Japanese Machine Orders for March decreased by 0.4% monthly and by 0.7% annualized. Economists predicted a decrease of 7.1% and 9.5%. Forex traders can compare this to Japanese Machine Orders for February, which increased by 2.3% monthly, and which decreased 2.4% annualized. The Eurozone Current Account (s.a.) for March was reported at €27.4B, and the Eurozone Current Account (n.s.a) was reported at €40.7B. Forex traders can compare this to the Eurozone Current Account (s.a.) for February, which was reported at €40.2B and to the Eurozone Current Account (n.s.a.), which was reported at €33.8B.

The Eurozone CPI for April is predicted to increase by 0.3% monthly and by 0.4% annualized. Forex traders can compare this to the Eurozone CPI for March, which increased by 0.5% monthly and 0.7% annualized. The Eurozone Core CPI for April is predicted to increase by 0.8% monthly and by 0.9% annualized. Forex traders can compare this to the Eurozone Core CPI for March, which increased by 1.1% monthly and 1.0% annualized. The Eurozone Harmonized Core CPI for April is predicted to increase by 0.7% monthly and by 1.1% annualized. Forex traders can compare this to the Eurozone Harmonized Core CPI for March, which increased by 1.0% monthly and 1.1% annualized.

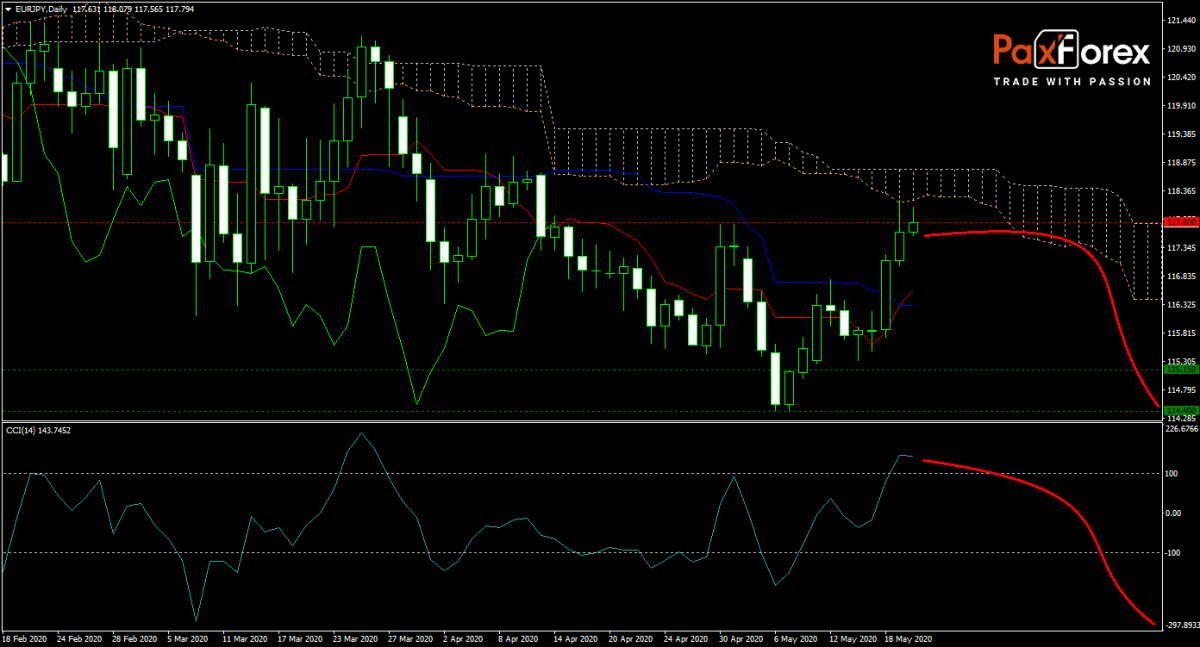

The EUR/JPY forecast turned considerably bearish after this currency pair advanced into the Ichimoku Kinko Hyo cloud. A proposed Franc-German rescue fund for the Eurozone boosted sentiment in the Euro, soothing concerns over lack of unity. It marked a step forward, but economic challenges related to the Covid-19 pandemic remain. Today’s machine orders out of Japan confirmed ongoing disruptions globally with Eurozone CPI data likely to present a challenge to the ECB. Will bears receive an incentive to force a sell-off? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EURJPY remain inside the or breakdown below the 117.550to 118.200 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 117.800

- Take Profit Zone: 114.400 – 115.150

- Stop Loss Level: 118.700

Should price action for the EURJPY breakout above 118.200 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 118.700

- Take Profit Zone: 120.300 – 121.150

- Stop Loss Level: 118.200

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.