Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Eurozone CPI for June is predicted to increase 0.3% monthly and 1.9% annualized. Forex traders can compare this to the Eurozone CPI for May, which increased 0.3% monthly and 2.0% annualized. The Eurozone Core CPI for June is predicted to increase 0.3% monthly and 0.9% annualized. Forex traders can compare this to the Eurozone Core CPI for May, which increased 0.2% monthly and 1.0% annualized. The Eurozone Harmonized Core CPI for June is predicted to increase 0.3% monthly and 0.9% annualized. Forex traders can compare this to the Eurozone Harmonized Core CPI for May, which increased 0.2% monthly and 0.9% annualized.

US Retail Sales for June are predicted to decrease 0.4% monthly, and Core Retail Sales are predicted to increase 0.4% monthly. Forex traders can compare this to US Retail Sales for May, which decreased 1.3% monthly, and to Core Retail Sales, which decreased 0.7% monthly. Retail Sales in the Control Group for June are predicted to increase 0.4% monthly. Forex traders can compare this to Retail Sales in the Control Group for May, which decreased 0.7% monthly.

US Business Inventories for May are predicted to increase 0.5% monthly. Forex traders can compare this to US Business Inventories for April, which decreased 0.2% monthly. Preliminary US Michigan Consumer Sentiment for July is predicted at 86.5. Forex traders can compare this to US Michigan Consumer Confidence for June, reported at 85.5. Preliminary Current Conditions for July are expected at 90.2, and Preliminary Expectations are predicted at 85.0. Forex traders can compare this to Current Conditions for June, reported at 88.6, and to Expectations, reported at 83.5.

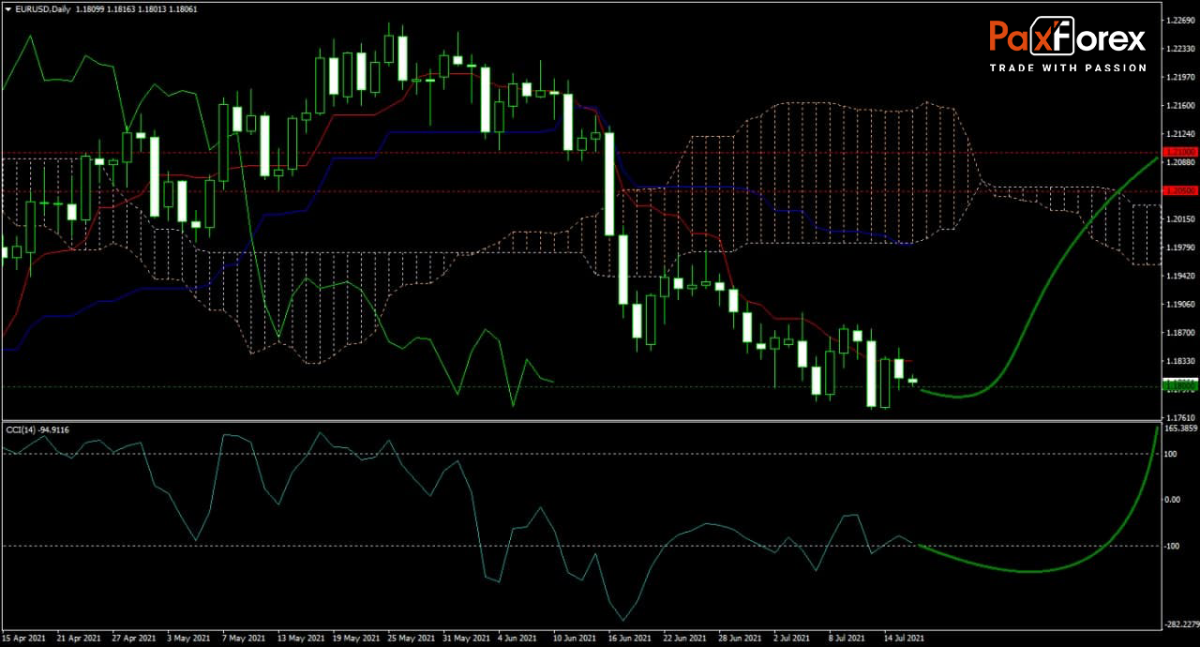

The forecast for the EUR/USD turned bullish after price action correction into a strong support area. More volatility lies ahead after the Tenkan-sen turned flat, while the Kijun-sen extends its descend. The Ichimoku Kinko Hyo Cloud shows signs of stabilization and entered a sideways trend of its own. The CCI formed a positive divergence and escaped extreme oversold territory with plenty of upside potential ahead. Can bulls capitalize on the bullish developments and accelerate the EUR/USD into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.1770 to 1.1830 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1800

- Take Profit Zone: 1.2050 – 1.2100

- Stop Loss Level: 1.1730

Should price action for the EUR/USD breakdown below 1.1770, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1730

- Take Profit Zone: 1.1600 – 1.1630

- Stop Loss Level: 1.1770

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.