Source: PaxForex Premium Analytics Portal, Fundamental Insight

Walt Disney has become one of the most popular blue-chip stocks thanks to its distinguished history. The House of Mouse has been delighting its customers for decades and thereby winning their loyalty.

Some of the latest news, there's been a lot of buzz about one of Disney's latest premieres. The debut of "Loki" from Marvel Studios on Disney+ was highly anticipated, and the god of mischief did not disappoint. In the second quarter, "Loki" was the most-watched premiere on Reelgood, with 10.5% of its 2 million users watching the first episode in the first weekend.

That was more than double the share of viewers received by the other top series released in the second quarter.

"Loki" also got a larger share of viewership in its opening weekend than Marvel's "WandaVision," which reached a 9.5 percent share in January, or " The Falcon and the Winter Soldier," which got a 6 percent share in March.

"Like our movies, our Disney+ original series have become must-see events. Starting with the success of 'Mandalorian,' followed by 'WandaVision' and 'the Falcon and the Winter Soldier,'' CEO Bob Chapek said during a discussion of earnings for the fiscal second quarter, which ended April 3. "They were not only immediate hits but also part of the cultural zeitgeist."

Disney's stock price declined after Disney+ missed analysts' consensus estimates for subscribers in the last quarter, but the strong start of "Loki" reinforces management's view that as more content is released, it will be a major catalyst for the service's growth.

Disney+ has added more than 70 million new subscribers over the past year, but the 103.6 million subscribers at the end of the second fiscal quarter did not reach the 109 million expected by analysts. That made some investors skeptical about whether the company could reach its target range of 230 million to 260 million subscribers in fiscal 2024.

Still, during the results announcement, Chapek stressed that Disney added 30 million households in the first six months of the fiscal year, which is in line with the company's expectations. "Every market we've entered has exceeded our expectations," he said.

Chapek called the "Loki" series "a huge catalyst for growth" for Disney+. Given that the series is just a drop in the stream of content that comes to the service, it's understandable why management remains confident in its ability to meet its subscriber targets.

To reach the lower end of its goal for fiscal 2024, Disney+ needs to more than double its subscribers in three years, which implies an annual growth rate of about 25 percent. That's certainly achievable, but it's also understandable that some investors doubt the streaming service will grow that fast. Netflix, for example, crossed the 100 million paid subscriber threshold in the third quarter of 2017, and after nearly four more years of growth, it still hasn't reached 230 million.

Disney+ will have to keep growing faster than Netflix to reach its targets. To do so, it will have to constantly surprise audiences with new content releases. As Chapek noted, engagement is a precursor to net subscriber growth.

That's why the robust launch of "Loki" was great news. In December, Disney unveiled an impressive content development plan for the next few years, including plans for 10 new original series from the Marvel and Star Wars universes. Also on the agenda are 15 live-action series, Disney, and Pixar animation.

The company decided to apply to Disney+ what has brought it success at the box office - in other words, it focused on quality rather than quantity. Given Disney's incredible track record before the pandemic, when the company produced one blockbuster after another, Chapek believes it can achieve the same success in streaming.

"Looking at our entire streaming portfolio, we expect that as we resume full production and move to a more normalized cycle, increased production volumes will drive additional sub-product growth at Disney+, ESPN+, Hulu and Hotstar," the CEO said.

Based on all this, the recent decline in Disney's stock price could be a good buying opportunity. But investors should pay close attention to the total number of Disney+ subscribers in the fiscal third-quarter earnings report, which will be out in a few months. If management isn't wrong, "Loki" should have helped it attract quite a few new subscribers.

A strong brand, decades of customer service and loyalty-building, and growth opportunities in streaming will all help Disney remain a blue-chip stock. Investors looking for a stock they can buy and hold with confidence for years can feel free to add Disney to their portfolio.

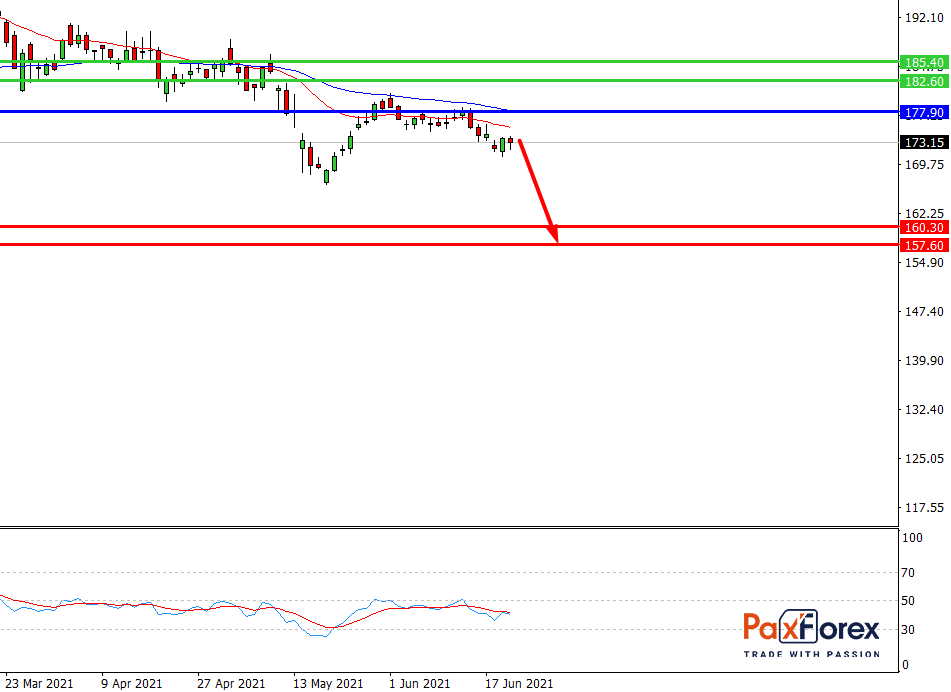

While the price is below 177.90, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 173.97

- Take Profit 1: 160.30

- Take Profit 2: 157.60

Alternative scenario:

If the level 177.90 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 177.90

- Take Profit 1: 182.60

- Take Profit 2: 185.00