Source: PaxForex Premium Analytics Portal, Fundamental Insight

While there is potential long-term value in Ethereum, if and when promised upgrades come to life, unlikely before the end of 2022. Reducing the carbon footprint is just one obstacle Ethereum and cryptocurrencies face. The surge in demand for DeFi projects and NFTs, many of which utilize the Ethereum blockchain, are likely to propel Ethereum above Bitcoin. In the short term, price action is poised to resume its downtrend. Institutional traders are not buying the dip, and many financial institutions talk positively but fail to act.

As equity markets are poised for a correction, downside pressure on the cryptocurrency market will intensify. Ethereum is already down by almost 60% from its all-time high, and the trend is set to accelerate. With some optimistic predictions placing Ethereum at 100,000 by 2025, the price is likely to test 1,000 in 2021 before attracting enough buy orders to advance. In the meantime, other blockchain projects cater to DeFi and NFTs, making the long-term outlook for Ethereum less bullish than what circulates on social media. It is comparable to Bitcoin at 100,000, which enthusiasts continue to hope for and predict nearly every year for the past decade.

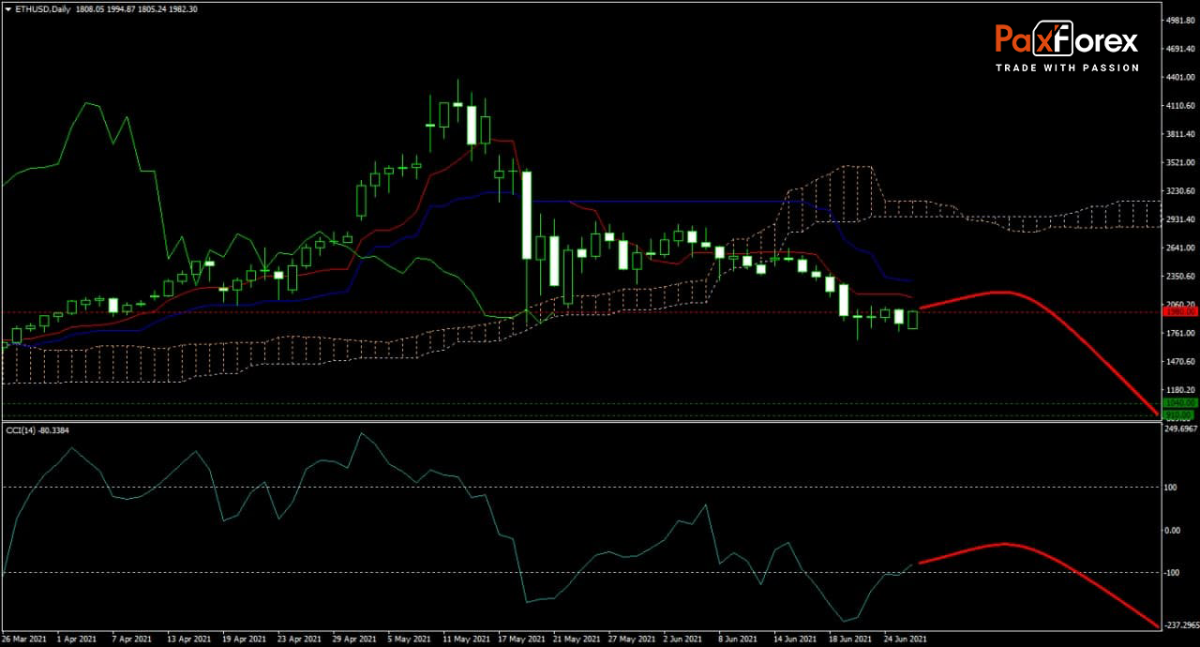

The forecast for the ETH/USD remains bearish, driven by negative technical and fundamental developments. While the Tenkan-sen and the Kijun-sen continue to move lower, the crossover of the Senkou Span A below the Senkou Span B confirms a change in the long-term outlook from bullish to bearish. The Ichimoku Kinko Hyo Cloud turned sideways and now has a bearish bias, and the CCI moved out of extreme oversold territory with plenty of renewed downside potential. Will bears extend their stronghold over price action and force the ETH/USD into its next support zone? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the ETH/USD remain inside the or breakdown below the 1,885.70 to 2,126.10 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1,980.00

- Take Profit Zone: 910.00 – 1,040.00

- Stop Loss Level: 2,300.00

Should price action for the ETH/USD breakout above 2,126.10, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 2,300.00

- Take Profit Zone: 2,658.00 – 2,848.00

- Stop Loss Level: 2,126.10

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.