Source: PaxForex Premium Analytics Portal, Fundamental Insight

Evaluating a cyclical corporation like Caterpillar is not easy. In fact, you can easily get carried away buying stock when things are going well and find that you've overpaid when the end markets start to fall. Usually, the most suitable time to buy is when things look bleak and valuations (based on current earnings) are very high. Nevertheless, let's try to take an impartial look at Caterpillar stock. Here's what you need to know before you buy this stock.

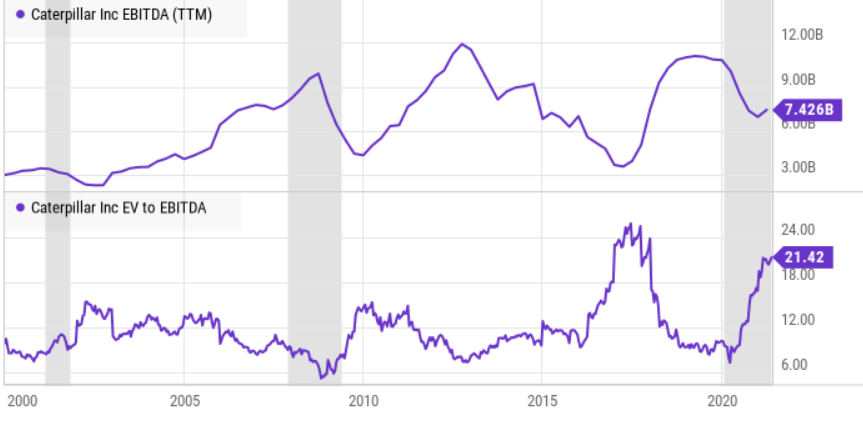

Investment articles usually end with a valuation, not start with one. But let's wait, because the following chart is crucial to understanding Caterpillar's investment rationale.

Readers can see the cyclicality in earnings before interest, taxes, depreciation, and amortization (EBITDA) in the chart below. You can also see a frequently used valuation metric, which is the ratio of enterprise value, or EV (market value plus net debt), to EBITDA.

Pay attention that when EBITDA peaks, the valuation is very low, and when EBITDA bottoms, the valuation is very high. Taking into account that earnings fluctuate so much, it is often the case that the best time to buy cyclical stocks is when valuations are high and earnings are about to rise. It goes against the usual investment maxim to buy only when valuations are low and sell when valuations are high. Sometimes it makes sense to buy at a high valuation and sell at a low cyclical stock valuation.

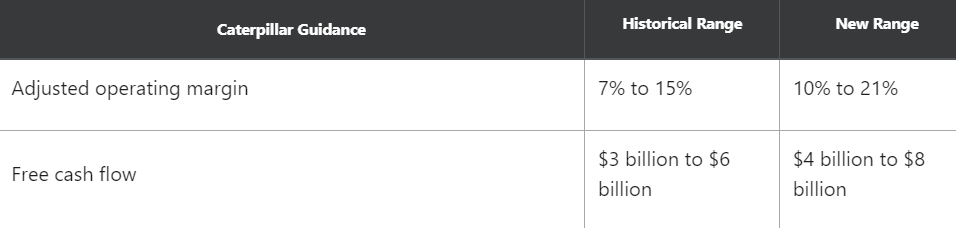

To value Caterpillar, consider its earnings and cash flows over the cycle. During the company's 2019 investor presentation, management outlined its profitability and free cash flow (FCF) generation targets for the cycle. Below are the projected operating margin and FCF ranges.

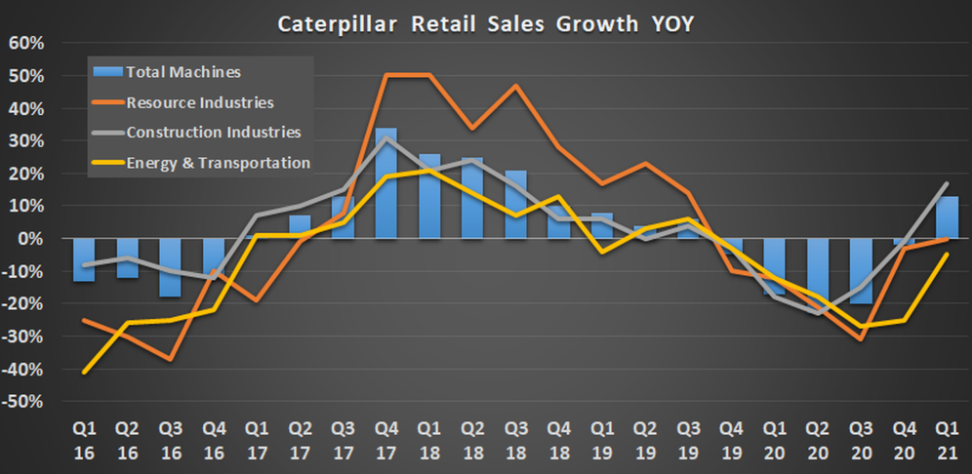

Of course, these forecasts were made long before the first coronavirus case occurred. Indeed, there were concerns that Caterpillar's FCF would fall below the range due to the sales downturn created by COVID-19. Fortunately, as is often the case with cyclical stocks, sales rebounded more sharply than expected. Caterpillar retail sales (the company sells through independent dealers) were positive again compared to last year.

The improvement is so great that Wall Street experts now forecast that Caterpillar's FCF will reach the $5.2 billion mark in 2021. For valuation purposes, one could argue that Caterpillar's actual FCF range in the current cycle would be between $5.2 billion and $8 billion. The midpoint is $6.6 billion.

Given that a reasonable valuation of a mature industrial company is about 20 times FCF, one can take the average FCF during the cycle ($6.6 billion in this case) and calculate Caterpillar's fair value at 20 times that, or about $132 billion.

That's pretty much the basis on which Caterpillar is trading right now.

What about the company's outlook? Is there any reason to believe that the $5.2 billion to $8 billion range is too conservative or overly optimistic?

The bearish argument is that industrial stocks are going through a typical cyclical recovery, characterized by an initial phase of strong upside. However, when dealers restock and end-market sales begin to slow naturally, Caterpillar sales will decline. Furthermore, bears are concerned about the state of governments' finances after the pandemic, which could limit infrastructure spending.

Optimists, by contrast, believe Caterpillar is at the very beginning of a multi-year recovery in mining capital spending - not least because mining commodity prices are rising and the industry itself is emerging from a period of relatively low investment. Similarly, Caterpillar's oil and gas-related sales should get a boost with oil prices above $60 a barrel. When you add in the possibility of an infrastructure bill in the U.S. and continued spending in China, Caterpillar is well-positioned for a prolonged recovery.

Overall, the stock looks quite attractive, so the investment decision comes down to your level of confidence in a bullish recovery scenario. If you think Caterpillar is set up for a long period of growth, then the stock doesn't look very favorable. All things considered, based on the calculations above, Caterpillar is fairly valued right now, so there is no need to close the value gap.

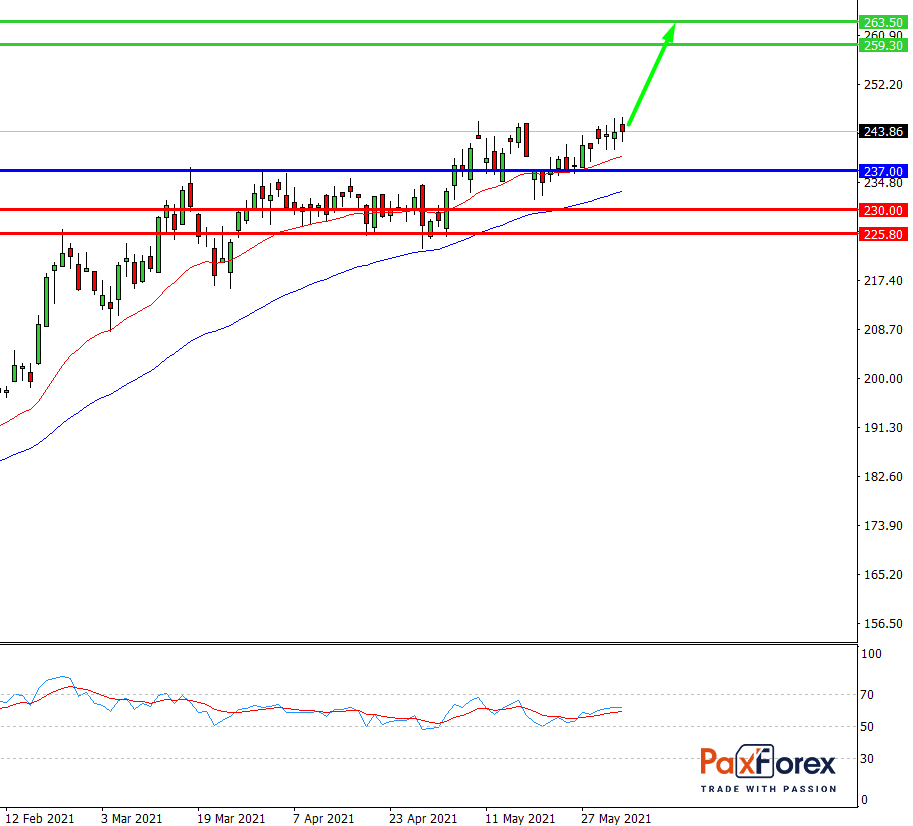

While the price is above 237.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 243.86

- Take Profit 1: 259.30

- Take Profit 2: 263.50

Alternative scenario:

If the level 237.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 237.00

- Take Profit 1: 230.00

- Take Profit 2: 225.80