Source: PaxForex Premium Analytics Portal, Fundamental Insight

FB stock has been under pressure this year from Covid and a high-profile boycott. Facebook's business is in the spotlight. And third-quarter earnings suggest that the company can overcome fears of a post-pandemic slowdown. But now FANG stock has another threat to overcome: antitrust lawsuits filed by the federal government and 48 states.

On Wednesday afternoon, the Federal Trade Commission and 48 state attorneys general filed separate antitrust lawsuits alleging that Facebook's acquisitions of Instagram and WhatsApp were anticompetitive and intended to strengthen the company's monopoly position.

While government cases seek remedies that would be highly disruptive, antitrust cases can take years. So is now a good time to buy FB stock?

The stakes in Facebook's antitrust lawsuits are huge. The FTC wants Facebook to be unbundled to create the same level of competition that would exist without mergers. On top of that, Facebook must provide ongoing resources to ensure robust competition.

FTC Chairman Joseph Simons said that Facebook's integration of Messenger, WhatsApp, and Instagram properties would complicate this separation. Facebook's protections do the same thing: The company would spend billions to maintain separate systems. Security and user experience would suffer.

If the government is successful, could the sum of Facebook's parts be more valuable than the whole? This argument has been made in the past. Nevertheless, Facebook's grand vision includes the integration of three properties.

The integration announced in early 2019 "to allow people to message through apps" is making progress, CEO Mark Zuckerberg said during his Q3 earnings report.

The social media giant easily beat third-quarter earnings estimates. Adjusted earnings were $2.40 per share, up 13% from a year ago, excluding a 31% tax credit. Revenue rose 22% to $21.5 billion. That beat estimates of $19.8 billion and doubled the second-quarter growth rate by 11%.

Facebook shares initially traded lower after the last day's earnings report on Oct. 29. Investors appeared to be focused on a slight decline in daily active users in the U.S. and Canada from 198 million to 196 million.

Facebook had previously warned that the spike in social networking app use that occurred early in the pandemic would moderate as life normalized. And it began in the summer. The trend of fixed or slightly lower daily and monthly active users is likely to continue into Q4, Facebook said. However, despite this rapid growth, Facebook's revenue actually accelerated in the third quarter.

At the end of July, management said that Facebook's revenue was up about 10% from a year ago at the start of the third quarter. However, this is well below the 22% growth for the entire quarter.

It is unclear to what extent Facebook's revenue growth in July was held back by a high-profile ad boycott aimed at its perceived tolerance of racist slurs. Management has since taken steps to address the issue.

The big picture is that Facebook advertisers, a group that has grown to 10 million businesses, are using the social media site to connect with potential customers like never before.

Growth in Q3 was 22%, as the number of ad impressions served across Facebook was up 35% from a year ago. Meanwhile, the average price per ad was down 9%. The latter figure was a big improvement over the second quarter. That quarter, the average purchase price through Facebook's ad auctions was down 21%.

Wall Street analysts believe that FANG stock still has a long way to go and provides unbeatable value for advertisers. Facebook has proven its resilience during the unprecedented economic downturn.

Facebook still has a lot of untapped potential that has excited Wall Street beyond its cryptocurrency venture. In August, the company began using TikTok with its recently released Instagram Reels. And long-term efforts to monetize WhatsApp's massive user base are just beginning.

Facebook announced a capital investment of $21 billion to $23 billion in 2021 through investments in data centers, servers, network infrastructure, and office space. Part of the increase from the $16 billion estimate The $16 billion reflects a delay in construction due to the pandemic.

The release of the $300 Quest 2 virtual reality headset should provide fourth-quarter revenue growth. "Pre-orders exceeded Quest's initial orders by more than five times and exceeded our expectations," Zuckerberg said.

Facebook warned that ongoing privacy regulations and changes to mobile operating platforms, particularly Apple's iOS 14, could hamper ad targeting and affect ad prices. Nevertheless, Apple has delayed the most important change until early next year.

Wall Street analysts believe that FANG stock still has incredible potential for further growth and represents unprecedented value for investors.

All of this potential makes it dangerous to bet against FB stock, even as it faces a lengthy antitrust fight. Nevertheless, investors who want to bet on Facebook should wait until it demonstrates its resilience again by reaching a proper buying point.

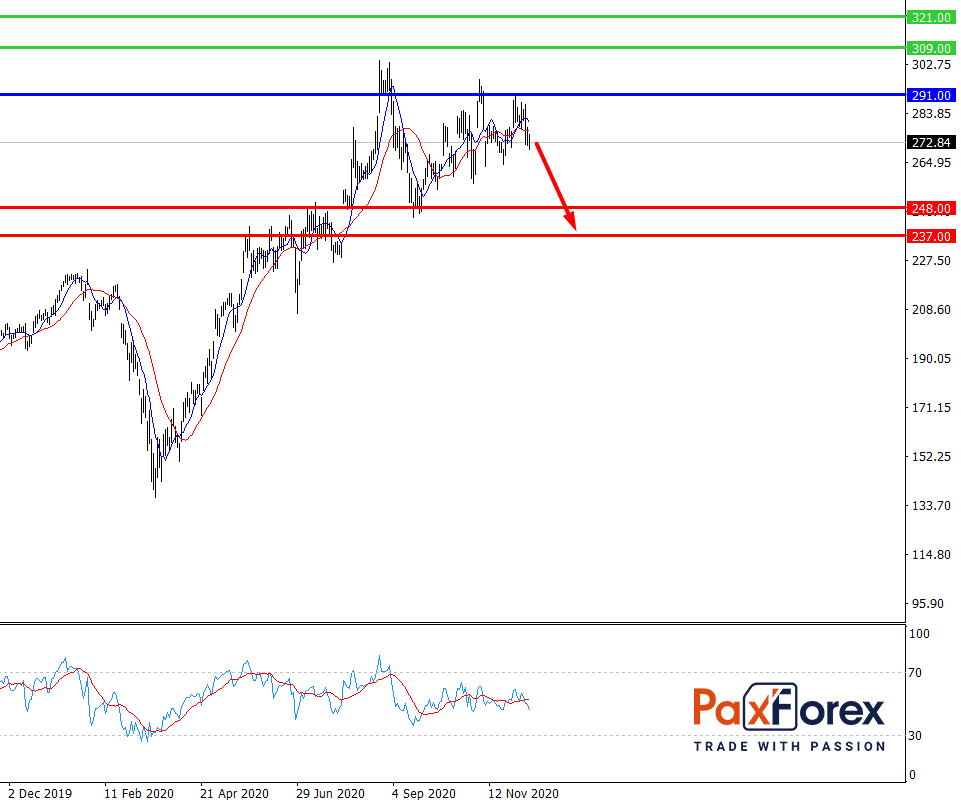

Provided that the price is below 291.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 271.00

- Take Profit 1: 248.00

- Take Profit 2: 237.00

Alternative scenario:

In case of breakout of the level 291.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 291.00

- Take Profit 1: 309.00

- Take Profit 2: 321.00