Source: PaxForex Premium Analytics Portal, Fundamental Insight

FAANG investors were over the moon in the current earnings season. While it may be too prosaic to say that investors should only hold these stocks, it seems that the benefits of the major tech company platforms have only been amplified and strengthened by the coronavirus pandemic. Attracting a more active audience, and now that the situation is getting better, these tech giants' earnings are on the rise.

You couldn't go wrong with any of the big companies in the first quarter, but Facebook was the most impressive.

In the Q1 of 2021, Facebook's revenue was up an incredible 48%, with advertising revenue up 46% and "other" revenue up 146%. Total costs were up just 29%, with most of it coming from servers, data centers, research, and development, all of which may be regarded as growth investments. In fact, marketing, general and administrative expenses were up only 2%! As a result, operating income grew by as much as 93%.

Yes, this time Facebook benefited from the foreign currency, which increased its growth rate by 4 percentage points. And yes, the company outperformed the first quarter of 2020, in which one month was hit by the coronavirus outbreak. Nevertheless, the business managed to increase 44% in constant currency, in addition to a still decent 18% growth in the first quarter of last year.

It's truly majestic. Facebook was able to rise daily active users (DAU) by 8%, thanks to increased engagement as a result of the pandemic, and delivered 12% more ads, but the true astonishment was a 30% rise in ad rates. That was due to higher-than-expected demand amid a stronger economy, as well as companies' desire to reach customers in a targeted way.

The majority of analysts believe this may not be as good as it sounds because of the iOS 14.5 update. The new operating system will allow users to disable Facebook's ability to track their behavior on other apps and websites. Some fear that it could limit targeting options, which is why Facebook is so popular with small businesses and advertisers in general.

With the core business running at full capacity, CEO Mark Zuckerberg actually paid more attention to new technologies. New initiatives, outlined in the "other revenue" category, accounted for just 2.8% of revenue this quarter, but grew 146% to $732 million and are starting to become a little more significant.

New revenue sources include commerce, creator services, and the augmented reality and virtual reality (AR/VR) computing platform.

Speaking of AR/VR, Zuckerberg was very enthusiastic about Oculus Quest 2, which has just been updated to allow wireless streaming. It could be a significant development and a breakthrough for AR/VR. Previous headsets had to have all sorts of wires, which Zuckerberg believes lowered the experience, saying during a conference call with analysts, "Wireless experience technology is very advanced, and most companies won't be able to provide that, but we think that's the minimum bar for high-quality experiences."

Another potential source of revenue that did make money during the pandemic is Facebook's involvement in commercials beyond simple advertising. in 2020, the company launched Facebook Shops, enabling small businesses to open stores on Facebook and Instagram. This initiative has already reached 1 million stores, attracting 250 million visitors a month. And Facebook Marketplace is more like a modern Craigslist, attracting 1 billion visitors a month. Moreover, WhatsApp business messaging and WhatsApp payments are growing in India.

Finally, monetization may become possible with new tools for creators. Currently, many creators and influencers get paid for recommending products, but Zuckerberg wants Facebook to give creators a wider range of audio and video tools, as well as other potential monetization options, including tipping or perhaps subscriptions.

It possibly puts the company in competition with start-up site OnlyFans, a subscription/tip site that's famous for R-rated (and X-rated) content creators, but which also attracts more mainstream writers who want to give fans a more intimate view of their lives. According to a recent Bloomberg study, OnlyFans generated $2 billion in gross revenue in 2020, of which it takes 20% commissions at very high margins.

Notably, while Facebook reported the highest earnings growth of any FAANG stock, it is also the cheapest company by P/E-about 28 times its projected earnings. Perhaps such skepticism was justified, given its greater concentration and reliance on advertising than other companies.

However, this reliance on advertising was tested during the pandemic, and Facebook handled it just fine - more than fine. If the company can bring more interesting technologies, such as AR/VR, to market and continue to monetize its 2.85 billion monthly users in new and different ways, its stock could still be very cheap, even after the recent post-reporting spike.

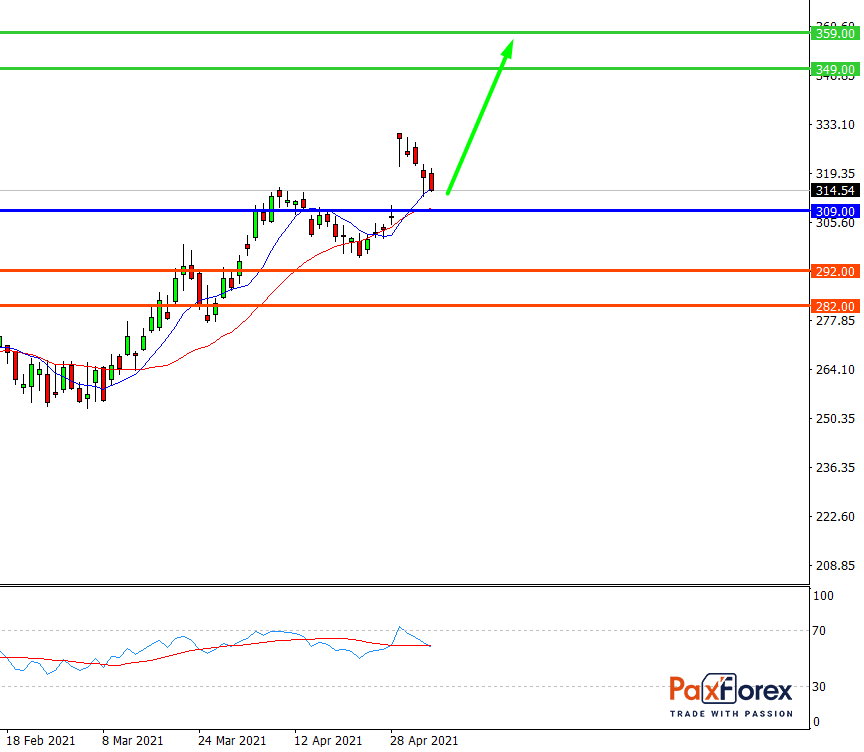

While the price is above 309.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 323.44

- Take Profit 1: 349.00

- Take Profit 2: 359.00

Alternative scenario:

If the level 309.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 309.00

- Take Profit 1: 292.00

- Take Profit 2: 282.00