The Japanese National CPI for April decreased by 0.2% monthly and increased by 0.1% annualized. Forex traders can compare this to the Japanese National CPI for March, which was reported flat at 0.0% monthly, and which increased by 0.4% annualized. The Japanese National Core CPI for February decreased by 0.2% annualized. Economists predicted a decrease of 0.1%. Forex traders can compare this to the Japanese National Core CPI for March, which increased by 0.4% annualized. The Bank of Japan decided to keep interest rates at -0.10%. Forex traders can compare this to the previous Bank of Japan interest rate decision where interest rates were left unchanged at -0.10%.

UK GfK Consumer Confidence for May was reported at -34. Forex traders can compare this to UK GfK Consumer Confidence for April, which was reported at -33. UK Public Sector Net Borrowing for April was reported at £61.40B. Economists predicted a figure of £35.00B. Forex traders can compare this to UK Public Sector Net Borrowing for March, which was reported at £14.01B.

UK Retail Sales for April decreased by 18.1% monthly and by 22.6% annualized. Economists predicted a decrease of 16.0% and 22.2%. Forex traders can compare this to UK Retail Sales for March, which decreased by 5.2% monthly and by 5.8% annualized. UK Core Retail Sales for April decreased by 15.2% monthly and by 18.4% annualized. Economists predicted a decrease of 15.0% and 18.2% annualized. Forex traders can compare this to UK Core Retail Sales for March, which decreased by 3.8% monthly and by 4.2% annualized.

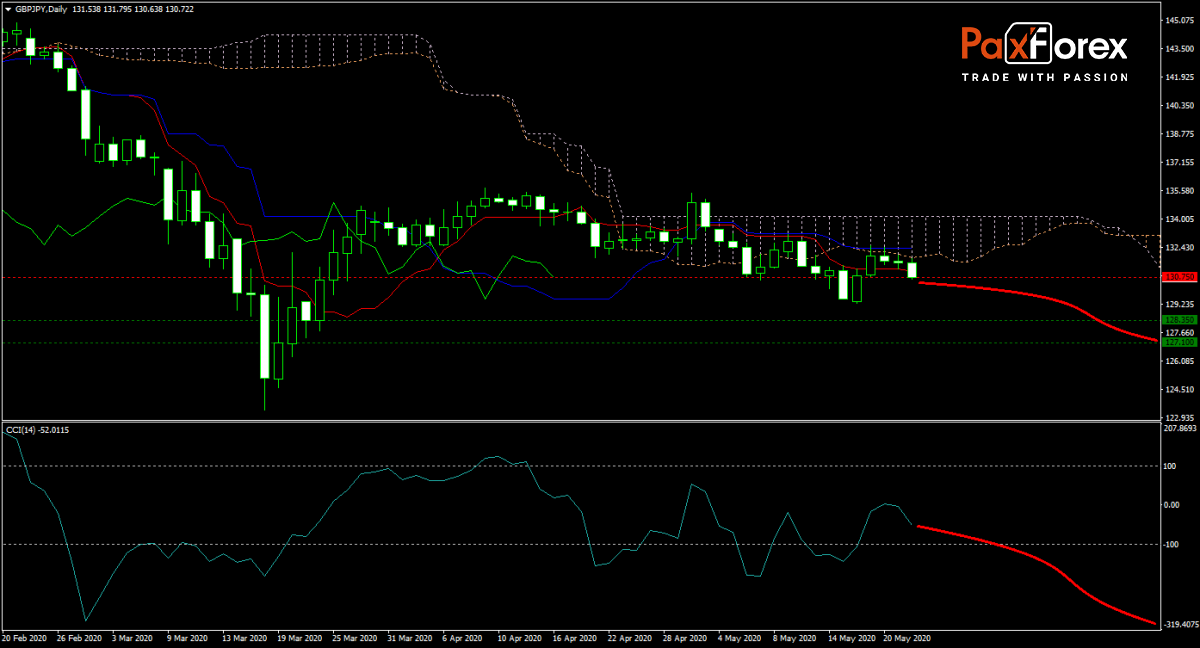

The GBP/JPY forecast changed to bearish with new Covid-19 cases surging past 5,000,000 globally. UK retail sales for April confirmed dismal economic data, and government borrowing surged. Price action is under downside pressure from the Ichimoku Kinko Hyo Cloud, and the Kijun-sen is increasing bearish momentum. Will this currency pair surrender to bears, and start a new sell-off, driven by safe-haven inflows into the Japanese Yen? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/JPY remain inside the or breakdown below the 130.150 to 131.100 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 130.750

- Take Profit Zone: 127.100 – 128.350

- Stop Loss Level: 131.500

Should price action for the GBP/JPY breakout above 131.100 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 131.500

- Take Profit Zone: 133.150 – 134.000

- Stop Loss Level: 131.100

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.