Source: PaxForex Premium Analytics Portal, Fundamental Insight

Not long ago, Cisco Systems stock hit a two-year high after this tech titan released its Q4 results on Aug. 18. Analysts were excited by Cisco's second consecutive quarter of year-over-year revenue growth (which succeeded a five-quarter revenue decline streak), as well as an optimistic forecast for fiscal 2022.

Cisco's mature business, low P/E ratio of 17, and a high dividend yield of 2.7% likely also made the company more attractive than more motley tech stocks, many of which have fallen this year amid concerns about their valuations, losses, and tighter post-pandemic comparisons. But is Cisco stock worth buying after it has risen more than 30 percent in the past year? Let's look at the company's recovery to address that.

Cisco's infrastructure platforms business, which sells routers, switches, and other equipment, accounted for 54% of its sales in fiscal 2021. This core business has encountered some difficulties over the past couple of years.

First off, the business has withstood stiff competition from rivals such as Huawei, Arista Networks, Hewlett Packard Enterprise, and Juniper Networks. According to IDC, Cisco will remain the global leader in the first quarter of 2021, with 49.3 percent of the ethernet switch market and 37.6 percent of the combined service provider and enterprise router market. However, the commoditization of both markets sequentially restrains the company's growth potential and pricing power.

At the same time, the trade war has made Cisco miss contracts with Huawei and others in China. Cisco is making only a small percentage of its revenues in China, but this decline has coincided with a slowdown in data center and corporate campus modernization elsewhere. This overall decline was exacerbated during the pandemic as companies delayed upgrading their networks.

The pandemic also hurt the applications business, which accounted for 11% of sales in fiscal 2021, as demand for unified communications and telepresence products, which are installed in offices for meetings and conference calls, declined. The Webex video conferencing platform, which is part of that segment, is also not keeping up with the simpler Zoom Video Communications platform as more people work from home.

Cisco's security business, which brought 7 percent of revenue in fiscal 2020, continued to grow as it was well protected from the trade war and the pandemic. Its services division, which generated 28% of sales, also remained steady. However, the strength of these two areas could not compensate for Cisco's other weaknesses.

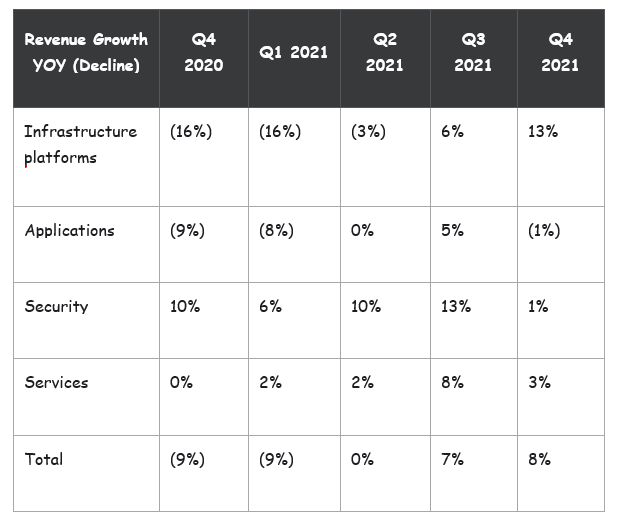

A quick look at Cisco's revenue growth over the past year shows why the stock is near a two-year high:

Cisco not only posted another quarter of positive revenue growth but also accelerated the pace of growth, with the infrastructure platforms business leading the way. Cisco attributed the recovery to double-digit order growth in all end markets and geographies and noted that the 31% increase in product orders this quarter was the largest in a decade.

During the conference call, CEO Chuck Robbins said that Cisco underwent "its third consecutive quarter of accelerating growth in the commercial, service and government sectors," and that all three markets experienced order growth above 20%. In other words, Cisco is defeating the cyclical and macroeconomic challenges that previously plagued its business.

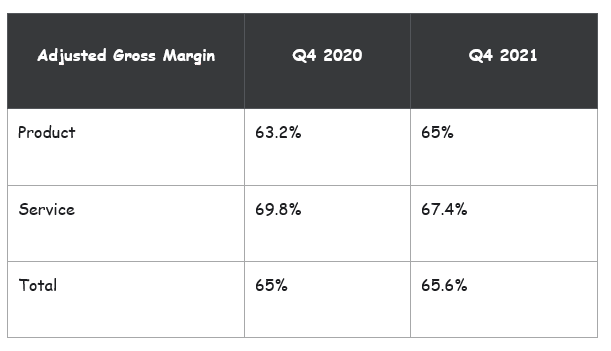

Cisco's Adjusted Gross Margin also increased year-over-year in the fourth quarter, as higher product margins offset lower service margins:

According to Chief Financial Officer Scott Herren, productivity gains and lower shipping costs boosted gross margins on products and were only "partially offset by relatively modest price declines." The statement suggests that Cisco can still leverage its scale, as well as its hardware and software bundling strategies, to maintain its leadership in a crowded networking market.

Cisco's orders are growing, but it may struggle to fulfill those orders (and turn them into real revenue) if it runs into component shortages.

Robbins said Cisco has faced component shortages over the past few months, but the company still expects its revenue to grow 7.5-9.5% year over year in the first quarter of 2022 and then grow 5-7% for the full year. Both of these figures beat analysts' forecasts.

As for the bottom line, Cisco expects the company's adjusted earnings to grow 4% to 7% in the first quarter and then grow 5% to 7% for the full year. Both of these estimates are in line with Wall Street expectations.

Most favor Cisco stock because everyone likes the company's low valuation, high dividend, and ability to withstand economic downturns. Those strengths haven't changed in the past few years, and they could make it an even more attractive investment this year as macroeconomic uncertainty drives more investors to "mature" technology stocks.

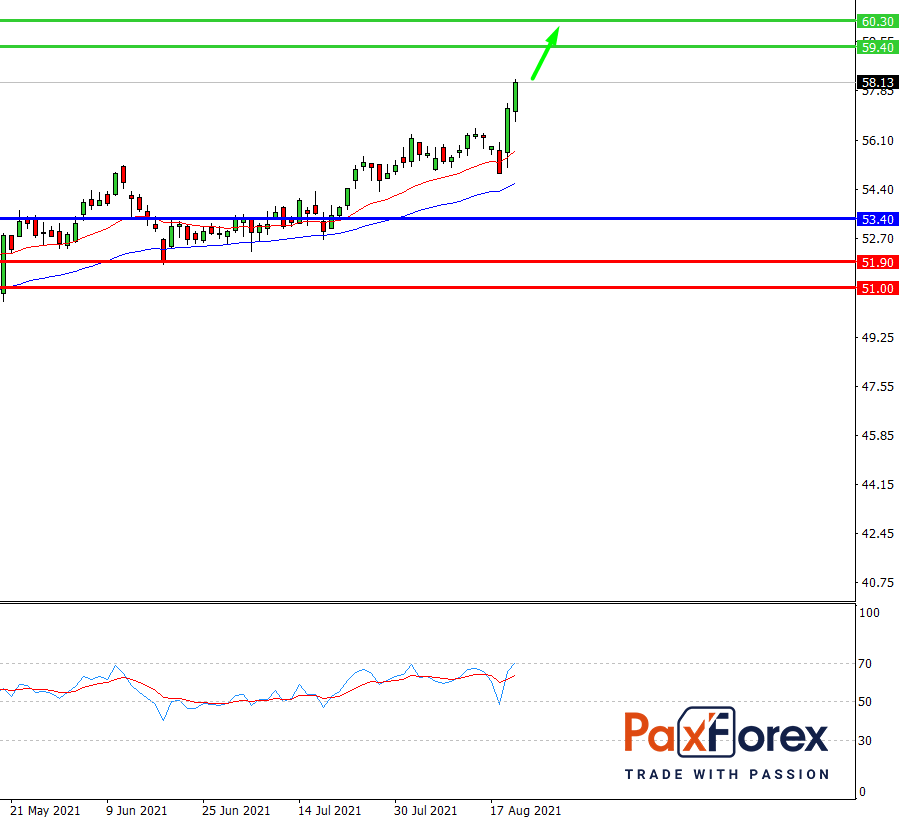

As long as the price is above 53.70, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 57.27

- Take Profit 1: 59.40

- Take Profit 2: 60.30

Alternative scenario:

If the level of 53.40 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 53.40

- Take profit 1: 51.90

- Take Profit 2: 51.00