Source: PaxForex Premium Analytics Portal, Fundamental Insight

eBay shares have attracted very little from traders and investors alike recently. They traded in a range for a long time until Jamie Iannone became CEO in April. Nevertheless, both the pandemic and the change in leadership have revived interest in consumer discretionary stocks. Such a different approach could make eBay an overlooked story of a comeback in a fast-growing industry.

Notwithstanding the success of e-commerce behemoths like Amazon or Shopify, eBay has become an underdog in the fast-growing retail segment. High charges, a difficult-to-use platform, and free listing options such as Facebook Marketplace have made eBay uninspiring. The company's stock has fallen so much that the former PayPal subsidiary now has a market capitalization nearly eight times that of eBay`s.

Conditions began to change with the return to the company in April 2020 of former eBay chief Iannone. Before his return, Iannone was involved in developing e-commerce strategies at Walmart eCommerce and Sam's Club. Those accomplishments made eBay management bring him back to the company.

Though, when he started, store closures during the pandemic had increased interest in e-commerce around the world. However, Iannone adopted several different strategies to improve the experience of both buyers and sellers on eBay.

Under his leadership, eBay decreased the number of steps in the listing process to make adding items less burdensome. He also introduced QR coding to make selections more efficient and focused on "non-new in-season" items to better use existing communities of buyers and sellers.

eBay also added tools and features that better enable small businesses to grow their ventures. The company simplified registration and enabled storefronts on mobile devices. Also, eBay used AI teams to remove "friction points." One addition included optimized filters to help customers find the right items. Finally, as agreements with PayPal expired, eBay added managed payments in several countries to facilitate the e-wallet experience. Many of these transitions have already taken place.

In the fourth quarter of 2020, Iannone announced that the number of advertised listings grew 86% during the year. He also added that eBay gained 11 million new buyers in 2020, and the frequency and retention of these buyers resemble pre-pandemic levels.

Such improvements have helped reach the top and bottom lines. In 2020, revenue rose 19% to just under $10.3 billion. Besides, GAAP net income from continuing operations rose nearly 68% from year-ago levels to just over $2.5 billion, or $3.58 per share.

This increase was due to operating expenses growing more slowly than revenues. Also, an investment in Adyen, the Dutch payments company in which eBay invests, brought in $709 million. This almost offset an income tax bill of $878 million. Besides, these figures do not include a one-time revenue gain of more than $3.1 billion from discontinued operations.

As for the future, the company believes that growth will continue shortly. Revenues from eBay projects will grow 35% to 37% in the first quarter of 2021. GAAP net income is also expected to be between $0.81 and $0.86 per share during that period, up from $0.64 a year earlier.

Given this optimism, it's not surprising that eBay stock has risen more than 60% since Iannone took office on April 27.

What's more, even after this rise, investors who buy now will only pay about 18 times as much for eBay stock from continuing operations. That seems cheap for a company reporting massive net income growth. Also, with global e-commerce expected to expand at an average annual growth rate of just under 15% through 2027, according to Grand View Research, eBay's double-digit revenue growth could continue for the foreseeable future.

Without a doubt, eBay has demonstrated a significant turnaround in 2020. Iannone's strategy to make the platform more user-friendly for both buyers and sellers may have added additional

revenue growth. However, COVID-19 probably fueled much of that improvement, so investors will probably need to see double-digit revenue and earnings growth after the pandemic to buy eBay stock.

Buying now, however, means that investors are paying roughly 18 times earnings when both companies and the industry are pointing to double-digit earnings growth. If this value offer stays the same after the pandemic ends, investors may continue to bid higher on eBay.

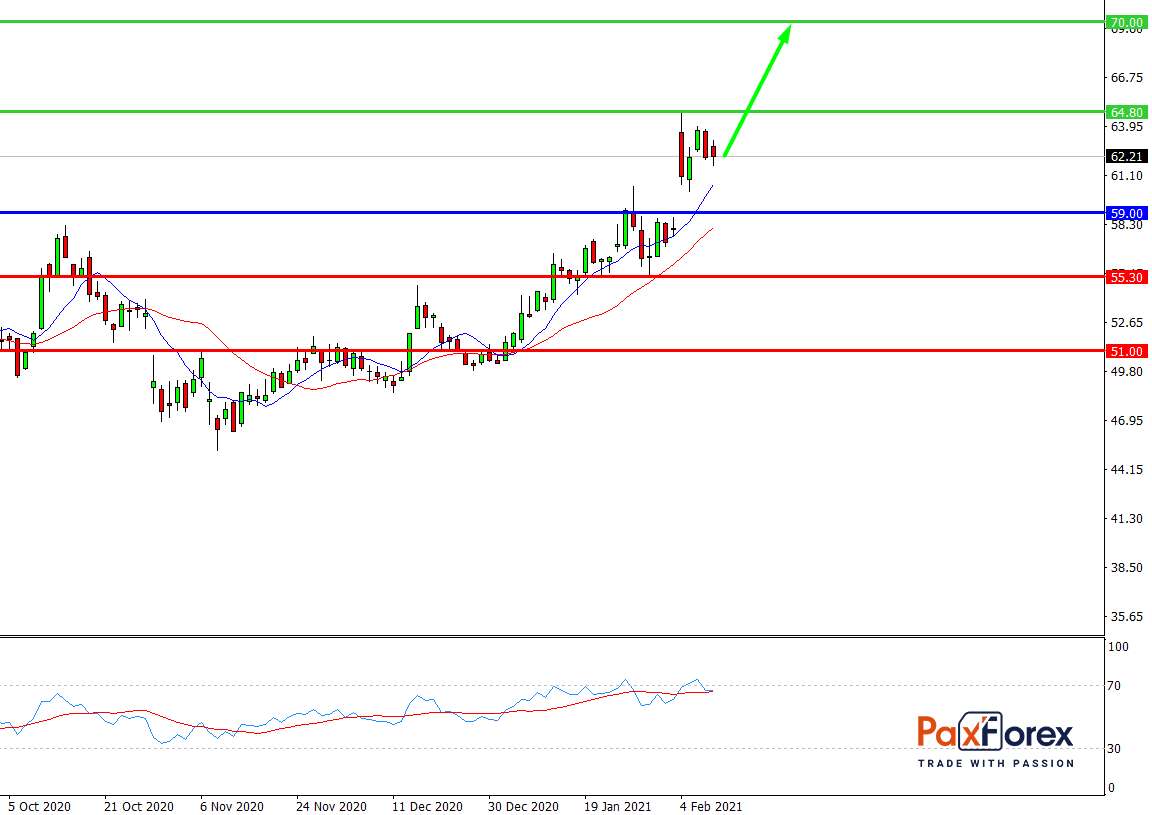

While the price is above 59.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 60.47

- Take Profit 1: 64.80

- Take Profit 2: 70.00

Alternative scenario:

If the level 59.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 59.00

- Take Profit 1: 55.30

- Take Profit 2: 51.00