Source: PaxForex Premium Analytics Portal, Fundamental Insight

After a significant period of halted orders for most of 2019 and 2020, Boeing has finally begun receiving new orders for the 737 MAX in 2021. Last month, the U.S. aerospace giant received its largest-ever order for a 737 MAX, as United Airlines ordered another 200 units of the notorious aircraft.

Unluckily, other customers keep cutting their orders for the 737 MAX, not letting Boeing make much headway in rebuilding its order book. Moreover, the company recently discovered another production problem affecting the 787 Dreamliner, further disrupting production and delivery plans. These problems underscore how far Boeing is from a return to normalcy.

In June, Boeing recorded 219 new firm orders. In addition to the huge deal with United Airlines, FedEx confirmed orders for 18 additional 767 freighters and one 777 freighter.

Meanwhile, Boeing delivered 45 commercial jets, with 33 of those coming from the 737 MAX.

However, orders for Boeing's commercial jets last month increased by only 45, from 4,121 to 4,166. That means 129 orders were removed from the order book, more than half of the orders for the month.

In particular, flydubai canceled orders for 65 737 MAX aircraft due to the severe negative impact of the pandemic on international travel. (At the same time, it has 170 737 MAX orders remaining. Given that flydubai currently operates only 52 planes, it could take a decade or more to master that many new planes.) Boeing has also increased its estimate of orders that are unlikely to be fulfilled, further reducing its backlog.

Looking at the first half of the year, the story looks much the same. Despite 505 gross orders for the 737 MAX, Boeing's 737 MAX backlog increased by only 52 units for the year.

On Tuesday, Boeing acknowledged that it had discovered a new defect affecting under-delivered 787 Dreamliner planes. It forced the company to suspend deliveries of the 787 again.

In the near term, Boeing will cut Dreamliner production below recent production levels of five planes a month. It will allow the company to prioritize inspections and modifications of previously built 787s so that it can eventually deliver those aircraft. However, further production slowdowns and increased inspections and modifications will increase Boeing's costs, compounding the company's losses.

Boeing also warned investors that it now expects less than half of the roughly 100 787 Dreamliner aircraft in its inventory to be delivered by the end of the year. The industry giant had previously expected to deliver most of those planes in 2021. Additional delivery delays would force Boeing to spend more cash in the near future, putting more strain on its already weak balance sheet.

Bulls may have hoped that June would be a turning point for Boeing thanks to a big order from United Airlines. But instead, it became even clearer that the company would not be able to recover quickly from the double blow of a long-standing 737 MAX and a COVID-19 pandemic.

First, despite getting another major order, Boeing has made little progress in recovering its 737 MAX backlog this year. What's more, the company's customer concentration has grown tremendously. United Airlines, Southwest Airlines, and Ryanair now account for nearly 30% of the 3,334 737s ordered. This could have a negative impact on the company's profitability, as large, established airlines tend to accept lower prices when buying planes.

Second, ongoing problems with Dreamliner production are hampering Boeing's efforts to rebuild its reputation. Until the company demonstrates that it can reliably produce the 787 and deliver it to customers on time, few airlines will be willing to place new orders for Boeing's top-selling wide-body model. It will force Boeing to keep production well below pre-pandemic levels for years to come.

To make a long story short, while Boeing did get some big orders this year, they won't be able to return the company's revenue and cash flow to 2018 highs - or even close to them. So don't expect any kind of wild rally in Boeing stock for the foreseeable future.

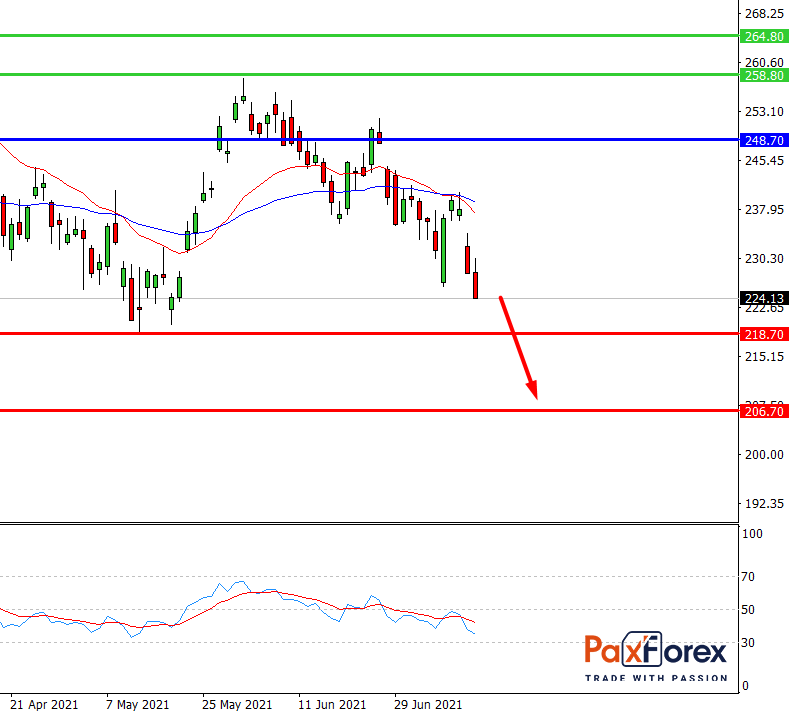

While the price is below 248.70, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 224.00

- Take Profit 1: 218.70

- Take Profit 2: 206.70

Alternative scenario:

If the level 248.70 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 248.70

- Take Profit 1: 258.80

- Take Profit 2: 264.80