Source: PaxForex Premium Analytics Portal, Fundamental Insight

ExxonMobil stock has delivered solid dividend income to millions of investors over the years, so it's no surprise that it still has many fans, despite its poor stock price performance. Over the past ten years, ExxonMobil stock has had a total return of 11.6%, compared to 372% for the S&P 500 Index. However, between 2000 and 2015, the stock enlargely outperformed the broader market.

Thus, the key question for investors considering this stock now should be how the company will behave over the next ten years.

As many people know, burning oil creates carbon and contributes to global warming. That is a fact that cannot be ignored, and one of the main reasons why the world seeks to limit its use in the future. As a result, clean energy is becoming a major resource for the world's energy supply. But it has not yet reached that level, which means that oil is still an important part of the global energy supply.

The International Energy Agency estimates that global oil demand could rise to 104.1 million barrels per day in 2026 from 96.5 million barrels per day in 2021. The agency predicts that market demand will begin to plateau in 2030. In the last decade, 60% of the growth in oil demand has come from road transportation. However, a shift to more electric vehicles is looming.

However, the petrochemical industry's need for oil may persist. The IEA expects the petrochemical industry to account for 60% of oil demand growth over the next decade due to demand for plastics. The petrochemical sector's appetite for oil should grow along with global population growth and economic growth, especially in emerging economies.

Even if one takes these projections at face value, it is still fair to assume that it will be several years before oil demand begins to decline, even if it reaches a point earlier where it stops growing strongly. That should be enough to keep the big oil companies profitable for years to come. ExxonMobil operates all over the world and has a significant presence in Asia.

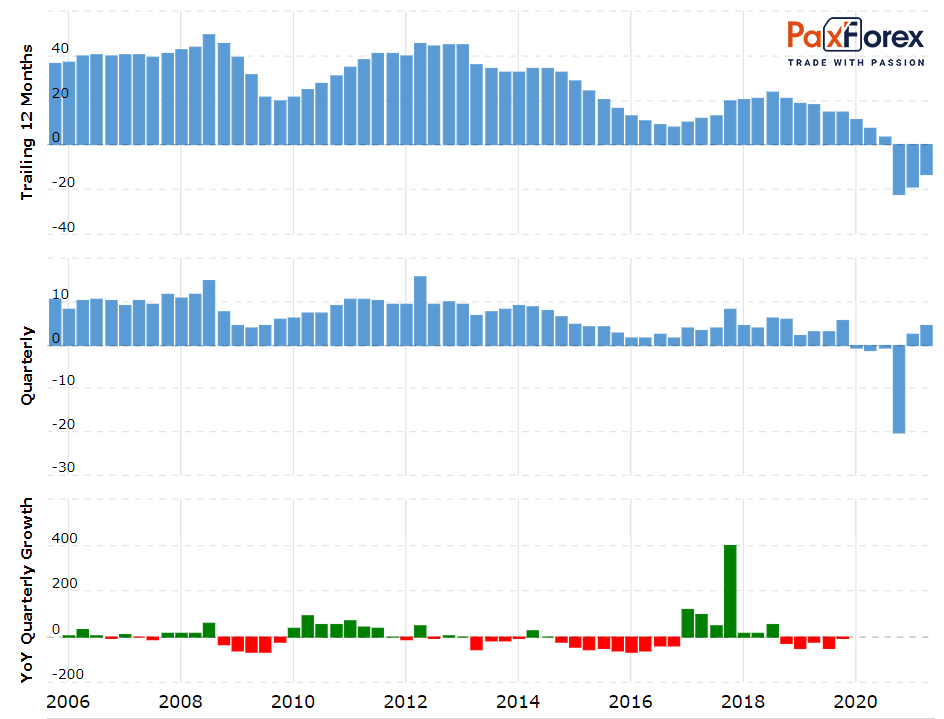

There is a bearish part to the argument: ExxonMobil's net income and EBITDA have been trending downward for the past decade.

Even more troubling, the company's debt levels have risen, and its return on invested capital has declined.

Commodity prices, such as oil and natural gas, are subject to large fluctuations and can remain low or high for long periods of time depending on political or macroeconomic factors. These changes directly affect ExxonMobil's earnings. As an example, ExxonMobil posted a profit of $4.7 billion in the second quarter, compared to a loss of $1.1 billion in the previous quarter.

Since the end of 2020, the company has reduced its debt by $7 billion. Its cost-cutting efforts have saved it $4 billion in structural costs over the past 18 months. By 2023, the total savings will be $6 billion. The company also cut its annual capital spending from more than $24 billion in 2019 to $17 billion in 2020. Management now expects capital spending to be near the lower end of its 2021 projection of $16 billion to $19 billion. In short, the company is moving in the right direction.

Nevertheless, ExxonMobil may not return to the level of earnings growth it showed during the shale boom. That's partly because oil demand growth is expected to slow. Even if higher commodity prices and stable demand allow the company to reduce debt and maintain dividend payments, earnings growth is likely to be limited. Moreover, projected conditions could put downward pressure on prices, and the influence of the Organization of the Petroleum Exporting Countries (OPEC) and its individual members could keep oil prices volatile.

For all of these reasons, ExxonMobil stock may continue to underperform the broader market over the next decade. Investors will be able to find better dividends and growth opportunities elsewhere.

As long as the price is below 58.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 54.62

- Take Profit 1: 51.90

- Take Profit 2: 50.30

Alternative scenario:

If the level of 58.00 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 58.00

- Take profit 1: 60.60

- Take Profit 2: 62.30