Source: PaxForex Premium Analytics Portal, Fundamental Insight

When Chevron presented its fourth-quarter 2020 earnings report, CEO Mike Wirth defined it as "an unprecedented year." That's an underestimation, keeping in mind that oil prices actually dropped below zero at one point. But the oil giant has lost its way, and it stands a good chance of capitalizing on this as oil prices rebound. Here are a few key things to consider if you're considering this integrated energy giant with a high dividend yield of 5.8%.

- The one place where Chevron sparkles especially lively is on its balance sheet.

Even though the business has not yet released its annual report, it ended the third quarter with a debt-to-equity ratio of about 0.26, the lowest among its peers. Its closest competitor was ExxonMobil, with a ratio of 0.39 times. The key point here, however, is that the two companies have actually switched places: historically, Exxon had a better debt-to-equity ratio, but the downturn in the energy sector in 2020 has changed that ratio dramatically because of the company's big capital expenditure plans.

To be fair, neither company is in a bad financial position, but Chevron simply has more range to count on its balance sheet if the situation doesn't get better. This is a huge advantage for many reasons: the company can continue to support its dividend and capital investment plans even as it takes advantage of outside opportunities.

- This brings us to our second point: Chevron seized on the crisis to buy Noble Drilling.

The total cost of the deal was about $13 billion, including about $8 billion in debt. The strength of Chevron's balance sheet allowed it to make such a deal during the recession in the industry. But the main point is that the oil giant was able to use the "unprecedented" crisis to sustain its status in the industry.

But, there is another significant aspect. Chevron planned to buy Anadarko Petroleum in late 2019 but was outbid by Occidental Petroleum. Chevron backed out of the purchase when it thought the price was too high. The deal turned out to be poorly timed for Occidental, but was a testament to Chevron's disciplined approach, as it chose not to get into a bidding war. In other words, investors should be assured that Chevron did not overbid Noble.

- Apart from that, Chevron was able to backtrack hard on its 2020 capital expenditure plans.

The bottom line was 35% lower than in 2019. But the roughly $13 billion the energy company spent was also below the company's revised pandemic projections of $14 billion. Thus, the company was able to adapt quickly to the changes in the industry. By comparison, Exxon spent $21 billion.

Despite spending cuts, Chevron's 2020 production was up 1 percent, helped by its purchase of Noble. Meanwhile, Exxon's production fell nearly 5%. So despite the industry's rapid growth and cost-cutting, Chevron is finding a way to keep expanding its business, while its closest counterpart on the balance sheet is just trying to make it through.

- All of this good news, however, must be weighed against the most obvious negative ones.

Even though oil prices were rising at the beginning of 2021, things are still not getting back to normal. To put some numbers in perspective, Chevron reported an adjusted loss of one cent per share in the fourth quarter of 2020, and for the full year, the adjusted loss was $0.20 per share. But if you include one-time items, such as the $4.5 billion the company earned, the full-year loss was a painful $2.96 per share. Chevron earned $8.7 billion in 2019, with higher oil prices more than offsetting that hit, and the company earned $1.54 a share.

The higher oil prices we've seen so far in 2021 will help boost earnings, but Chevron says its break-even point is $55 a barrel. That's low compared to peers, but it means Chevron really needs oil to stay in its current range (it recently topped $60 a barrel), or 2021 will be another challenging year. The problem is that the course of the global pandemic is unknown. So for now, it looks like oil reserves are declining and demand is slowly coming back - but that dynamic could easily change to negative amid new symptoms of the disease.

Assessing the big picture, Chevron is probably the best oil company to date, given its strong financial position, relatively low spending requirements, and its ability to take advantage of the downturn to strengthen its position in the industry. Given the uncertainty that still exists, investors looking at the energy sector should like what they see here. And while you wait for the industry to recover, you can get a generous 5.8% dividend yield, backed by more than 30 years of annual dividend increases.

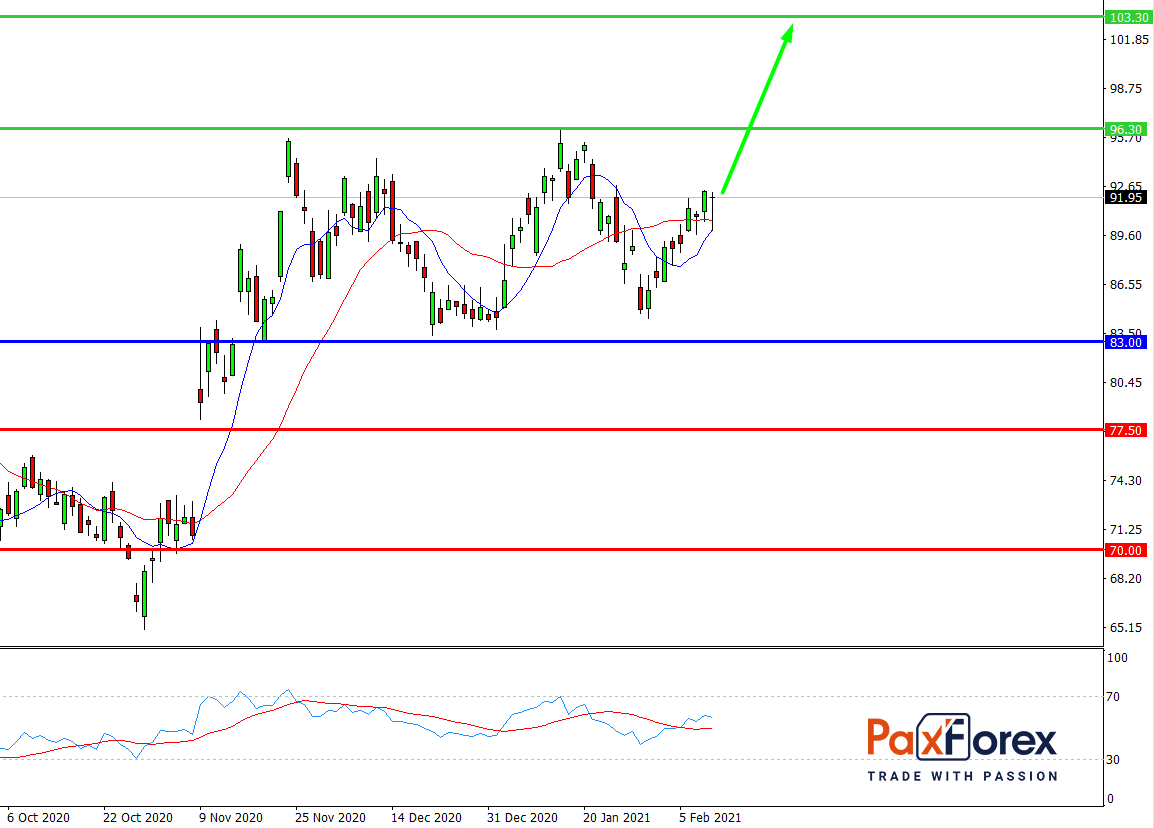

While the price is above 83.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 92.00

- Take Profit 1: 96.30

- Take Profit 2: 103.30

Alternative scenario:

If the level 83.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 83.00

- Take Profit 1: 77.50

- Take Profit 2: 70.00