Source: PaxForex Premium Analytics Portal, Fundamental Insight

The German GfK Consumer Confidence Survey for November was reported at -3.1. Economists predicted a figure of -2.8. Forex traders can compare this to the German GfK Consumer Confidence Survey for October, reported at -1.7. The French Business Survey for October was reported at 93. Economists predicted a level of 96. Forex traders can compare this to the French Business Survey for September, reported at 94. Advanced Eurozone Consumer Confidence for October is predicted at -15.0. Forex traders can compare this to the previous Eurozone Consumer Confidence for September, reported at -13.9.

US Initial Jobless Claims for the week of October 17th are predicted at 860K, and US Continuing Claims for the week of October 10th are predicted at 9,500K. Forex traders can compare this to US Initial Jobless Claims for the week of October 10th, which were reported at 898K, and to US Continuing Claims for the week of October 3rd, which were reported at 10,018K. US Existing Home Sales for September are predicted to increase by 5.0% monthly to 6.30M. Forex traders can compare this to US Existing Home Sales for August, which increased by 2.4% monthly to 6.00M. The US Leading Index for September is predicted to increase by 0.7% monthly. Forex traders can compare this to the US Leading Index for August, which increased by 1.2% monthly.

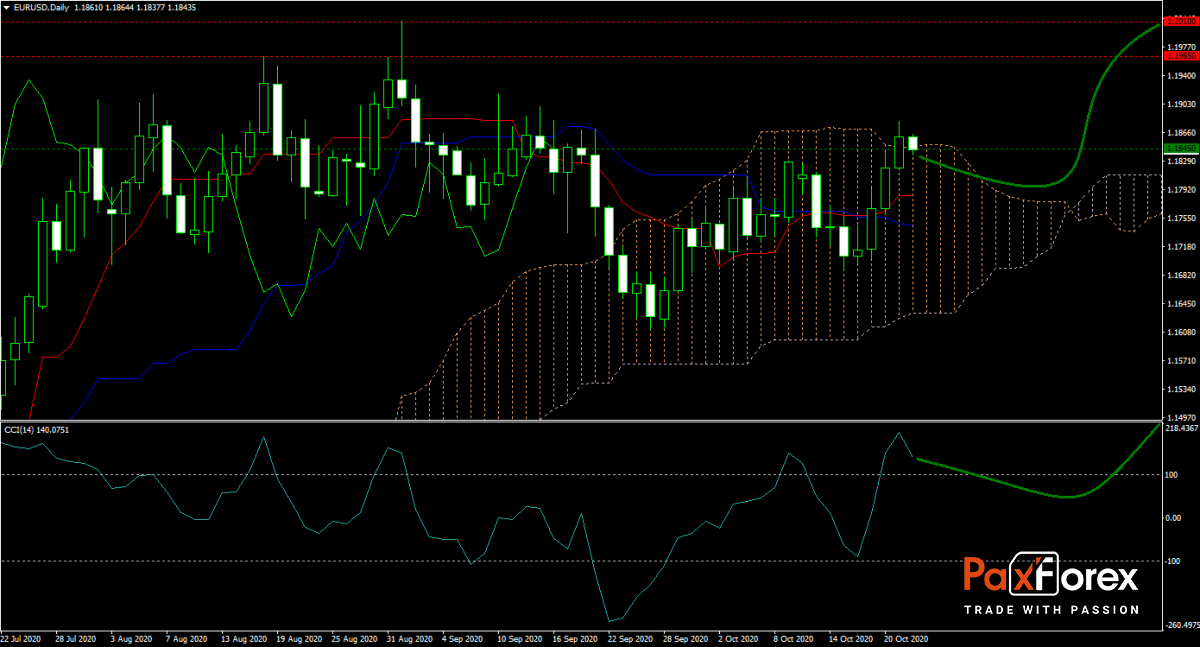

The forecast for the EUR/USD remains bullish despite the disappointing set of economic data released this morning. Forex traders will focus on US initial jobless claims data, which disappointed over the last four weeks and started to increase. A reading above 900K will set the US Dollar into a sell-off. The CCI started to move off its peak but remains in extreme overbought territory. A small correction can correct this condition, while price action moved above its Ichimoku Kinko Hyo Cloud. Can bulls take this development and rally into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.1820 to 1.1880 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1855

- Take Profit Zone: 1.1965 – 1.2010

- Stop Loss Level: 1.1780

Should price action for the EUR/USD breakdown below 1.1820 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1780

- Take Profit Zone: 1.1690 – 1.1715

- Stop Loss Level: 1.1820

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.