Source: PaxForex Premium Analytics Portal, Fundamental Insight

Facebook shares have been volatile since the company published its third-quarter profit and loss statement late last month. Shares fell last Friday (the day after the report was released) before they rose higher last week.

The company cited uncertainty over advertising revenue growth and regulatory restrictions in its report. Such issues may lead investors to question whether communications company stocks can overcome these tailwinds and continue to thrive in an ever-changing environment.

Facebook increased its revenue by 22 percent year on year in the third quarter, which ended September 30. It resulted in diluted earnings per share of $2.71, a 28 percent increase over the same period last year.

It should be noted that the shares of Facebook increased by 43% for the year. The company enjoyed relative success in 2020, with an increase in the number of users restrained by slower growth in advertising revenue. Fortunately for Facebook shareholders, this was just a slowdown in growth, not a decline in revenue amid the pandemic.

Against this backdrop, Facebook shares are trading at a forward P/E ratio of just over 28. It makes the company attractive enough for investment, given its recent revenue growth. Moreover, analysts (on average) forecast revenue growth of 45% this year and 11% in 2021. While these forecasts may change, they are a sign that Facebook is likely to continue to show double-digit revenue growth for the foreseeable future.

However, the Facebook stock may still face significant obstacles. One problem is the resumption of antitrust controls, as the Federal Trade Commission is reportedly close to formally filing a lawsuit against Facebook. As the company has tremendous market power over social media advertisers, such lawsuits continue to be a source of concern for shareholders.

Indeed, Facebook dominates the social networking industry. However, since Facebook never charges users for using its platform, proving an antitrust charge can be difficult.

Another serious problem is its long-term growth prospect. In the last quarter, the number of active users increased 14 percent monthly to 3.2 billion for all Facebook-owned applications.

With a global population of about 7.7 billion, Facebook accounts for almost 42% of the world's population. Given that a significant proportion of the remaining 58% does not have access to the Internet, user growth may soon slow down to low single-digit levels.

Facebook has solved this problem by developing new products, namely Portal and Oculus. Portal is a video communication device in the house, which has the Alexa system from Amazon built into it. Oculus is a virtual reality headset (VR). Facebook bought Oculus in 2014, but just integrated it with Facebook.

Of the two, Oculus can offer more potential. Facebook does not tie Oculus to any specific hardware, which gives it an advantage over its main competitor Sony. Besides, it can use Facebook's huge user base to communicate with social networks, which further extends its VR experience. Besides, Facebook recently reduced the price of Oculus Quest 2 to $299, which should increase sales.

Given the company's growth potential relative to its valuation, it makes sense that Facebook shares remain an excellent option to buy. Profit growth could slow down sharply in 2021. However, investors are likely to benefit from 28-fold forward earnings for double-digit growth.

Moreover, while saturation could be a problem in a few years, advertising revenue growth remains above 20%. Also, as the company integrates Oculus more and more deeply into Facebook, it should gain additional benefits as consumers begin to use VR.

It should be recognized that antitrust issues may become a hindrance to the company's shares. However, given the assessment and prospects for further growth, Facebook is still a stock of huge value.

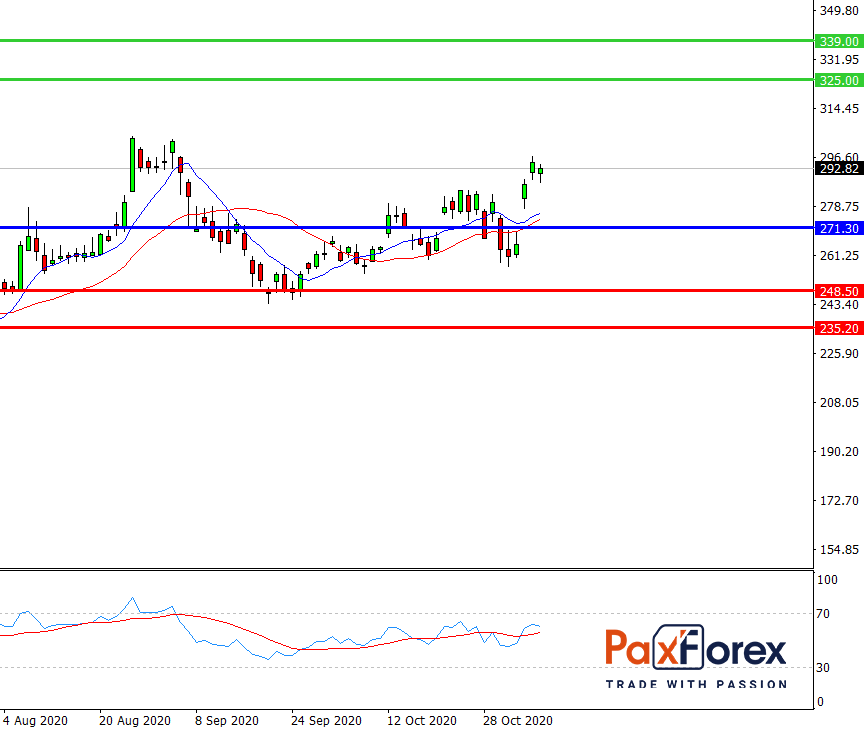

As long as the price is above 271.30, follow these recommendations:

- Time frame: D1

- Recommendation: long position

- Entry point: 294.68

- Take Profit 1: 325.00

- Take Profit 2: 339.00

Alternative scenario:

In case of breakdown of the level 271.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 271.30

- Take Profit 1: 248.50

- Take Profit 2: 235.20