Source: PaxForex Premium Analytics Portal, Fundamental Insight

For several reasons, Caterpillar, a manufacturer of construction, mining, power, and transportation equipment, is perfectly poised to rebound in 2021. Many investors may be enticed to long stock because of that, but the fundamental question is whether or not to do so right now. Let's take a look at what's going to happen in 2021 and try to get a little clarity on the matter.

First, Caterpillar equipment retail sales have probably reached the bottom and look set for growth in 2021. For the record, Caterpillar mostly sells through independent retailers who run their own businesses, and a look at their rolling three-month retail sales implies a rebound to growth soon.

It is a good sign, as Caterpillar sales can outperform expectations during the upswing, as they did in 2017, and it also tends to be good news for the stock.

Second, as noted above, Caterpillar sells mostly through dealers. There is a reason for optimism here, based on the fact that these dealers decreased their inventory more than awaited in the fourth quarter. That means they are likely to order more equipment from Caterpillar in due course.

In a discussion of the quarterly report, CEO Jim Umpleby said dealers reduced their inventory by $1.1 billion in the fourth quarter, compared with an expected $700 million reduction. Again, that's an advantage.

In fact, dealer inventory was down $2.9 billion in 2020, and CFO Andrew Bonfield said dealer inventory levels are "at the lower end of their normal range for several months of sales" and "This dealer inventory reduction positions us well for 2021."

Third, while management avoided full-year projections because of the uncertainty caused by the pandemic, it did focus its efforts on improving free cash flow (FCF) from machinery, energy, and transportation in 2021.

Caterpillar received $3.1 billion in FCF in 2020, which was more than enough to pay a $2.2 billion dividend. Also, Umpleby said Caterpillar would meet its FCF targets in 2021, which were laid out at an Investor Day presentation in 2019. At the time, company executives projected that its FCF would be between $4 billion and $8 billion over the cycle, so it's likely that in 2021 we can expect to see an improvement to at least $4 billion.

There are two ways to look at this. Thinking positively, you can look at the improvement in FCF and the fact that the dividend is very well covered. If we look at the matter skeptically, then Caterpillar was well below the lower end of its projected FCF cycle in 2020.

Caterpillar is trying to reduce the cyclicality of its earnings by increasing the amount of revenue generated from services. As Umpleby noted, Caterpillar's services sales were down 13% in 2020, compared to a 22% decline in total revenue. As a result, services as a share of total sales increased to 41% of total machinery, energy and transportation sales.

The company expects service sales to grow in 2021, which should help reduce Caterpillar's revenue cyclicality over the long term.

Management believes its end markets are improving, and sales will grow in 2021. The residential sector in North America remains strong, and that should help sales of smaller equipment, while construction activity in Asia is already recovering.

Meanwhile, in commodities, "mining fundamentals are expected to continue to improve," while "metals prices support reinvestment and quoted activity continues to be strong," according to Umpleby. Besides, the U.S. infrastructure bill will boost sales of aggregates and heavy construction materials.

The outlook for the energy and transportation segment is mixed, with electricity sales supported by data center activity and transportation revenues increasing along with increased railroad activity. On the other hand, "While we are encouraged by recent changes in oil prices, we expect oil and gas to continue to reflect conditions in this market," Umpleby said.

Long story short, this is good news for dividend investors because dividends are very well covered even at the bottom of the sales cycle, and management plans to increase payouts. It's probably good news for investors who are worried about the short-term future because Caterpillar does look poised for a solid recovery in 2021.

However, there are some concerns for long-term investors. Nonresidential markets in the U.S. are not in great shape, and there is no guarantee that China will stimulate its economy through infrastructure spending as it has in the past. Coal mining, a troubled industry, is a major contributor to demand for heavy mining equipment, and Caterpillar's outlook for oil and gas spending has been disappointing. Meanwhile, the fact is that Caterpillar failed to meet its FCF targets in 2020, and its valuation doesn't look particularly cheap at the moment.

On the whole, Caterpillar is in recovery, but it may not be as strong as in previous cycles. Cautious investors may want to wait until Caterpillar starts to exceed expectations before buying.

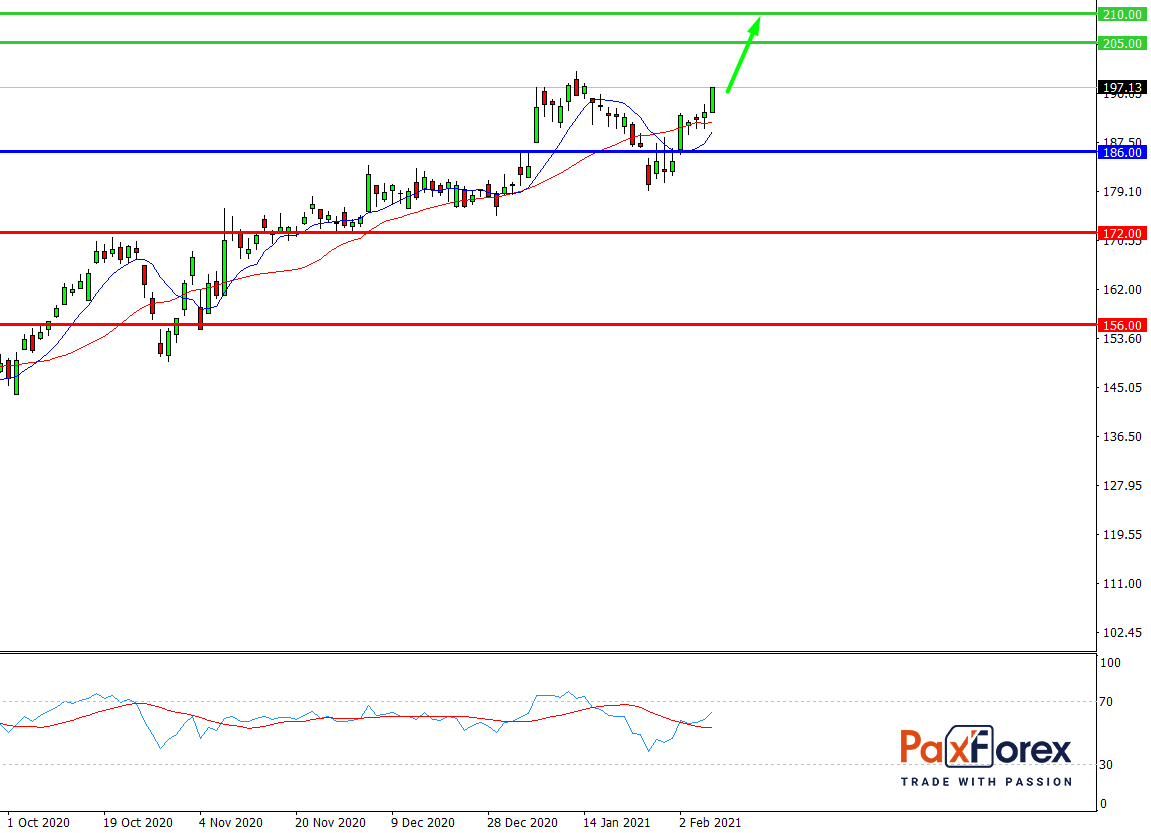

While the price is above 186.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 198.00

- Take Profit 1: 205.00

- Take Profit 2: 210.00

Alternative scenario:

If the level 186.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 186.00

- Take Profit 1: 172.00

- Take Profit 2: 156.00