Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Swiss National Bank Sight Deposit Interest Rate is predicted at -0.75%. Forex traders can compare this to the previous Swiss National Bank Sight Deposit Interest Rate, reported at -0.75%. Traders should monitor the press release following the announcement for clues about potential changes to monetary policy and the inflation outlook.

The UK Markit/CIPS Manufacturing PMI for September is predicted at 59.0. Forex traders can compare this to the UK Markit/CIPS Manufacturing PMI for August, reported at 60.3. The UK Markit/CIPS Services PMI for September is predicted at 55.0, and the UK Markit/CIPS Composite PMI is predicted at 54.5. Forex traders can compare this to the UK Markit/CIPS Services PMI for August, reported at 55.0, and the UK Markit/CIPS Composite PMI, reported at 54.8.

The Bank of England is predicted to keep interest rates at 0.10%, and the Asset Purchase Target at £875B. Forex traders can compare this to the previous Bank of England meeting where the UK central bank decided to keep interest rates at 0.10% and kept the Asset Purchase Target at £875B. Traders should monitor the press release following the announcement for clues about potential changes to monetary policy and the inflation outlook.

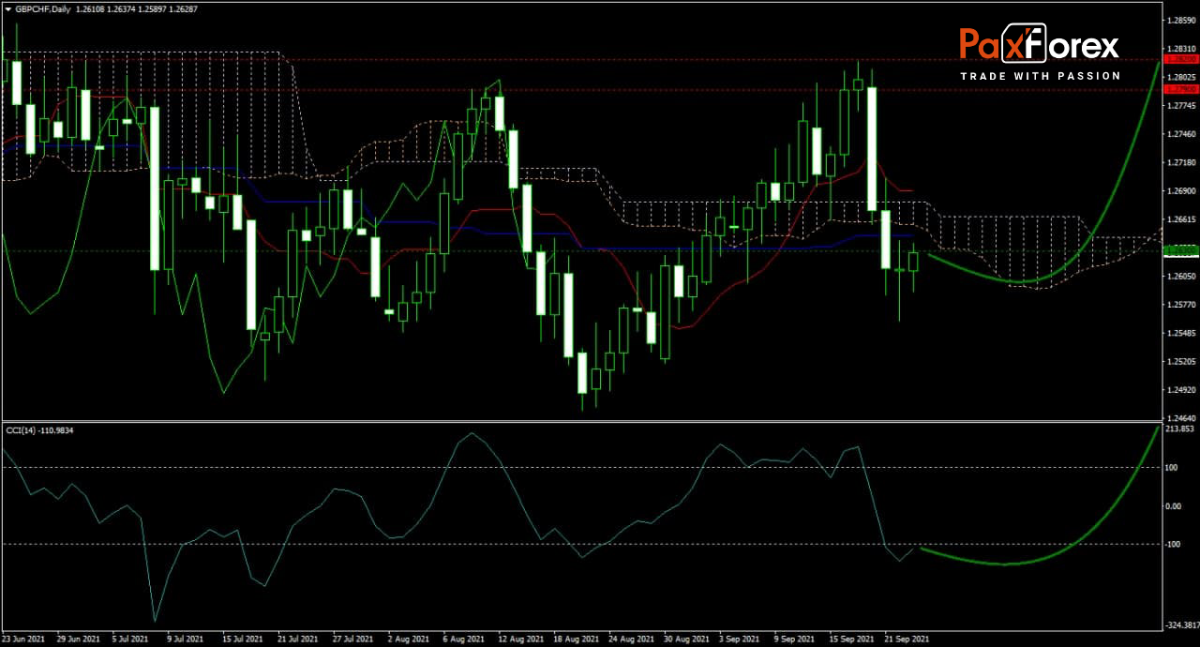

The forecast for the GBP/CHF turned bullish after this currency pair halted its most recent correction. Adding to upside pressures is the Ichimoku Kinko Hyo Cloud, which adopted a bullish stance after the Senkou Span A crossed above the Senkou Span B. Traders should account for a rise in volatility as the Swiss National Bank and the Bank of England announce their interest rate decisions today. The Kijun-sen and the Tenkan-sen turned sideways, while the CCI is advancing after reaching extreme oversold territory. A breakout above -100 will result in a final buy signal. Can bulls pressure the GBP/CHF into its horizontal resistance area and recover the most recent sell-off? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/CHF remain inside the or breakout above the 1.2590 to 1.2655 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2630

- Take Profit Zone: 1.2790 – 1.2820

- Stop Loss Level: 1.2560

Should price action for the GBP/CHF breakdown below 1.2590, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2560

- Take Profit Zone: 1.2470 – 1.2515

- Stop Loss Level: 1.2590

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.