Source: PaxForex Premium Analytics Portal, Fundamental Insight

eBay stock has been on a roll in 2021. Investors have favored the company's low-asset business model, which has seen a surge in customers and spending since the pandemic.

The stock is up nearly 39% year-to-date, and it continues to break new records. As a result, some investors are asking: Does eBay stock have an opportunity to go even higher?

Like many other online platforms, eBay's business rose sharply during the pandemic. From the fourth quarter of 2019 through the fourth quarter of 2020, the number of active buyers increased by 11 million to 185 million. Moreover, buyer interest persisted even during the resumption of economic activity in the first quarter of 2021, and eBay reached the 187 million active buyers mark at the end of the first quarter.

Prior to the pandemic, eBay posted a 5% decline in gross merchandise volume ( GMV) in 2019. Given this weak result, it's understandable that the stock was selling at a relatively low forward price-to-earnings (P/E) ratio of 11 at the time.

But last year, GMV growth accelerated to 26% in the second quarter. The ratio slowed in the second half of the year and rose again to 29% in the most recent report.

eBay expects the growth rate to slow down in the current period as the company posted strong results in last year's quarter, but it's still impressive that management expects revenue growth of 12% to 14% year-over-year.

It may be too early to tell, but it looks like customers who joined the company during the pandemic will be here for the long haul. The eBay platform gives shoppers access to a unique mix of new and used items. You can buy a new pack of baby diapers and a used smartphone at the same time. Product selection and price savings are the two things that attract shoppers to eBay.

Organic buyer interest during the pandemic allowed eBay to cut back on advertising costs. Before the pandemic, many shoppers regularly received promotional offers from eBay for 20 percent off their entire order with a maximum discount of $100. In addition, there were sometimes $15 off any order worth $75 or more. After the pandemic began, however, these offers disappeared.

Reduced advertising spending allowed eBay to increase its transaction acceptance rate, which is the amount of revenue eBay gets per transaction, from 9% in Q4 2019 to 10% in Q1 2021.

In addition, eBay is leaving order fulfillment and logistics to sellers. Recently, this strategy has become a competitive advantage as several factors, including a shortage of truck drivers, have driven up shipping costs.

eBay recently closed the sale of Adevinta, which brought in $2 billion in cash. This event caused eBay to raise its share repurchase target this year from $2 billion to $5 billion. In addition, the company entered into an agreement to sell its business in Korea for $3 billion. Investors are welcoming these sales because they will allow eBay to focus on its core business.

Overall, an increase in active buyers, lower advertising activity, and billion-dollar share repurchases will help support eBay's earnings per share (EPS). Nonetheless, management is guiding investors that earnings per share will decline in the second quarter. However, this is more of a result of hard comparisons to the same quarter last year.

However, the eBay of tomorrow is not the eBay of yesterday. The company is finally taking advantage of its smaller size and seller-supported platform to do things that Amazon and Walmart just can't.

Earlier this month, for example, eBay announced that it was extending its "Authenticity Guarantee" service to luxury handbags sold through its platform. Last month, the company said it would allow the sale of NFTs (non-fungible tokens) on its site. Last year, eBay introduced a program of certified refurbished goods to support sales of office and home electronics. These are developments that better reflect the situation of consumers and companies, so to speak, and the way today's global culture is structured.

The anticipated downturn in earnings caused by the pandemic may be one reason that eBay stock can be purchased at a relatively inexpensive forward price-to-earnings ratio of 17.7. Thus, despite eBay's stock price rising in 2021, it has an opportunity to go even higher.

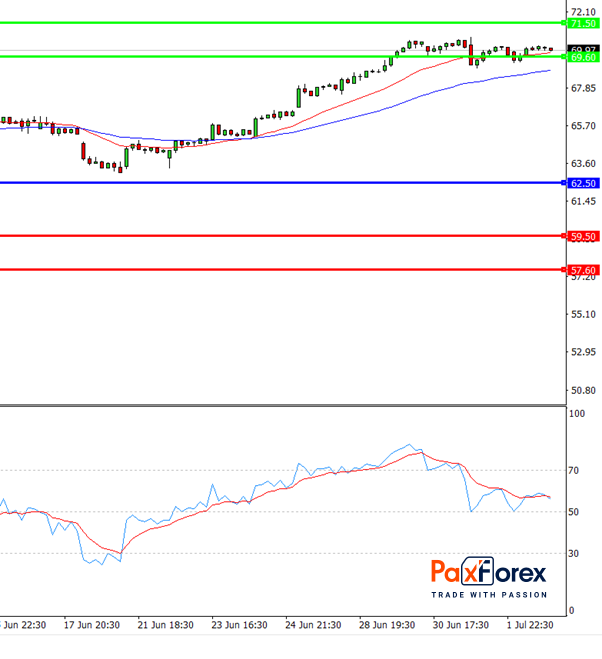

Provided that the company is traded above 62.50, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 65.35

- Take Profit 1: 69.60

- Take Profit 2: 71.50

Alternative scenario:

In case of breakdown of the level 62.50, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 62.50

- Take Profit 1: 59.50

- Take Profit 2: 57.60