Source: PaxForex Premium Analytics Portal, Fundamental Insight

The German ZEW Survey Current Situation Index for February is predicted at -67.0 and the German ZEW Survey Economic Sentiment Index at 59.6. Forex traders can compare this to the German ZEW Survey Current Situation Index for January, reported at -66.4, and to the German ZEW Survey Economic Sentiment Index, reported at 61.8. The Eurozone ZEW Survey Economic Sentiment Index for February is predicted at 57.0. Forex traders can compare this to the Eurozone ZEW Survey Economic Sentiment Index for January, reported at 58.3.

The advanced Eurozone GDP for the fourth quarter is predicted to decrease by 0.7% quarterly and by 5.1% annualized. Forex traders can compare this to the Eurozone GDP for the third quarter, which decreased by 4.3% quarterly, and which increased by 12.4% annualized. The US Empire Manufacturing Index for February is predicted at 6.0. Forex traders can compare this to the US Empire Manufacturing Index for January, reported at 3.5.

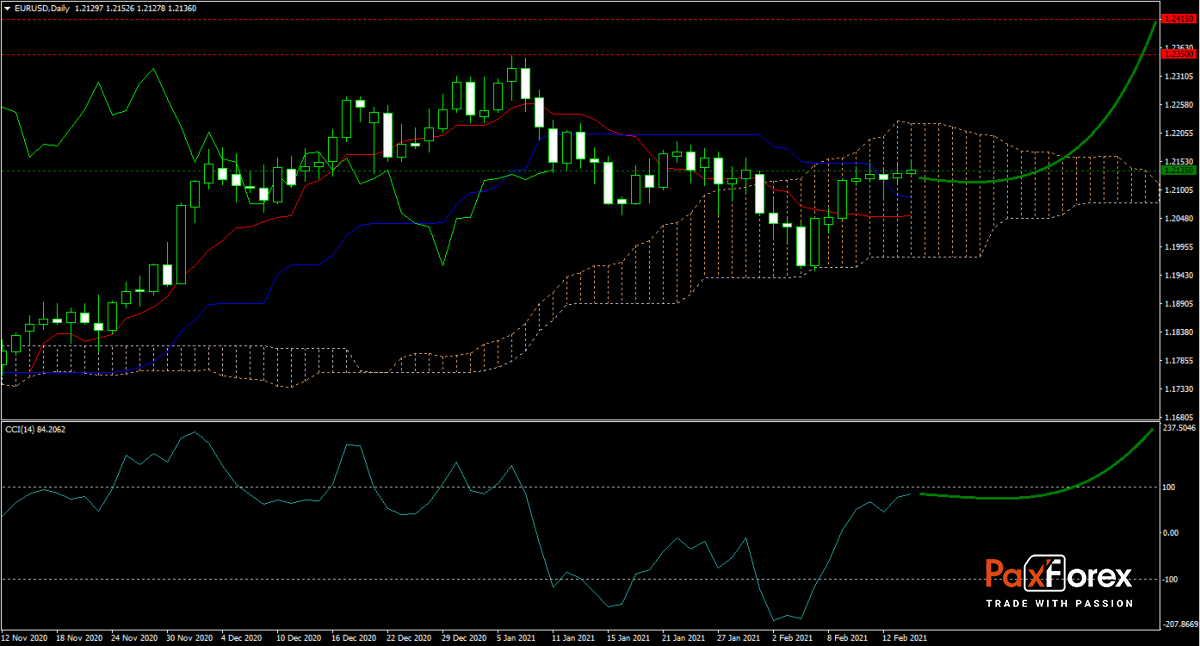

The forecast for the EUR/USD is cautiously bullish, as the Eurozone and the US economies face similar issues of high debt and a struggling economy. The Eurozone prints a trade surplus, driven by Germany, while the US manages monthly trade deficits, placing the Euro in a better fiscal environment. This currency pair moved above its Tenkan-sen, which shows signs of ascending, and its Kijun-sen, bound to enter a sideways trend. Price action also entered its narrowing Ichimoku Kinko Hyo Cloud, from where a breakout is likely. The CCI is approaching extreme overbought territory with more upside potential ahead. Will bulls pressure the EUR/USD higher until it reaches its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.2115 to 1.2155 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2135

- Take Profit Zone: 1.2350 – 1.2415

- Stop Loss Level: 1.2085

Should price action for the EUR/USD breakdown below 1.2115 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2085

- Take Profit Zone: 1.1950– 1.2020

- Stop Loss Level: 1.2115

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.