Source: PaxForex Premium Analytics Portal, Fundamental Insight

The French Business Survey for June is predicted at 109. Forex traders can compare this to the French Business Survey for May, reported at 107. The Final Spanish GDP for the first quarter is predicted to decrease 0.5% quarterly and 4.3% annualized. Forex traders can compare this to the Spanish GDP for the fourth quarter, which was flat at 0.0% quarterly, and which decreased 8.9% annualized.

The German IFO Business Climate Index for June is predicted at 100.6. Forex traders can compare this to the German IFO Business Climate Index for May, reported at 99.2. The German IFO Current Assessment Index for June is predicted at 97.8. Forex traders can compare this to the German IFO Current Assessment Index for May, reported at 95.7. The German IFO Expectations Index for June is predicted at 103.9. Forex traders can compare this to the German IFO Expectations Index for May, reported at 102.9.

US Initial Jobless Claims for the week of June 19th are predicted at 380K, and US Continuing Claims for the week of June 12th are predicted at 3,470K. Forex traders can compare this to US Initial Jobless Claims for the week of June 12th, which were reported at 412K, and to US Continuing Claims for the week of June 5th, which were reported at 3,518K.

US Preliminary Durable Goods Orders for May are predicted to increase 2.8% monthly, and Durables Excluding Transportation are predicted to increase 0.8% monthly. Forex traders can compare this to US Durable Goods Orders for April, which decreased 1.3% monthly, and to Durables Excluding Transportation, which increased by 1.0% monthly. Capital Goods Orders Non-Defense Excluding Aircraft for May are predicted to increase 0.6% monthly. Forex traders can compare this to Capital Goods Orders Non-Defense Excluding Aircraft for April, which increased 2.2% monthly.

The final US GDP for the first quarter is predicted to increase by 6.4% annualized. Forex traders can compare this to the fourth-quarter GDP, which increased 4.3% annualized. Final GDP Sales for the first quarter are predicted to increase 9.5% annualized. Forex traders can compare this to fourth-quarter GDP Sales, which increased 9.4% annualized. The final GDP Price Index for the first quarter is predicted to increase by 4.3% annualized. Forex traders can compare this to the fourth quarter GDP Price Index, which increased by 1.9% annualized. The Final Core PCE for the first quarter is predicted to increase by 2.5% annualized. Forex traders can compare this to the fourth quarter Core PCE, which increased 2.5% annualized.

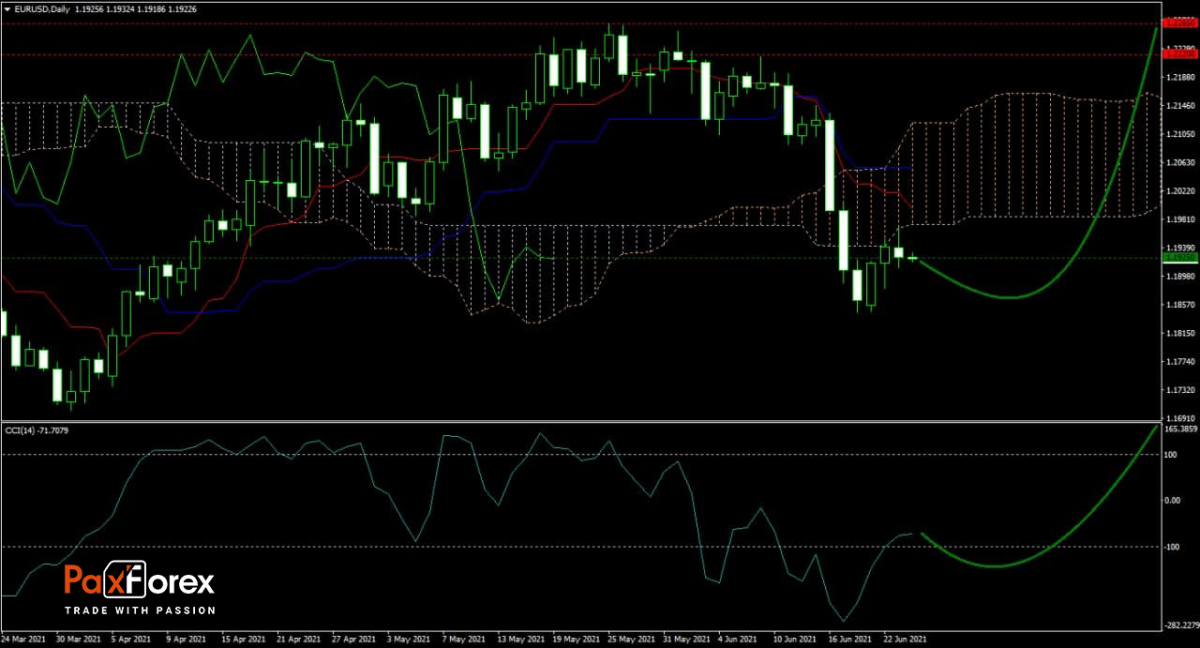

The forecast for the EUR/USD is turning bullish following a correction after this currency pair was unable to extend its advance. Traders should remain cautious until price action can recover from its breakdown below its moderately ascending Ichimoku Kinko Hyo Cloud. The Kijun-sen entered a sideways trend, but the Tenkan-sen maintains its downtrend, suggesting more short-term volatility. After the CCI started to advance inside of extreme oversold territory, can the breakout provide the next technical catalyst? Will bulls gather enough strength to force the EUR/USD into its horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.1880 to 1.1970 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1925

- Take Profit Zone: 1.2220 – 1.2265

- Stop Loss Level: 1.1825

Should price action for the EUR/USD breakdown below 1.1880, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1825

- Take Profit Zone: 1.1700 – 1.1740

- Stop Loss Level: 1.1880

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.