Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Preliminary French Markit Manufacturing PMI for November is predicted at 50.1. Forex traders can compare this to the French Markit Manufacturing PMI for October, reported at 51.3. The Preliminary French Markit Services PMI for November is predicted at 37.7. Forex traders can compare this to the French Markit Services PMI for October, reported at 46.5. The Preliminary French Markit Composite PMI for November was reported at 34.0. Forex traders can compare this to the French Markit Composite PMI for October, reported at 47.5.

The Preliminary German Markit Manufacturing PMI for November is predicted at 56.5. Forex traders can compare this to the German Markit Manufacturing PMI for October, reported at 58.2. The Preliminary German Markit Services PMI for November is predicted at 46.3. Forex traders can compare this to the German Markit Services PMI for October, reported at 49.5. The Preliminary German Markit Composite PMI for November is predicted at 50.4. Forex traders can compare this to the German Markit Composite PMI for October, reported at 55.0.

The Preliminary Eurozone Markit Manufacturing PMI for November is predicted at 53.1. Forex traders can compare this to the Eurozone Markit Manufacturing PMI for October, reported at 54.8. The Preliminary Eurozone Markit Services PMI for November is predicted at 42.5. Forex traders can compare this to the Eurozone Markit Services PMI for October, reported at 46.9. The Preliminary Eurozone Markit Composite PMI for November is predicted at 45.8. Forex traders can compare this to the Eurozone Markit Composite PMI for October, reported at 50.0.

The Preliminary UK Markit Manufacturing PMI for November is predicted at 50.5. Forex traders can compare this to the UK Markit Manufacturing PMI for October, reported at 53.3. The Preliminary UK Markit Services PMI for November is predicted at 42.5. Forex traders can compare this to the UK Markit Services PMI for October, reported at 52.3. The Preliminary UK Markit Composite PMI for November is predicted at 42.5. Forex traders can compare this to the UK Markit Composite PMI for October, reported at 52.1.

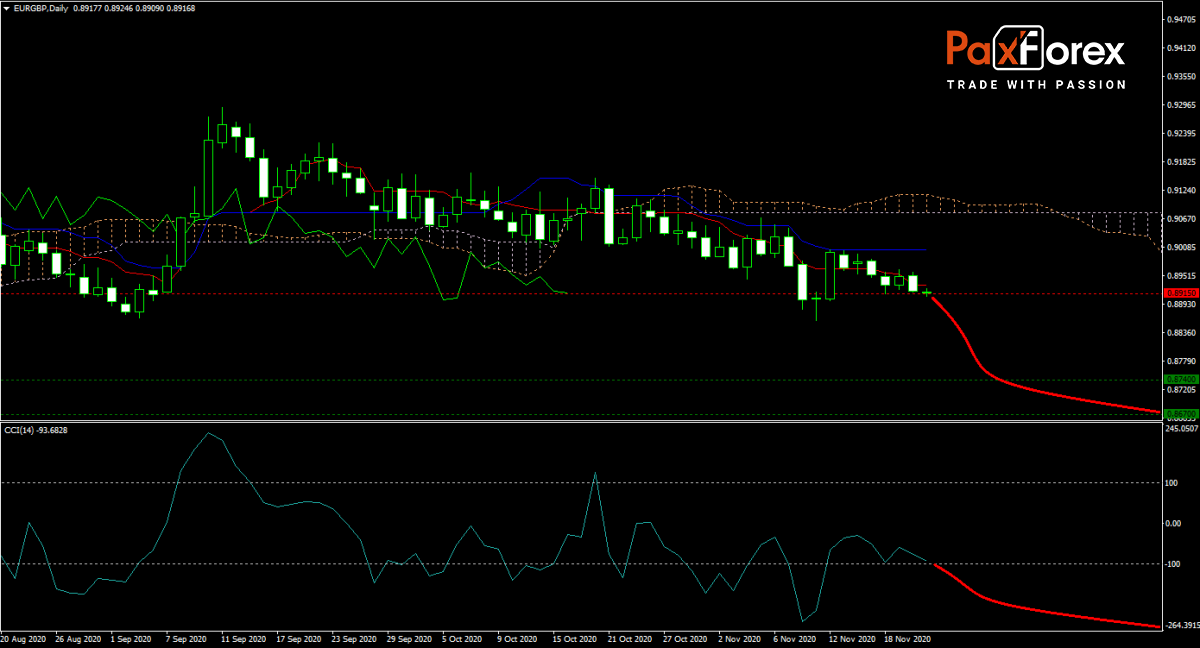

The forecast for the EUR/GBP remains bearish amid economic weakness out of the Eurozone. Germany may enter a recession in the fourth quarter of 2020 or the first quarter of 2021 and drag down the Euro. More debt across the continent weighs on the outlook, while the UK could surprise to the upside following the end of the Brexit transition period. The Ichimoku Kinko Hyo Cloud is sloping downwards, the Kijun-sen and Tenkan-sen are expected to follow the trend lower, and the CCI has more downside potential. Will bears pressure the EUR/GBP into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/GBP remain inside the or breakdown below the 0.8880 to 0.8940 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.8915

- Take Profit Zone: 0.8670 – 0.8740

- Stop Loss Level: 0.9000

Should price action for the EUR/GBP breakout above 0.8940 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9000

- Take Profit Zone: 0.9100 – 0.9145

- Stop Loss Level: 0.8940

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.