Source: PaxForex Premium Analytics Portal, Fundamental Insight

eBay has been a somewhat dormant e-commerce player for the past few years, but it revived last year thanks to a sudden interest in online shopping during the coronavirus pandemic and a new CEO who took office in April 2020. Now some investors are wondering if the transformation will continue and what it will mean for the company's stock.

Of course, eBay could be at a disadvantage again in the near term as consumers begin to gradually forget about the pandemic and return to offline shopping. What eBay investors are interested in is not so much what happens in the next few quarters, but whether management has been able to use the surge in sales in 2020 to put the company on a long-term growth path.

eBay was once one of the darlings of the technology boom of the 1990s, but interest waned in the 2000s as high fees, free listings on competing sites, and a difficult-to-use platform led to a loss of interest in the company and the stock. Moreover, the fact that one-time subsidiary PayPal quickly became much larger than eBay after its public spin-off did not help its reputation. Despite recent improvements, PayPal's market value is more than seven times that of eBay.

Over the past year, however, eBay has been strengthened by two factors. First, as a result of the lockdown caused by COVID-19, online retailers benefited across the board as millions of people were forced to temporarily forego shopping at most stores. Second, Jamie Iannone was offered the CEO position. Iannone is a former eBay executive who started e-commerce initiatives at Walmart eCommerce and Sam's Club.

As CEO of eBay, Iannone contributed to what he called eBay's "technological reinvention" in the first quarter of 2021. It led to a redesign of the Web site and the overall sales process. For example, he added QR coding to the packing lists for faster pickup of merchandise. Iannone also simplified the process of listing items for sale on eBay. Features such as image-based listings have reduced listing times by 75%.

eBay has also simplified digital payments with its Managed Payments platform. Most of the most common digital wallets are now available to buyers. Thus, credit cards, debit cards, and PayPal are no longer the only payment options, and users are no longer required to have a separate PayPal account. In addition, the eBay system now manages claims and returns processes on one platform. These changes have simplified the selling process for both buyers and sellers.

The change in sales terms and improvements to the site have dramatically changed the financial outlook. In 2020, revenue was up 19% over the previous year and GAAP net income was up 68%.

By comparison, Walmart's online sales were up 79% in 2020 on the back of overall revenue growth of 9%. Over the same period, Amazon reported net sales growth of 39% (excluding Amazon Web Services) in 2020. While eBay lags behind its much larger competitors in e-commerce revenue growth, investors should also keep in mind that before Iannone came in, eBay's revenue growth in 2019 was 1%.

Thanks to a record gross merchandise volume of more than $27 billion, revenues in the first quarter of 2021 were up 42% from the year-ago quarter. In addition, eBay's GAAP net income rose to $569 million. That's a 32% increase over the same quarter last year if you exclude a one-time gain of $3.1 billion from discontinued operations in 2020.

The revenue growth allowed eBay to generate a free cash flow of $855 million during the quarter, a 65% increase over the same quarter last year. It helped the company cover $117 million in interest expense and $122 million in dividends. eBay is also having an easier time managing its debt, as total debt levels have dropped from just under $7.8 billion a year ago to about $6 billion today.

Investors have taken notice, and even after the recent decline, eBay's stock price has risen more than 45% in the past 12 months. And while the price-to-earnings (P/E) ratio has climbed above the single digits, an earnings ratio of 14 keeps the valuation below the P/E of 30 for Walmart and 62 for Amazon.

Nonetheless, the financials point to possible near-term difficulties. The company's projected quarterly revenue in the second quarter is about $3 billion, which is about 3 percent growth over 12 months. In addition, the company hasn't released any guidance for the year. While many other e-commerce companies have also declined to publish full-year guidance, it speaks to the uncertainty surrounding the industry as consumers return to more offline shopping options.

Despite near-term doubts, the actions taken by eBay during the pandemic may justify new investments. Indeed, when the pandemic subsides, it may temporarily slow sales. But consumers tended to do more online shopping even before the pandemic. Iannone's approach has made eBay a more user-friendly site, which makes it more likely that it will become more popular with sellers and buyers even after the pandemic is over.

It does not mean that eBay will necessarily match the revenue growth of retail giants such as Walmart or Amazon. Nonetheless, with a P/E ratio of 14, these consumer stocks still have significant growth potential and are now priced in.

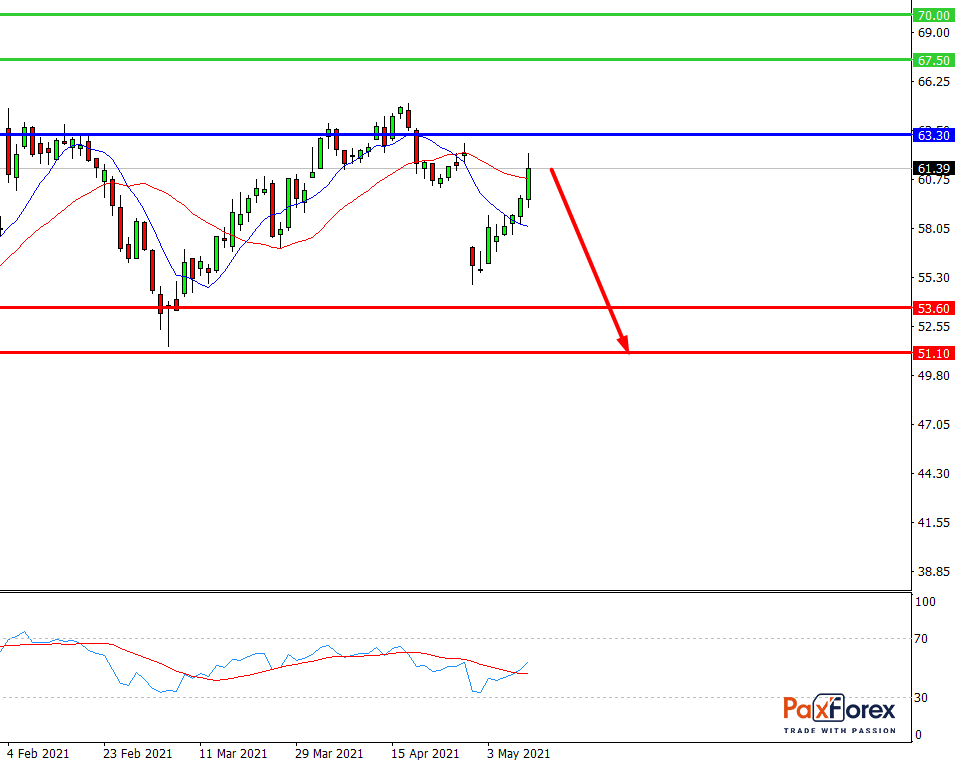

Provided that the company is traded below 63.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 59.78

- Take Profit 1: 53.60

- Take Profit 2: 51.10

Alternative scenario:

In case of breakout of the level 63.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 63.30

- Take Profit 1: 67.50

- Take Profit 2: 70.00