Source: PaxForex Premium Analytics Portal, Fundamental Insight

German Retail Sales for December are predicted to decrease by 2.6% monthly and to increase by 5.0% annualized. Forex traders can compare this to German Retail Sales for November, which increased by 1.9% monthly and 5.6% annualized. The Spanish Markit Manufacturing PMI for January is predicted at 50.9. Forex traders can compare this to the Spanish Markit Manufacturing PMI for December, reported at 51.0. The Italian Markit/ADACI Manufacturing PMI for January is predicted at 52.4. Forex traders can compare this to the Italian Markit/ADACI Manufacturing PMI for December, reported at 52.8.

The Final French Markit Manufacturing PMI for January is predicted at 51.5. Forex traders can compare it to the French Markit Manufacturing PMI for December, reported at 51.1. The Final German Markit/BME Manufacturing PMI for January is predicted at 57.0. Forex traders can compare it to the German Markit/BME Manufacturing PMI for December, reported at 58.3. The Final Eurozone Markit Manufacturing PMI for January is predicted at 54.7. Forex traders can compare it to the Eurozone Markit Manufacturing PMI for December, reported at 55.2.

UK Net Consumer Credit for December is predicted at -£1.100B, and Net Mortgage Lending is predicted at £5.591B. Forex traders can compare this to UK Net Consumer Credit for November, reported at -£1.539B, and to Net Mortgage Lending, reported at £5.680B. UK Mortgage Approvals for December are predicted at 105.00K. Forex traders can compare this to UK Mortgage Approvals for November, which were reported at 104.97K. The final UK Markit/CIPS Manufacturing PMI for January is predicted at 52.9. Forex traders can compare this to the UK Markit/CIPS Manufacturing PMI for December, reported at 57.5.

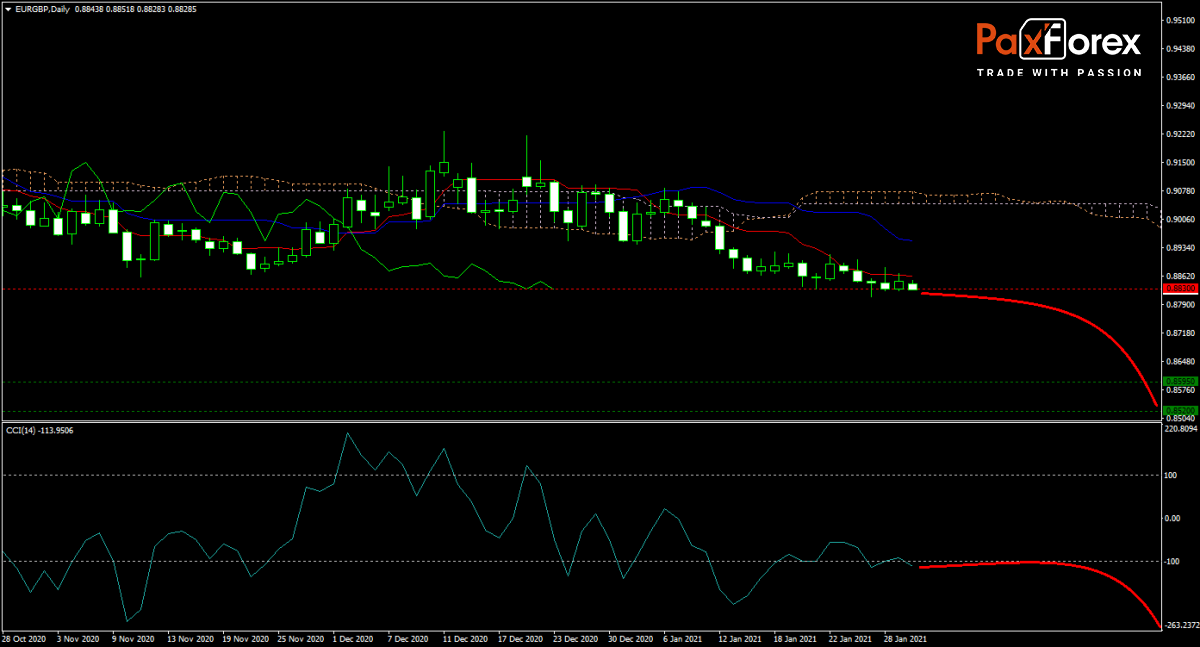

The forecast for the EUR/GBP remains bearish. Fundamental conditions out of the EU weaken further, while the UK continues to move ahead following Brexit. It expands via beneficial trade deals that position the economy to participate in growth, whereas the EU remains stagnant. The Ichimoku Kinko Hyo Cloud is narrow and carries a bearish bias with the Tenkan-sen and Kijun-sen descending. While the CCI reached extreme oversold territory, it has more downside potential. Can bears take advantage of favorable conditions and pressure the EUR/GBP into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/GBP remain inside the or breakdown below the 0.8800 to 0.8865 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.8830

- Take Profit Zone: 0.8520 – 0.8595

- Stop Loss Level: 0.8920

Should price action for the EUR/GBP breakout above 0.8865 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.8920

- Take Profit Zone: 0.9000 – 0.9045

- Stop Loss Level: 0.8865

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.