Source: PaxForex Premium Analytics Portal, Fundamental Insight

Since the end of March 2020, eBay's stock price has risen 146%. Due to the unfortunate COVID-19 situation, many people have been forced to turn to reliable online sources to buy goods, and the e-commerce marketplace eBay has received a huge boost from this wave of traffic. Revenue growth accelerated from a 2% year-over-year decline in the first quarter of 2020 to 42% in the first quarter of 2021.

So far, investors have boosted the company's stock price by 47% in 2021, compared to the 13.6% return of the broader market as measured by the Nasdaq Composite Index. Should you still think about investing in eBay at current levels?

Valuation is always important when assessing the potential growth of a stock. eBay is trading at 19 times the consensus earnings forecast for 2021, which is below the average S&P 500 earnings forecast of 22. The stock could be slightly undervalued, relying on how much eBay will evolve over the long term.

Nevertheless, eBay has faced tougher year-over-year growth comparisons this year. In Q2, revenue grew 11% in currency-neutral terms, down 42% in the first quarter and 30% in the year-ago quarter. In the third quarter, management anticipates revenue to increase 6% to 8% on a currency-neutral basis compared to last year's quarter.

The stock price is up 7.1% since the Aug. 11 earnings report, but given the slowdown, it's hard to say whether the stock will continue to rise in the near term. However, eBay could accelerate earnings growth again in 2022, based on management's strategy to improve the trading platform business.

CEO Jamie Iannone took over in April 2020 and brings with him extensive experience as a chief operating officer of Walmart's e-commerce division. eBay faces growing pressure from new competitors such as Etsy, which posted triple-digit revenue growth in 2020 and added 35.5 million new active buyers. That's more than three times eBay's growth of 11 million active buyers in 2020.

In recent quarters, eBay has reported strong results in new categories, including authentic sneakers, trading cards, and high-end watches. Trading cards, for example, brought in $2 billion in gross merchandise volume (GMV) in the first half of the year, and Iannone sees "untapped potential" for further growth in this category.

Still, $2 billion GMV isn't much compared to eBay's total GMV of $22 billion in the last quarter, but there's more to the strategy than the category's recent expansion. The point is to provide more in-demand things that attract young people, particularly Generation Z and Millennials who like to shop frequently.

Before Iannone joined the company, eBay was concentrated on increasing the overall number of active shoppers without paying attention to the quality of its customers in terms of how engaged they were or how much they spent. As a result, growth in the number of active shoppers slowed to just 1% right before the pandemic in Q1 2020. In essence, Iannone wants to reduce reliance on what he calls "one-time shoppers" and focus on attracting "lifelong enthusiasts" to the marketplace to drive higher growth, which is already yielding good results.

For example, eBay has found that a Generation Z shopper will buy $500 sneakers, but then spend another $2,000 on other categories of merchandise. Iannone explained this during eBay's second-quarter earnings call:

"We're seeing [the same thing] in watches, where a high-end watch buyer spends $8,000 in non-watch categories, and that's over 50 items, and that's one of eBay's advantages - the cross-category nature of shopping, which is very difficult for other competitors to replicate."

Although eBay's number of active buyers fell by 7 million sequentially to 159 million this quarter, that's still a broad customer reach that reflects the wide variety of products eBay offers as the company seeks to attract higher-value buyers.

"Compared to last year, the number of these buyers is increasing, and their spending on eBay is increasing even faster," Iannone said. "This better mix of buyers adds value for sellers and will lead to a better state of our ecosystem in the long run."

If eBay can attract more high-volume buyers to the marketplace, it will attract more sellers. That, in turn, will lead to more product selection, which will also help attract more buyers and create a growth flywheel.

Iannone has breathed new life into eBay, which, in our opinion, makes this stock worth watching even after rising over the past year. There are faster-growing online retail stocks, but eBay is not going away. The company generates a healthy level of free cash flow, which it returns to shareholders through stock repurchases and dividend payments. Over the past year, eBay's free cash flow was $2.9 billion, a high margin of 29 percent compared to total revenue of $10 billion.

It's not too late to invest in eBay. If management continues to be successful in attracting young buyers, the stock could generate above-market returns.

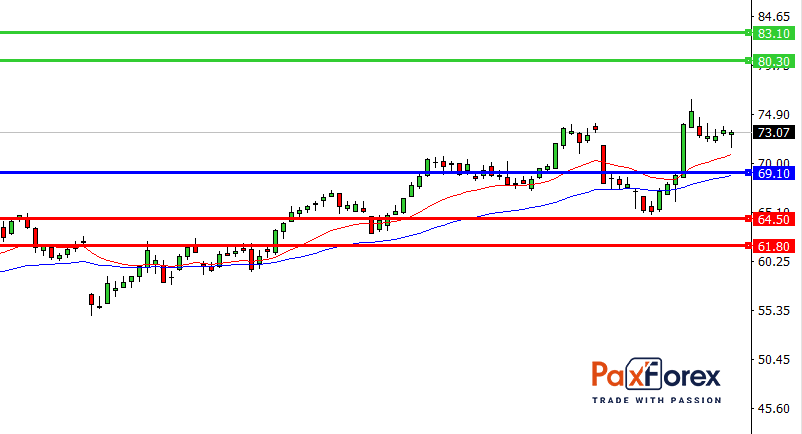

As long as the price is above 69.10, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 72.84

- Take profit 1: 80.30

- Take Profit 2: 83.10

Alternative scenario:

If the 69.10 level is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 69.10

- Take profit 1: 64.50

- Take Profit 2: 61.80