Eurozone Industrial Production for January is predicted to increase by 1.4% monthly and to decrease by 3.1% annualized. Forex traders can compare this to Eurozone Industrial Production for December, which decreased by 2.1% monthly and 4.1% annualized. The ECB is predicted to keep its Interest Rate at 0.00%, its Deposit Facility Rate at -0.50%, and its Marginal Lending Facility Rate at 0.25%; this would equal no change in the ECB rate policy from the previous meeting.

US Initial Jobless Claims for the week of March 7th are predicted at 218K, and US Continuing Claims for the week of February 29th are predicted at 1,733K. Forex traders can compare this to US Initial Jobless Claims for the week of February 29th, which were reported at 216K and to US Continuing Claims for the week of February 22nd, which were reported at 1,729K. The US PPI for February is predicted to decrease by 0.1% monthly, and to increase by 1.8% annualized. Forex traders can compare this to the US PPI for January, which increased by 0.5% monthly and by 2.1% annualized. The US Core PPI for February is predicted to increase by 0.2% monthly and by 1.7% annualized. Forex traders can compare this to the US Core PPI for January, which increased by 0.5% monthly and by 1.7% annualized. The US Core PPI ex Trade for February is predicted to increase by 0.2% monthly and by 1.3% annualized. Forex traders can compare this to the US Core PPI ex Trade for January, which increased by 0.4% monthly and by 1.5% annualized.

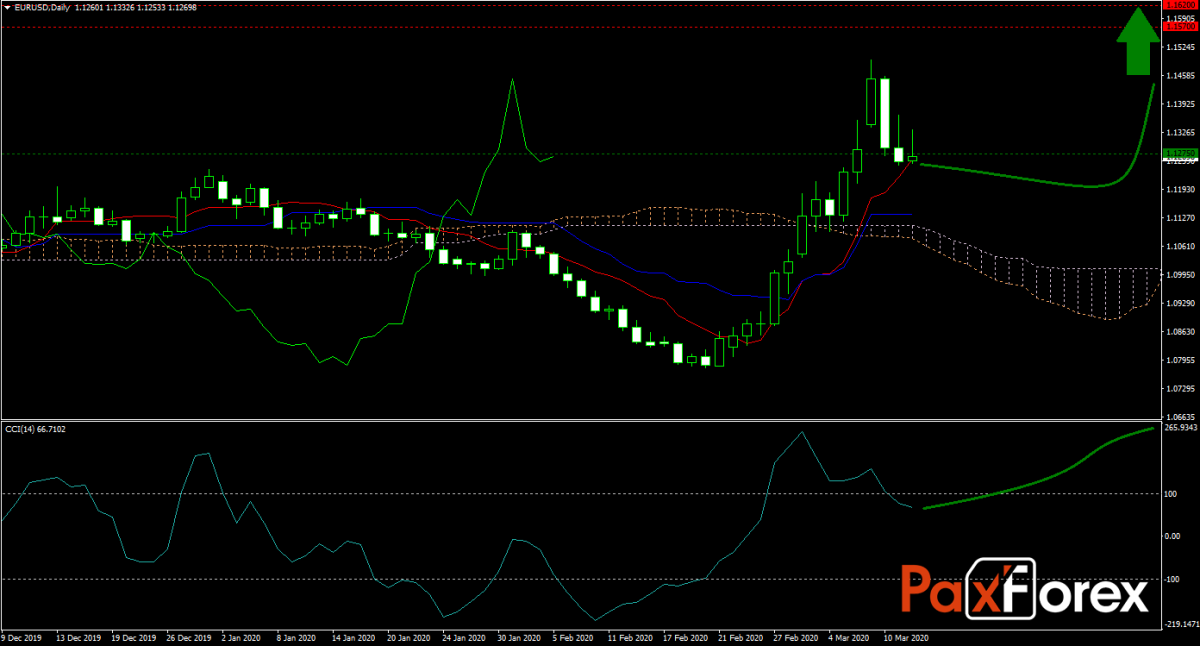

The EUR/USD rallied sharply after the US Fed delivered a 0.50% interest rate cut to 1.25%. Markets expect another 0.75% cut this month to 0.50%, but how long will the ECB remain on the sidelines? The current EUR/USD forecast remains slightly bullish. Will bulls get the data they need to keep the rally alive, or are bears ready to step in? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.1250 to 1.1350 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1275

- Take Profit Zone: 1.1570 – 1.1620

- Stop Loss Level: 1.1225

Should price action for the EUR/USD breakdown below 1.1250 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1225

- Take Profit Zone: 1.0890 – 1.0990

- Stop Loss Level: 1.1275

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.