Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Australian Trade Balance for December was reported at A$6,785M. Forex traders can compare this to the Australian Trade Balance for November, reported at A$5,014M. Exports for December increased by 3.0% monthly, and imports decreased by 2.0%. Forex traders can compare this to exports for November, which increased by 3.0%, and to imports, which increased by 10.0%. Australian NAB Business Confidence for the first quarter was reported at 14. Forex traders can compare this to Australian NAB Business Confidence for the fourth quarter, reported at -8.

US Initial Jobless Claims for the week of January 30th are predicted at 830K, and US Continuing Claims for the week of January 23rd are predicted at 4,700K. Forex traders can compare this to US Initial Jobless Claims for the week of January 23rd, reported at 847K, and to US Continuing Claims for the week of January 16th, reported at 4,771K. Preliminary US Non-Farm Productivity for the fourth quarter is predicted to decrease by 2.8% quarterly, and Unit Labor Costs are predicted to increase by 4.0% quarterly. Forex traders can compare this to US Non-Farm Productivity for the third quarter, which increased by 4.6% quarterly, and to Unit Labor Costs, which decreased by 6.6% quarterly. US Factory Orders for December are predicted to increase by 0.7% monthly. Forex traders can compare this to US Factory Orders for November, which increased by 1.0% monthly.

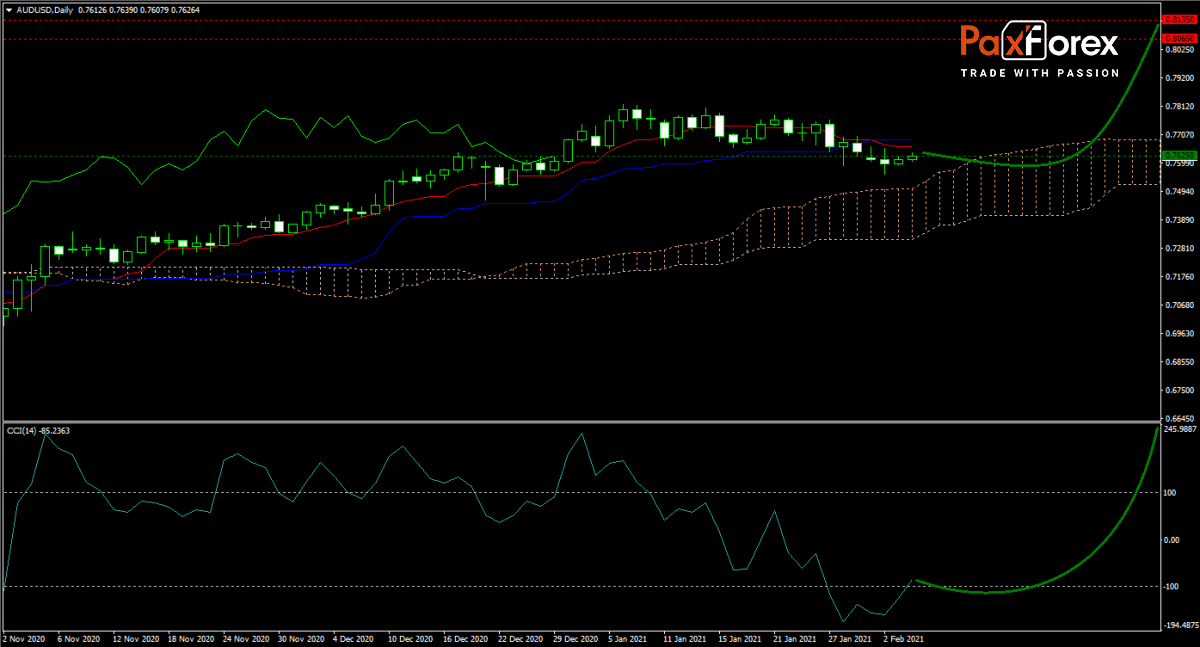

The forecast for the AUD/USD remains cautiously bullish. While the US economy remains weak, debt will explode further, with a rise in inflationary pressures is ignored. Australia continues to feel the pressure from its sour relationship with China. Price action is approaching its ascending Ichimoku Kinko Hyo Cloud, which could spark another rally. The Tenkan-sen and Kijun-sen turned sideways, but the CCI moved out of extreme oversold territory and has plenty of upside potential. Will bulls rally the AUD/USD into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.7590 to 0.7660 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7625

- Take Profit Zone: 0.8065 – 0.8135

- Stop Loss Level: 0.7555

Should price action for the AUD/USD breakdown below 0.7590 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7555

- Take Profit Zone: 0.7410 – 0.7460

- Stop Loss Level: 0.7590

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.