Australian Consumer Inflation Expectations for May increased by 3.4% annualized. Forex traders can compare this to Australian Consumer Inflation Expectations for April, which increased by 4.6% annualized. The Australian Employment Change for April was reported at -594.3K. Economists predicted a figure of -575.0K. Forex traders can compare this to the Australian Employment Change for March, which was reported at 5.9K. The Unemployment Rate for April was reported at 6.2%. Economists predicted a reading of 8.3%. Forex traders can compare this to the Unemployment Rate for March, which was reported at 5.2%. 220.5K Full-Time Positions were and 373.8K Part-Time Positions were lost in April. Forex traders can compare this to the loss of 0.4K Full-Time Positions and to the creation of 6.4K Part-Time Positions, which were reported in March. The Labor Force Participation Rate for April was reported at 63.5%. Economists predicted a reading of 65.2%. Forex traders can compare this to the Labor Force Participation Rate for March, which was reported at 66.0%.

US Initial Jobless Claims for the week of May 9th are predicted at 2,500K, and US Continuing Claims for the week of May 2nd are predicted at 25,100K. Forex traders can compare this to US Initial Jobless Claims for the week of May 2nd, which were reported at 3,169K and to US Continuing Claims for the week of April 25th, which were reported at 22,647K. The US Import Price Index for April is predicted to decrease by 3.1% monthly, and the US Export Price Index is predicted to decrease by 2.1% monthly. Forex traders can compare this to the US Import Price Index for March, which decreased by 2.3% monthly, and to the US Export Price Index, which decreased by 1.6% monthly.

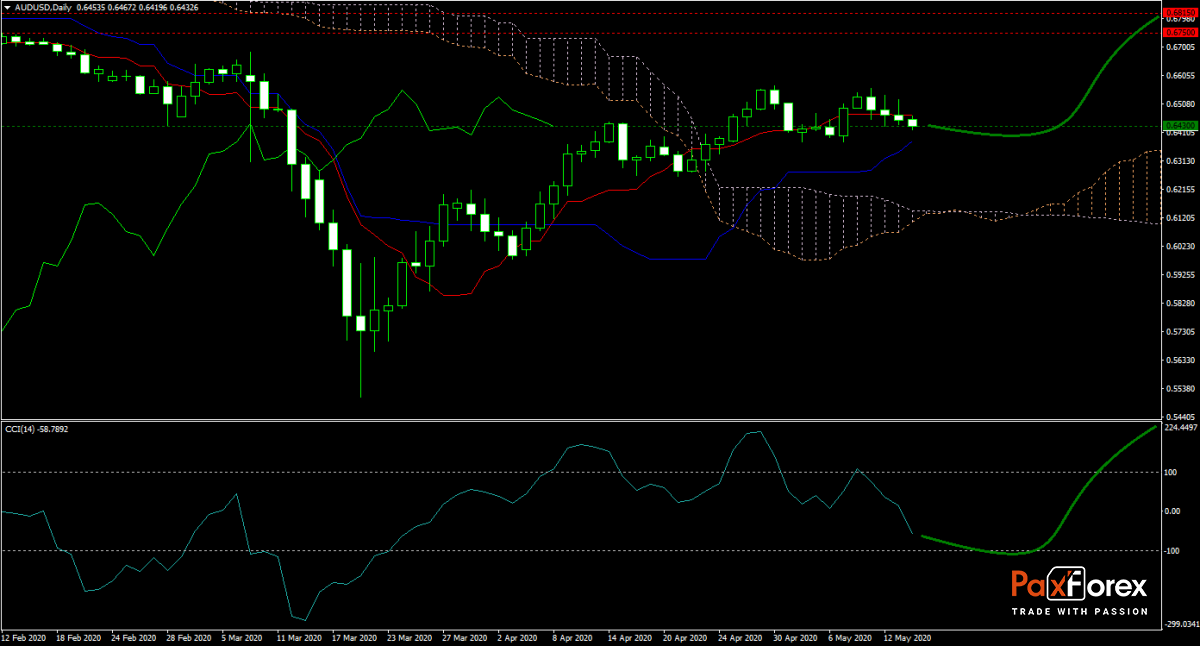

The AUD/USD forecast remains mildly bullish with US data disappointing and the government discussing more financial aid. Rumors of a second $1,200 direct payment as part of more assistance point towards a bigger-than-expected economic problem. Price action is trading around the Tenkan-sen with the Kijun-sen adding upside momentum. Today’s US initial jobless claims are in focus following Australia’s disappointing employment report. Will bulls receive the necessary catalyst to stampede higher? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.6380 to 0.6470 zone the following trade set-up is r

ecommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6430

- Take Profit Zone: 0.6750 – 0.6815

- Stop Loss Level: 0.6340

Should price action for the AUD/USD breakdown below 0.6380 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6340

- Take Profit Zone: 0.6215 – 0.6260

- Stop Loss Level: 0.6380

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.