Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Japanese Jobless Rate for May was reported at 3.0%, and the Job-to-Applicant Ratio at 1.09. Economists predicted a figure of 2.9% and 1.08. Forex traders can compare this to the Japanese Jobless Rate for April, reported at 2.8%, and to the Job-to-Applicant Ratio, reported at 1.09. Japanese Retail Sales for May decreased 0.4% monthly and increased 8.2% annualized. Forex traders can compare this to Japanese Retail Trade for April, which decreased 4.6% monthly, and increased 11.9% annualized.

The French Unemployment Rate for the first quarter is predicted at 8.1%. Forex traders can compare this to the French Unemployment Rate for the fourth quarter, reported at 8.0%. Eurozone Economic Sentiment for June is predicted at 116.5. Forex traders can compare this to Eurozone Economic Sentiment for May, reported at 114.5. Eurozone Industrial Sentiment for June is predicted at 12.3. Forex traders can compare this to Eurozone Industrial Sentiment for May, reported at 11.5. Eurozone Services Sentiment for June is predicted at 14.8. Forex traders can compare this to Eurozone Services Sentiment for May, reported at 11.5. Final Eurozone Consumer Confidence for June is predicted at -3.3. Forex traders can compare this to the previous Eurozone Consumer Confidence for June, reported at -5.1.

The Preliminary German CPI for June is predicted to increase 0.4% monthly and 2.3% annualized. Forex traders can compare this to the German CPI for May, which increased 0.5% monthly and 2.5% annualized. The EU Harmonized German CPI for June is predicted to increase 0.4% monthly and 2.1% annualized. Forex traders can compare this to the EU Harmonized German CPI for May, which increased 0.3% monthly and 2.4% annualized.

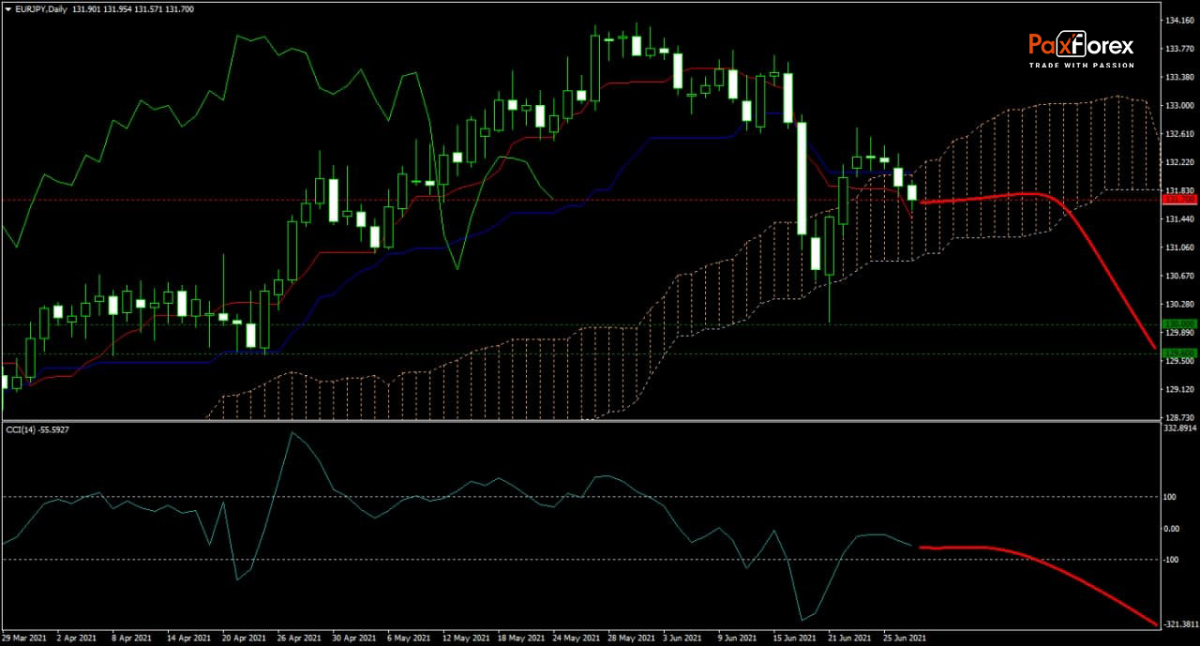

The forecast for the EUR/JPY remains bearish after the reversal failed to gather steam. While the Kijun-sen remains flat, the Tenkan-sen extends its descend. The Ichimoku Kinko Hyo Cloud shows signs of increasing bearish pressures, suggesting more medium-term downside potential. After the CCI moved out of extreme oversold territory, traders should expect a reversal. Can bears force the EUR/JPY into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EURJPY remain inside the or breakdown below the 131.450 to 132.100 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 131.700

- Take Profit Zone: 129.600 – 130.000

- Stop Loss Level: 132.350

Should price action for the EURJPY breakout above 132.100, PaxForex recommends the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 132.350

- Take Profit Zone: 133.100 – 133.600

- Stop Loss Level: 132.100

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.