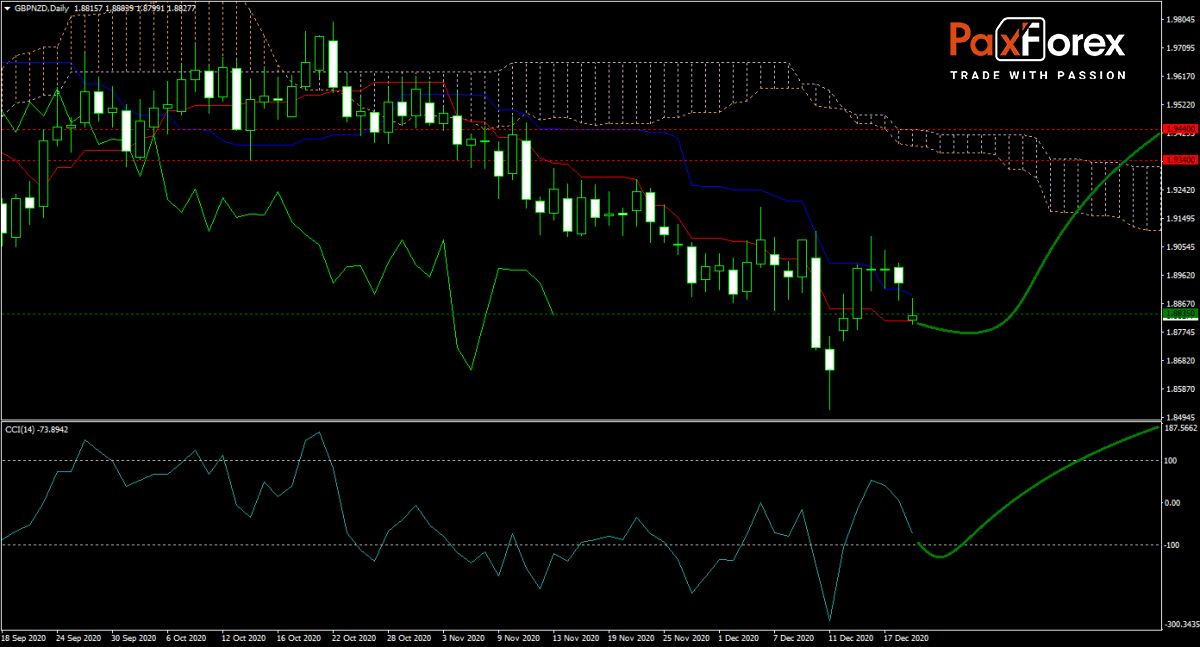

The forecast for the GBP/NZD turned bullish after its most recent sell-off dropped price action into its sideways trending Tenkan-sen. With selling pressure easing, this currency pair could enter a reversal and short-covering rally into its descending Ichimoku Kinko Hyo Cloud. The CCI approaches extreme oversold conditions but indicates upside potential. A brief dip below -100 can spark a massive rally in the GBP/NZD. Will bulls capitalize on favorable developments and force price action into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/NZD remain inside the or breakout above the 1.8780 to 1.8920 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.8835

- Take Profit Zone: 1.9340 – 1.9440

- Stop Loss Level: 1.8720

Should price action for the GBP/NZD breakdown below 1.8780 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.8720

- Take Profit Zone: 1.2670 – 1.2760

- Stop Loss Level: 1.8780

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.