Source: PaxForex Premium Analytics Portal, Fundamental Insight

UK GfK Consumer Confidence for December was reported at -26. Economists predicted a figure of -31. Forex traders can compare this to UK GfK Consumer Confidence for November, reported at -33. UK Retail Sales for November decreased by 3.8% monthly and increased by 2.4% annualized. Economists predicted a decrease of 4.2% and an increase of 2.8%. Forex traders can compare this to UK Retail Sales for October, which increased by 1.3% monthly and by 5.8% annualized. UK Core Retail Sales for November decreased by 2.6% monthly and increased by 5.6% annualized. Economists predicted a decrease of 3.3% and an increase of 4.1%. Forex traders can compare this to UK Core Retail Sales for October, which increased by 1.4% monthly and by 7.8% annualized. UK CBI Industrial Industrial Trends Orders for December are predicted at -34. Forex traders can compare this to CBI Industrial Trends Orders for November, reported at -40.

The German PPI for November increased by 0.2% monthly and decreased by 0.5% annualized. Economists predicted an increase of 0.1% and a decrease of 0.6%. Forex traders can compare this to the German PPI for October, which increased by 0.1% monthly, and which decreased by 0.7% annualized. The German IFO Business Climate Index for December is predicted at 90.0. Forex traders can compare this to the German IFO Business Climate Index for November, reported at 90.7. The German IFO Current Assessment Index for December is predicted at 89.0. Forex traders can compare this to the German IFO Current Assessment Index for November, reported at 90.0. The German IFO Expectations Index for December is predicted at 92.5. Forex traders can compare this to the German IFO Expectations Index for November, reported at 91.5.

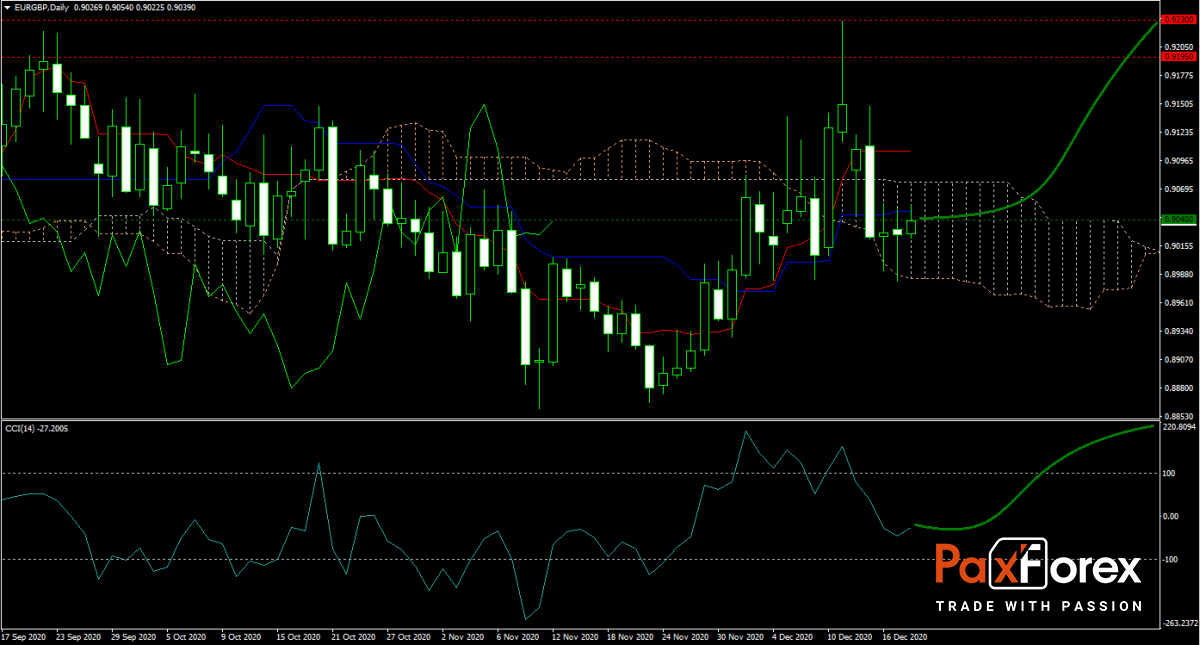

The forecast for the EUR/GBP remains bullish over the short-term, while the long-term trend carries a bearish bias due to expected Eurozone weakness in 2021. The post-Brexit outlook for the UK continues to improve, adding to a bullish trading scenario in 2021. This currency pair entered its Ichimoku Kinko Hyo Cloud, while the Tenkan-sen and Kijun-sen entered a sideways trend. Can bulls extend the EUR/GBP advance into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/GBP remain inside the or breakout above the 0.9000 to 0.9080 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9040

- Take Profit Zone: 0.9195– 0.9230

- Stop Loss Level: 0.8985

Should price action for the EUR/GBP breakdown below 0.9000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.8985

- Take Profit Zone: 0.8860 – 0.8900

- Stop Loss Level: 0.9000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.