Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Final Japanese Leading Index for November was reported at 96.4, and the Final Japanese Coincident Index was reported at 89.0. Economists predicted a figure of 96.6 and 89.1. Forex traders can compare this to the Japanese Leading Index for October, reported at 94.3, and to the Japanese Coincident Index, reported at 89.4.

The German GfK Consumer Confidence Survey for February is predicted at -7.9. Forex traders can compare this to the German GfK Consumer Confidence Survey for January, reported at -7.3. French Consumer Confidence for January is predicted at 94. Forex traders can compare this to French Consumer Confidence for December, reported at 95.

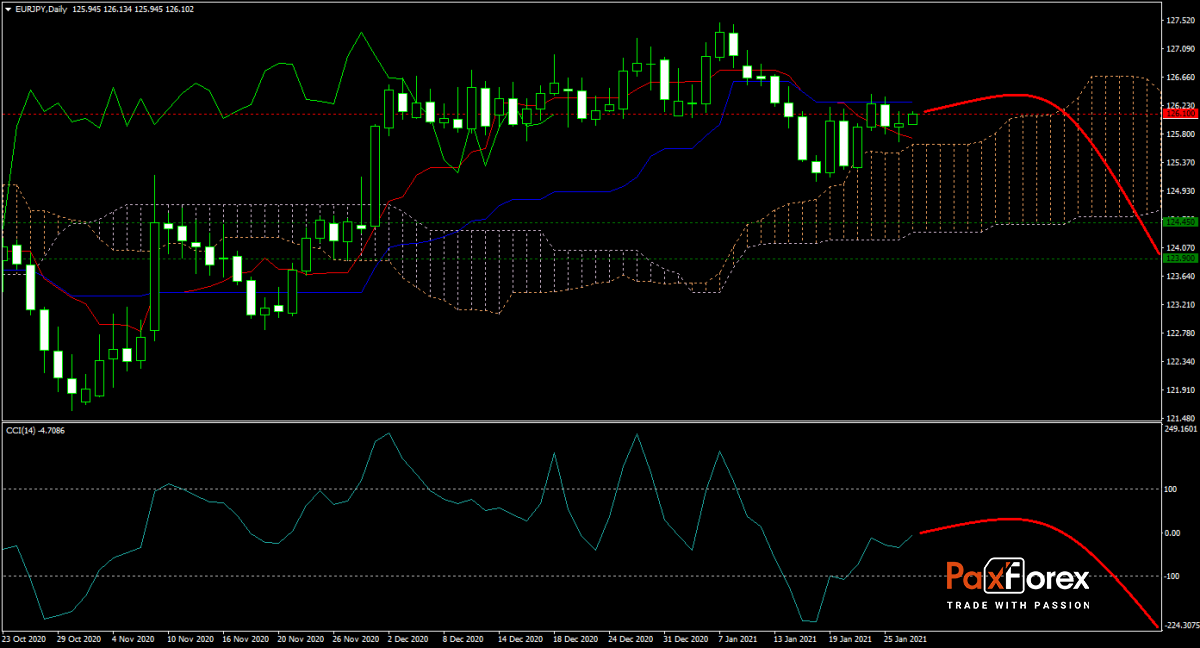

The forecast for the EUR/JPY remains bearish, and the sideways Kijun-sen provides the next resistance level. Adding to downside momentum is the descending Tenkan-sen and the Senkou Span A. With Covid-19 infections topping 100,000,000, global debt spiking, and the economy under ongoing stress, traders should prepare for more volatility and a bearish bias over the next few weeks. Will bears ride the pending flight to safe-haven assets and force the EUR/JPY into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EURJPY remain inside the or breakdown below the 125.950 to 126.300 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 126.100

- Take Profit Zone: 123.900 – 124.450

- Stop Loss Level: 126.600

Should price action for the EURJPY breakout above 126.300 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 126.600

- Take Profit Zone: 127.100 – 127.500

- Stop Loss Level: 126.300

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.