Source: PaxForex Premium Analytics Portal, Fundamental Insight

Despite strengthening commodity prices, the energy sector remains far from favorable. However, for investors with opposing views, it is a prospective chance to buy. The difficulty is that energy companies still have some very real problems to deal with. That's why energy giant Chevron is one of the best options in this area. Here are some circumstances to support this idea.

There are many ways to invest in the energy sector, from exploration and production to downstream (chemicals and refining), and each major area has a different dynamic. Chevron, one of the world's largest integrated energy companies, is represented across the value chain, from drilling to transportation (downstream sector) to refining. It ensures a balanced portfolio because, in a normal market, some areas tend to perform better than others and help smooth out financial results.

Conservative investors understand that diversification is essential for their portfolios, but it can also be good for a company's business. It may seem like little consolation, but Chevron's international downstream segment was on the upside in 2020, while all other reportable segments posted losses. It was a disastrous year, but it would have been much worse if the company had focused only on drilling for oil or operating in one market/region.

Diversification is great, but Chevron is hardly the only diversified oil company. It is one of many companies that are in the integrated segment of the industry. But one area where Chevron stands apart is financial strength. The company's debt-to-equity ratio is about 0.33, lower than ExxonMobil's 0.4 and much lower than its European peers, who have a ratio of 0.6 or higher.

To be fair, European oil majors tend to have higher debt loads and higher cash balances than Chevron or Exxon. But spending huge amounts of cash during an industry downturn is not always seen as a positive factor by investors, and increasing the debt load on an already overstretched balance sheet is also unwanted. So Chevron's low-leverage approach may give it more leeway. Indeed, the company used its financial strength to increase its debt during 2020, allowing it to weather the blow without having to cut its dividend. The company also managed to make a profitable acquisition and maintain industry-leading leverage.

For more conservative income investors, company dividends are sacred. BP and Royal Dutch Shell cut their dividends last year, while Exxon, Chevron, and Total did not. That said, Chevron is currently on a more than a three-decade streak of annual dividend increases. And it just announced a 4% dividend increase along with first-quarter earnings. Total is currently focusing more on paying down debt than raising dividends, and while Exxon's dividend history is as strong as Chevron's, if not stronger, its balance sheet is not in as good shape. And, importantly, Exxon has big spending plans that it needs to fund, suggesting that dividends may have to take a back seat to capital spending in the near term. Chevron's spending plans were relatively modest even before the pandemic.

All things considered, it helps explain why Chevron's dividend yield of 4.9% is near the bottom of the peer group. Nevertheless, the stock's yield is still near the high end of the company's historical range. So it looks like Chevron stock is historically cheap today, even though you can get higher returns from other companies in the sector. The problem is that higher returns require a higher level of risk. For conservative investors, it's probably not worth it.

One clear rebuke to Chevron is that the company is stalling as the world seeks to move beyond oil and natural gas. It's a valid objection - Chevron is just tiptoeing into the depths of clean energy, while other companies like BP and Shell seem to be jumping in with a bang.

The fact is that the energy transition takes time, and the world will likely need more of all energy sources as emerging economies keep enhancing. So oil and natural gas are unlikely to disappear all at once.

Meanwhile, renewables are looking a bit pricey right now, as high competition is inflating prices and potentially reducing future profitability. So a wait-and-see stance could work in Chevron's favor if the company avoids overspending to appease Wall Street. And with such a strong balance sheet, there's no reason it can't buy its way into the sector through acquisition if a good opportunity presents itself. We hope that such a chance will present itself when investors become disillusioned with renewable energy and lower stock prices for clean-energy-oriented companies.

Every investment has a few drawbacks, and Chevron is no exception. However, for conservative investors looking to invest in the unpopular energy sector, Chevron has many upsides. In particular, the company's historically high returns, industry-leading financial strength, and diversified business model give it an edge over its peers. And the negative fact that Chevron is taking its time with global warming may not be as bad as some fear.

So, for most income investors, Chevron compares very favorably to its competitors.

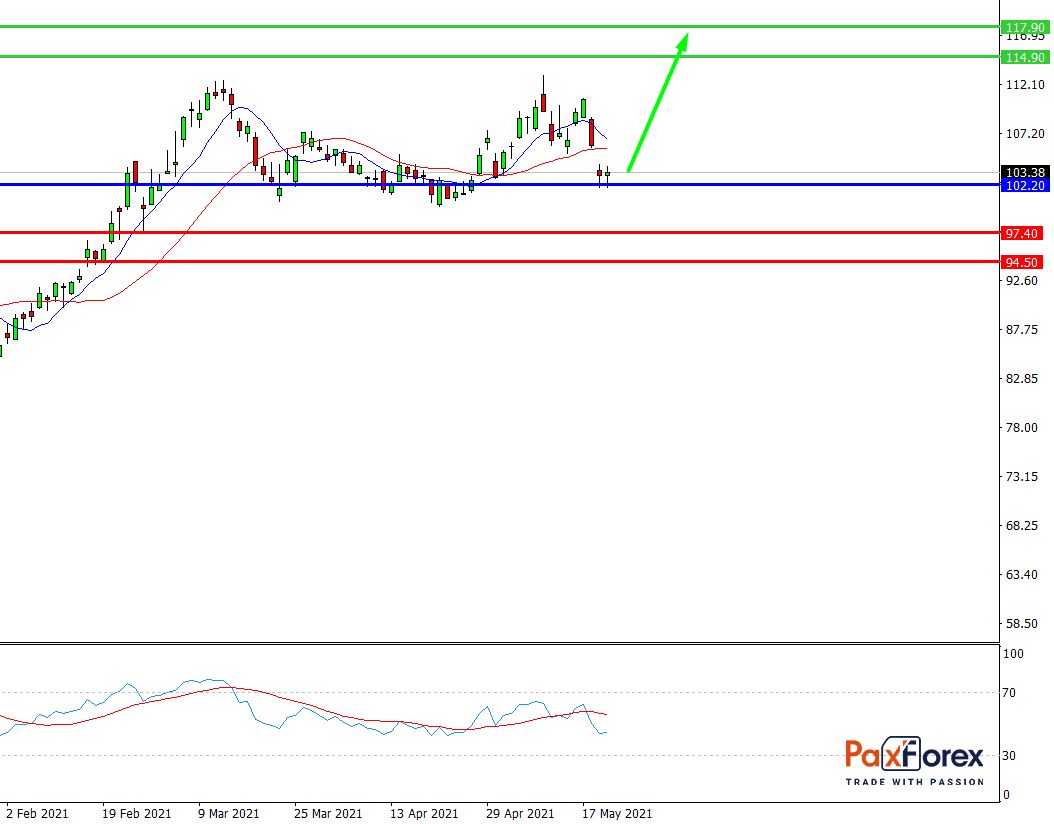

While the price is above 102.20, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 106.18

- Take Profit 1: 114.90

- Take Profit 2: 117.90

Alternative scenario:

If the level 102.20 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 102.20

- Take Profit 1: 97.40

- Take Profit 2: 94.50