Source: PaxForex Premium Analytics Portal, Fundamental Insight

Bitcoin, Ethereum, and the rest of the cryptocurrency world continue to tumble from what many viewed as unsustainable levels. Several factors are contributing to the sell-off. Chinese regulators called for regulation into cryptocurrency mining and transaction. US regulators changed tax reporting requirements, and institutional clients drop non-core assets from their portfolios, with cryptocurrencies the primary victim. Most overestimate the appetite of institutions for cryptocurrencies and do not understand the correlation with other assets. Nervousness in equity markets, a combination of lofty valuations and a rise in inflationary pressures, adds to selling pressure.

It is not all bad news, as Ethereum developers work hard to solve the carbon footprint problems, which joined the chorus of downside pressures on the entire cryptocurrency market. Developers push forward to change the present proof-of-work system to a proof-of-stake. It will slash electricity costs by an estimated 99%. It will eradicate one issue, but the high gas prices needed for transactions persist. Volatility is likely to remain in place throughout the next few months. While a spike higher is expected, traders should prepare for more medium-term downside until price action can test the 880 to 1,000 support region.

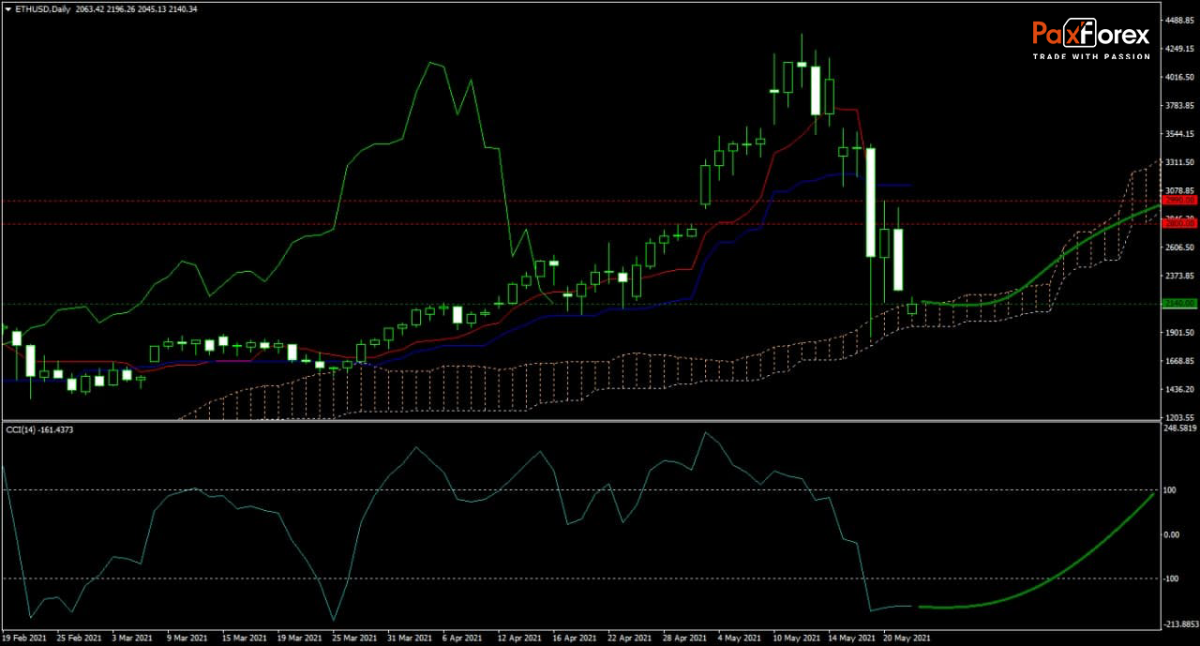

The forecast for the ETH/USD is turning moderately bullish in the short-term after price action corrected into its ascending Ichimoku Kinko Hyo Cloud. Following a reversal of the steep sell-off, more downside is possible as the bullish technical scenario continues to break down. After the descending Tenkan-sen crossed below the flat Kijun-sen, more selling is likely to follow. The CCI dropped into extreme oversold territory and can spike higher before a new collapse to a lower low. Will bears strengthen their grip on the ETH/USD after a minor reversal and force more downside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the ETH/USD remain inside the or breakout above the $2,045 to $2,245 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ $2,140

- Take Profit Zone: $2,800 – $2,990

- Stop Loss Level: $1,860

Should price action for the ETH/USD breakdown below $2,045, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ $1,860

- Take Profit Zone: $1,165 – $1,360

- Stop Loss Level: $2,045

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.