Source: PaxForex Premium Analytics Portal, Fundamental Insight

Shares of construction industry giant Caterpillar continue to rally. After a strong performance in 2020, the stock entered the new year as one of the best players in the Dow Jones.

But Caterpillar is not trading higher because its performance is excellent. In fact, its performance last year was pretty woeful and included one of the worst quarters in the company's history. Alternatively, Caterpillar's fresh historical high is based on future performance and expectations that the business will be a great successor of the 2021 bull market, infrastructure incentives, higher oil prices, and other post-pandemic circumstances. Let's take a look at Caterpillar's performance in 2020 and the outlook for the coming years to see if the company can justify an increase in its stock price.

Caterpillar's 22% decline in full-year revenue and 42% decline in earnings may look bumpy, but it wasn't that long ago that things were much worse.

There were signs of improvement in the fourth quarter as Caterpillar's construction and materials industry continued to recover from pandemic low levels. Caterpillar makes most of its sales through its extensive dealer network. Dealers tend to build up inventory when they expect sales to rise. Still, Caterpillar stated that dealers sharply reduced their inventory by $1.1 billion in the fourth quarter of 2020. The $2.9 billion year-over-year reductions in dealer inventory were the largest annual drop since 2013.

Although Caterpillar's fourth-quarter dealer inventory guidance was far from perfect, the company is confident that things are about to change. Caterpillar is a cyclical stock whose sales are profoundly reliant on market cycles. The company has been on a multi-year upswing that was interrupted by the U.S.-China trade war in 2018 and 2019 and then the COVID-19 pandemic in 2020 and 2021. More than half of the company's sales are outside North America, so Caterpillar profits from emerging markets but is also vulnerable to geopolitical challenges.

With dealer inventories set to improve, the company will be able to benefit from the broad spread of the COVID-19 vaccine and a stimulated economy. A strong U.S. housing market and rising oil prices are helping its North American sales, while the rest of its business -- especially in Asia, Europe, Africa, and the Middle East -- has done well throughout 2020.

In early February, Caterpillar completed the acquisition of Weir Group's oil and gas division as part of its rebranding of SPM Oil and Gas. With the price of WTI crude oil exceeding $60 a barrel (the highest price since late 2019), Caterpillar appears to have struck a deal to acquire Weir's assets that integrates perfectly with its good services business. Thus, Caterpillar begins a period of sales and revenue growth.

Notwithstanding a daunting year, Caterpillar managed to generate enough free cash flow (FCF) to fund its $2.2 billion annual dividend obligation. This is a good sign that Caterpillar's operations, as opposed to debt, can support dividend payments in tough times. However, the company added $2 billion of debt to its balance sheet in 2020 to boost liquidity. As Caterpillar enters a period of FCF growth, a dividend hike is likely to follow. More impressive, however, is that Caterpillar has increased its annual payout for 27 consecutive years, making it a Dividend Aristocrat. Many of these dividend increases have occurred during difficult market cycles, a testament to Caterpillar's discipline. Management has repeatedly noted that it is proud of its Aristocrat status and plans to continue this trend for years to come.

Caterpillar's upbeat outlook and solid dividend are great reasons to pay attention to the stock. But unfortunately, much of that optimism is already "included in the price." Even before Caterpillar stock entered a rising trend, it soared to a new all-time high. After easily outperforming the market in 2020, the stock is now up more than 150% from its pandemic low and 62% last year, more than four times the S&P 500 and the industrial sector as a whole.

Not so long ago, Caterpillar was seen as a solid investment because of its good long-term value, strong balance sheet, and stable and growing dividend payout. And even after passing $200 a share, Caterpillar looked expensive, but there were many reasons why it was still cheap.

Still, Caterpillar's disappointing dealer inventory results and the fact that revenues and net income have improved but remained flat signals that the company is not yet out of the recession. It remains a great long-term buy but has yet to enter and maintain a period of growth. Investors should watch the company's dealer inventories to determine when the uptrend begins. Also, Caterpillar will face a light impact starting in the second quarter, so it's better to compare its results to those of 2019.

There's no denying that Caterpillar should show some significant and potentially record results in the coming years. At this point, the stock is probably a bit ahead of itself, so it's best to watch its progress from the sidelines rather than diving headfirst with the crowd.

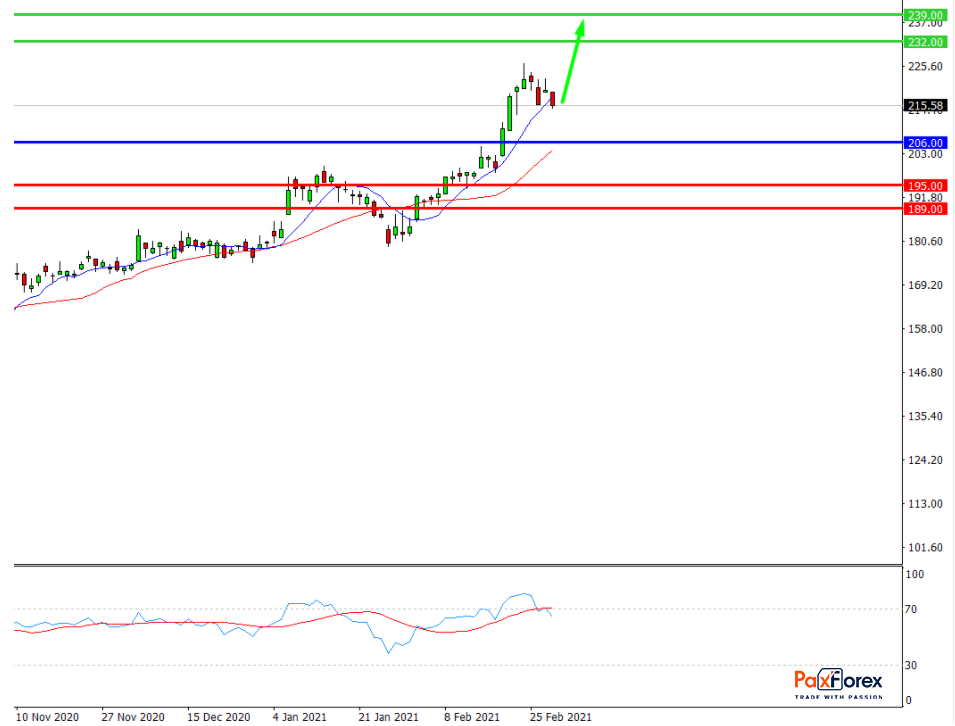

While the price is above 206.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 216.00

- Take Profit 1: 232.00

- Take Profit 2: 239.00

Alternative scenario:

If the level 206.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 206.00

- Take Profit 1: 195.00

- Take Profit 2: 189.00