Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian Home Loans for November increased by 5.5% monthly, and Investment Lending for Homes increased by 6.0% monthly. Forex traders can compare this to Australian Home Loans for October, which increased by 0.8% monthly, and to Investment Lending for Homes, which increased by 0.3% monthly.

The US PPI for December is predicted to increase by 0.4% monthly and by 0.8% annualized. Forex traders can compare this to the US PPI for November, which increased by 0.1% monthly and 0.8% annualized. The US Core PPI for December is predicted to increase by 0.2% monthly and by 1.3% annualized. Forex traders can compare this to the US Core PPI for November, which increased by 0.1% monthly and by 1.4% annualized.

US Advanced Retail Sales for December are predicted to decrease by 0.2% monthly, and Retail Sales Less Autos are predicted to decrease by 0.1% monthly. Forex traders can compare this to US Advanced Retail Sales for November, which decreased by 1.1% monthly, and to Retail Sales Less Autos, which decreased by 0.9% monthly. Retail Sales Control Group is predicted to increase by 0.1% monthly. Forex traders can compare this to the Retail Sales Control Group, which decreased by 0.5% monthly.

US Industrial Production for December is predicted to increase by 0.5% monthly, and Manufacturing Production is predicted to increase by 0.5% monthly. Forex traders can compare this to US Industrial Production for November, which increased by 0.4% monthly, and to Manufacturing Production, which increased by 0.8% monthly. Capacity Utilization for December is predicted at 73.6%. Forex traders can compare this to Capacity Utilization for November, reported at 73.3%.

The US Empire Manufacturing Index for January is predicted at 6.0. Forex traders can compare this to the US Empire Manufacturing Index for December, reported at 4.9. US Business Inventories for November are predicted to increase by 0.5% monthly. Forex traders can compare this to US Business Inventories for October, which increased by 0.7% monthly. Preliminary US Michigan Consumer Sentiment for January is predicted at 80.0. Forex traders can compare this to US Michigan Consumer Confidence for December, reported at 80.7.

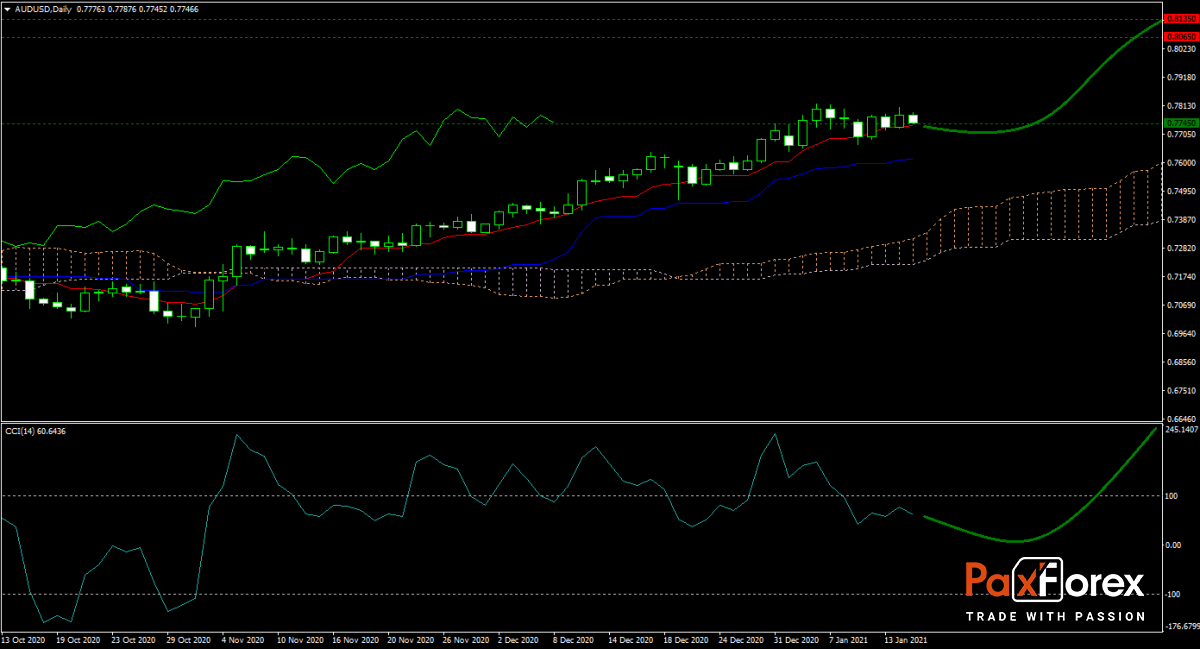

The forecast for the AUD/USD remains moderately bullish despite the strained economic relationship between Australia and China. US President-elect Biden’s $1.9 trillion Covid-19 stimulus plan, following the $900 billion announced last month, and together with a second Biden debt-trap will pressure the US lower throughout 2021. The Kijun-sen, the Tenkan-sen, and the Ichimoku Kinko Hyo Cloud all support more upside. After the CCI moved out of extreme overbought territory, it has more room to reverse higher. Will bulls pressure the AUD/USD into its next horizontal resistance zone? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.7700 to 0.7800 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7745

- Take Profit Zone: 0.8065 – 0.8135

- Stop Loss Level: 0.7665

Should price action for the AUD/USD breakdown below 0.7700 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7665

- Take Profit Zone: 0.7555 – 0.7600

- Stop Loss Level: 0.7700

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.