Source: PaxForex Premium Analytics Portal, Fundamental Insight

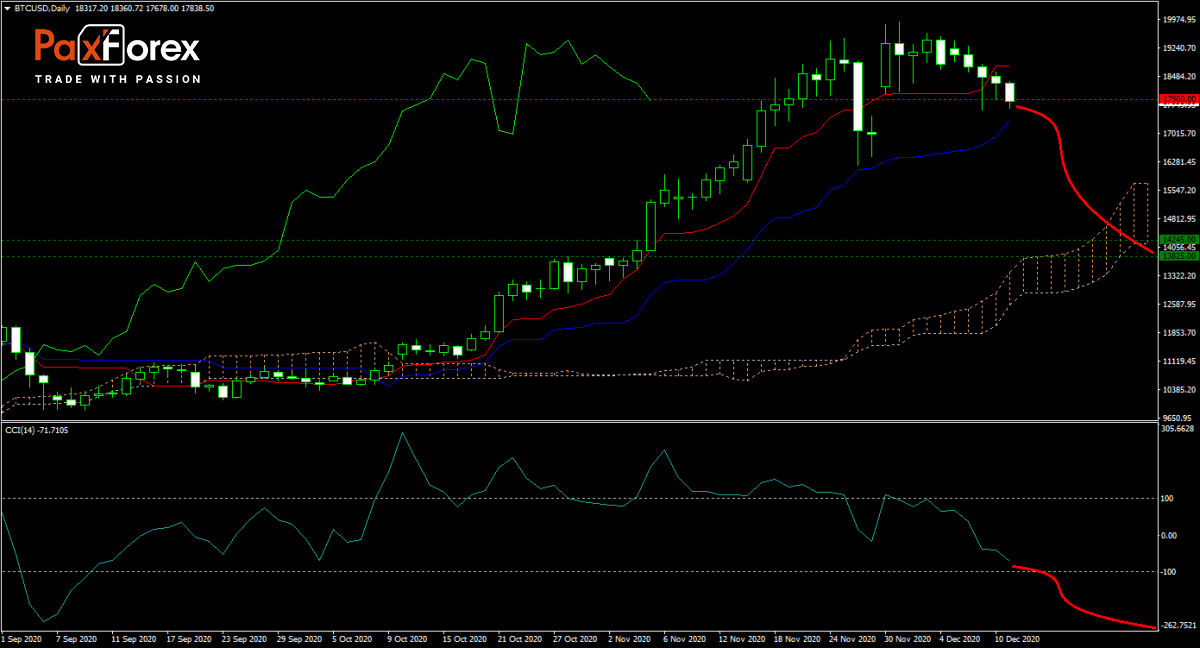

The maturity of Bitcoin extends with more institutional money flowing in and driving price action, and less social media inspires retail trading activity. While more portfolio managers consider Bitcoin as an inflation hedge and alternative to gold, price action is poised for a medium-term pullback. After it corrected below its sideways trending Tenkan-sen, it is now likely to move below its ascending Kijun-sen, which can result in more selling pressure.

After failing twice to take out the 20,000 level, weakening momentum can result in a sell-off over the next few weeks. Institutional tax-related selling may add to a downward spiral that can drop the BTC/USD into its ascending Ichimoku Kinko Hyo Cloud. It will allow long-term traders to add to their buy positions, as the outlook for 2021 remains bullish with the US Dollar set to weaken further.

The forecast for the BTC/USD over the short-term is bearish, and the medium-term outlook is negative until this cryptocurrency completes a correction. The CCI moved out of extreme overbought conditions and is now in negative territory with more downside potential. Can bears capitalize on recent developments and force the BTC/USD into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the BTC/USD remain inside the or breakdown below the 17,600 to 18,750 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 17,900

- Take Profit Zone: 13,825 – 14,245

- Stop Loss Level: 19,400

Should price action for the BTC/USD breakout above 18,750 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 19,400

- Take Profit Zone: 20,400 – 21,000

- Stop Loss Level: 18,750

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.