Source: PaxForex Premium Analytics Portal, Fundamental Insight

For most of the past year, the Federal Reserve banned share buybacks and limited dividend payouts to ensure that banks had enough capital to deal with the uncertainty caused by the coronavirus pandemic. So naturally, once those restrictions were lifted on June 30, most of the big banks announced their intentions to raise dividends and increase share buybacks.

Citigroup was the only major bank not to announce a dividend increase. It disappointed the broad market, but the bank appears to have a good reason for that decision.

Banks return capital to shareholders in two main ways: dividends and share buybacks. But Citigroup is now in a position where a buyback would maximize returns to investors. Citigroup faced regulatory challenges last year that included a $400 million fine. The fine was also accompanied by injunctions from the U.S. Office of the Comptroller of the Currency, which regulates national banks, and the Federal Reserve, ordering Citigroup to improve internal risks and controls. That, along with other problems encountered during the pandemic, led to a sharp drop in the stock.

Although they have since recovered, Citigroup still trades below book value (TBV), which is the bank's total shareholder equity net of intangibles and goodwill. In essence, TBV is a measure of how much the bank would be worth if it were immediately liquidated. Banks typically trade based on their TBV, so an increase or decrease in TBV can greatly affect the stock price. A stock buyback is most profitable for a bank when it trades below TBV. Regardless, when banks conduct stock buybacks, they increase the bank's earnings per share (EPS) by reducing the number of shares and giving the remaining shareholders more of the profits.

But when banks trade below tangible book value, the math works so that share buybacks also increase TBV. When the stock price is higher than TBV, buybacks reduce TBV. Since Citigroup currently trades at just 86% of TBV, that's a unique opportunity for the bank to conduct a stock buyback and maximize value. As analyst Mike Mayo said after the bank's earnings report was released, "So you should probably sell ... your chairs, silverware and whatever else you can to buy back your stock, I think."

As a result, Citigroup will want to use most of its earnings and excess capital to buy back as many shares as possible, rather than to pay dividends. Citigroup CFO Mark Mason said in a recent earnings call that the bank has $4 billion in excess capital beyond the amount it wants to hold for regulatory purposes. The bank then plans to sell its consumer banking business in 13 global markets, which is backed by $7 billion in the capital, which will free up capital, and of course, the bank should continue to show positive earnings results going forward. Overall, that could lead to the bank buying back a large number of shares over the next year.

Another reason Citigroup doesn't think it should raise its dividend is that the bank is already paying a high dividend compared to peers, even after the planned increase. Here's a comparison with other banks' planned dividend increases:

- JPMorgan Chase 2.6%.

- Bank of America 2.2%

- Wells Fargo 1.8%

- Citigroup 3%

Citigroup leads its peers in dividends and has an attractive yield of 3%. While it is true that the bank's stock trades at a lower valuation than its peers, even if Citigroup stock traded at $80, which is the price it was at before the pandemic, the bank would have a yield of 2.6% on a quarterly dividend of $0.51, and it would still be the best performer in the group of similar banks.

While many market participants would probably like to see Citigroup raise its dividend a bit, just to appease the market, it still has a higher yield than its peers and a generally attractive dividend yield. Given the way the math works, it makes much more sense for the bank to use capital to buy back shares, which would increase earnings per share and TBV per share and prove beneficial to the stock in the long run. Not every bank makes an obvious decision to buy back shares when they are trading at or below TBV, so that is a good sign to shareholders that management sees an opportunity and clearly seizes it.

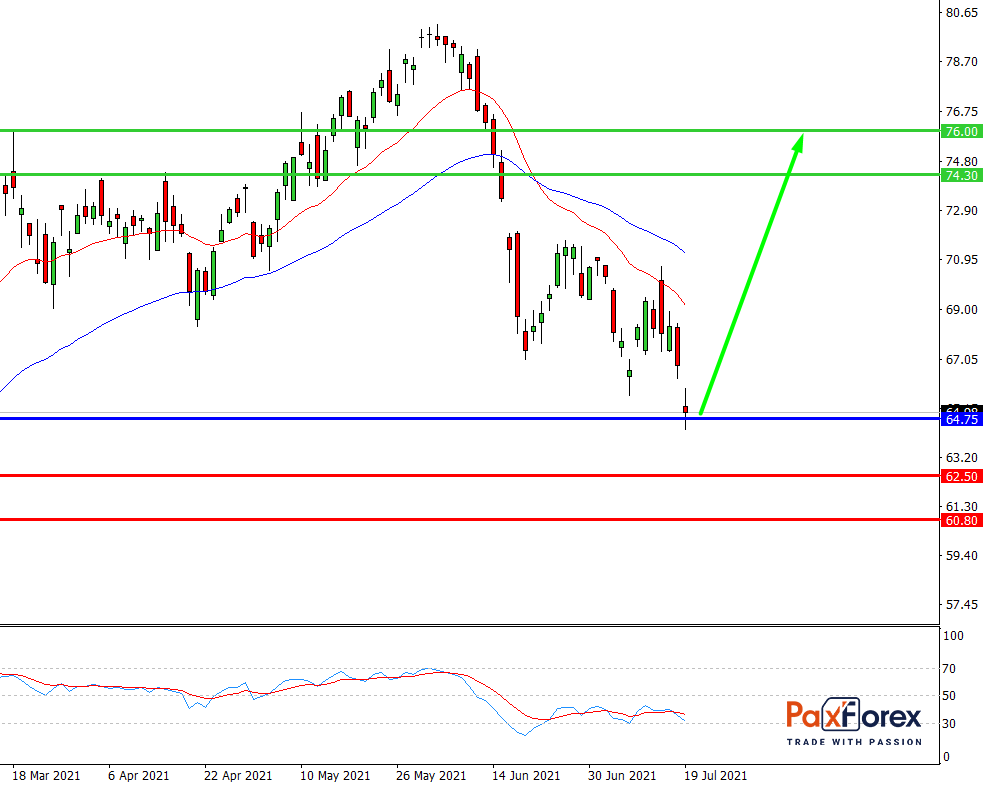

While the price is above 64.75, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 65.50

- Take Profit 1: 74.30

- Take Profit 2: 76.00

Alternative scenario:

If the level 64.75 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 64.75

- Take Profit 1: 62.50

- Take Profit 2: 60.80