Source: PaxForex Premium Analytics Portal, Fundamental Insight

It's no secret that Wall Street loves Mickey Mouse these days. On Monday, Disney stock hit another all-time high. Investors won't have to wait long for the company's next big success signal: Disney will report new financial results shortly after the market closes on Thursday.

Disney's fiscal year 2020 revenues were down 6 percent, while fourth-quarter (ended Oct. 3) revenues were down 23 percent from a year ago due to declines in the Parks, Entertainment and Products and Studio Entertainment segments. Adjusted earnings for the full fiscal year were down 65%. Previously, third-quarter revenues were down 42% and adjusted earnings were down 94%.

Disneyland Resort President Ken Potrock said Monday that Disney California Adventure will expand its outdoor dining and indoor shopping options for limited ticket time in mid-March.

There is no information on actual dates or prices, but it's fair to say that tickets will likely sell out even at Disney's increased prices. There is pent-up demand in Southern California for returns to iconic theme parks and popular regional entertainment venues. With the cancellation of Disneyland's annual program last month, everyone will be paying retail prices for a stay.

Disney California Adventure's partial reopening will allow the company to bring about 1,000 employees back to work, according to The Hollywood Reporter. That's a far cry from the tens of thousands of employees working in pre-recession times, but it's all about small steps now.

The good news should continue after next month's unique event until efforts to defeat the pandemic succeed. Legislative work is already underway to accelerate the opening of state theme parks.

Nevertheless, the fiscal first-quarter report still has much to clarify, but if you're expecting strong growth and high profitability, you'll be surprised. Everyone knows Disney is not in great shape right now. Revenues will go the wrong way. The media giant is not likely to be in trouble again, as closed attractions and rising costs to keep Disney+ thriving will claw into modest positive net profits from the rest of its projects.

It's okay if the quarter itself turns out to be a tough one, as investors' eyes are on the horizon. Right now, that outlook has nothing to do with Disney's earnings report, the closing of Disneyland, or the empty list of theatrical releases coming shortly.

Disney stock has more than doubled since the collapse 11 months ago. Of all media stocks, the House of Mouse just topped the list of the 15 most valuable companies by market capitalization among traders in the state.

Undoubtedly, the headline numbers will not be pretty. The $15.9 billion analysts see at the top will be nearly 24% lower than where it was a year ago. The target is a loss of $0.42. That's more than double the deficit reported just three months earlier when the pandemic seemed even grimmer.

Regardless of this week's stock chart, many analysts are not so optimistic about Disney. There is some logic to this, as half of the global theme park resorts are now closed. It's been almost a year since Disney released its movie. The cruise ships are anchored. The company still has its media networks and an unparalleled catalog of content. It also has streaming services - Hulu, ESPN+, and, more importantly, Disney+ - that have taken the stock to new heights.

For investors, it may well be the Disney+ numbers that matter more than the media empire as a whole. Since its launch 15 months ago, Disney+ has flipped. As of early December, the platform had 86.8 million subscribers. Disney+ accounted for just 7% of fiscal fourth-quarter revenue. And where is it now? Average revenue declined as the platform expanded into India and other markets with lower price points. And then what happens? As prices rise, will the downward trend in average revenue per user reverse sooner or later?

How popular was the second season of The Mandalorian? Now armed with a larger audience on Disney+, does WandaVision look any better? We can ignore the top line drop. Disney will bounce back. Disneyland, cruise ships, and theaters showing Disney movies will likely be back in business later this year. Disney's recurring quarterly losses will soon disappear into the rearview mirror (worst case) or look necessary to catapult Disney+ (best case). The company needs to stabilize all of its recent successes, but that's likely to happen given the momentum on its side.

Now there is hope for a return to normalcy with the spread of vaccines and drugs for the virus. Since many people have been putting off trips and visits to theme parks since the pandemic began, there may be increased demand once they feel safe again. Movie theater attendance is also likely to increase. However, there is uncertainty about the timing of this changeover.

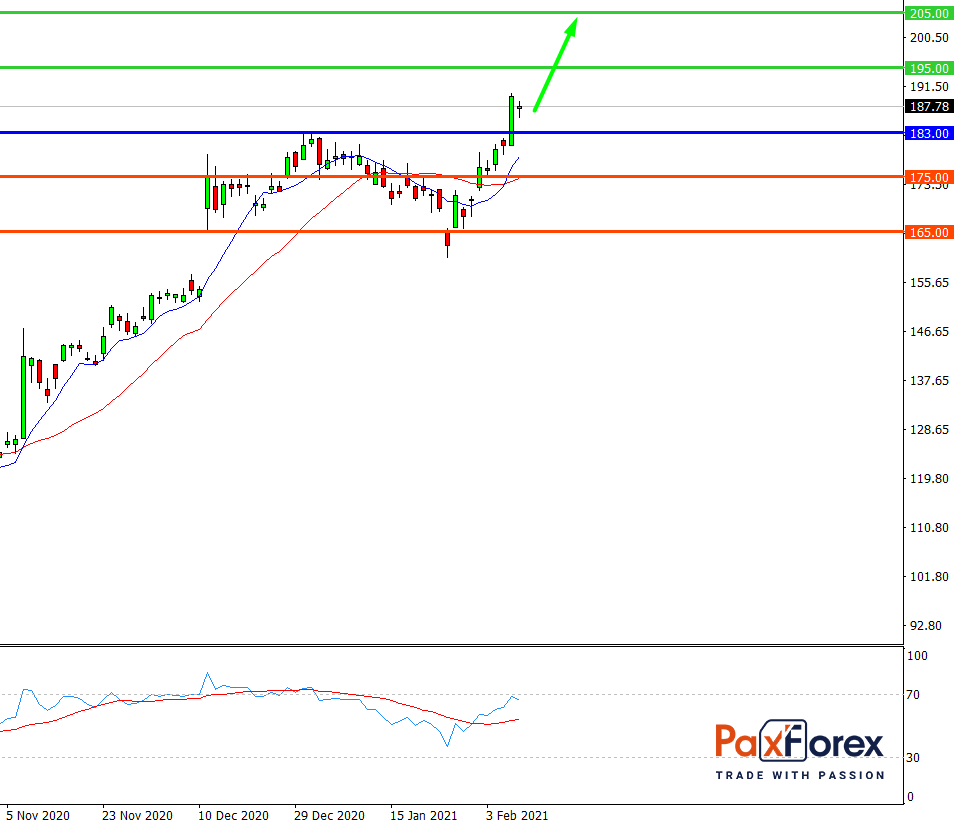

While the price is above 183.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 188.00

- Take Profit 1: 195.00

- Take Profit 2: 205.00

Alternative scenario:

If the level 183.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 183.00

- Take Profit 1: 175.00

- Take Profit 2: 165.00