Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Australian Employment Change for January was reported at 29.1K. Economists predicted a figure of 40.0K. Forex traders can compare this to the Australian Employment Change for December, reported at 50.0K. The Unemployment Rate for January was reported at 6.4%. Economists predicted a reading of 6.5%. Forex traders can compare this to the Unemployment Rate for December, reported at 6.6%. 59.0K Full-Time Positions were created and 29.8K Part-Time Positions were lost in January. Forex traders can compare this to the creation of 35.7K Full-Time Positions and 14.3K Part-Time Positions, reported in December. The Labor Force Participation Rate for January was reported at 66.1%. Economists predicted a reading of 66.2%. Forex traders can compare this to the Labor Force Participation Rate for December, reported at 66.2%.

US Initial Jobless Claims for the week of February 13th are predicted at 765K, and US Continuing Claims for the week of February 6th are predicted at 4,413K. Forex traders can compare this to US Initial Jobless Claims for the week of February 6th, which were reported at 793K, and to US Continuing Claims for the week of January 30th, which were reported at 4,545K.

US Housing Starts for January are predicted at 1,658K starts, and Building Permits at 1,678K permits. Forex traders can compare this to US Housing Starts for December, reported at 1,669K starts and Building Permits, reported at 1,704K permits. The US Import Price Index for January is predicted to increase by 1.0% monthly, and the US Export Price Index is predicted to increase by 0.7% monthly. Forex traders can compare this to the US Import Price Index for December, which increased by 0.9% monthly, and to the US Export Price Index, which increased by 1.1% monthly. The Philadelphia Fed Manufacturing Index for February is predicted at 20.0. Forex traders can compare this to the Philadelphia Fed Manufacturing Index for January, reported at 26.5.

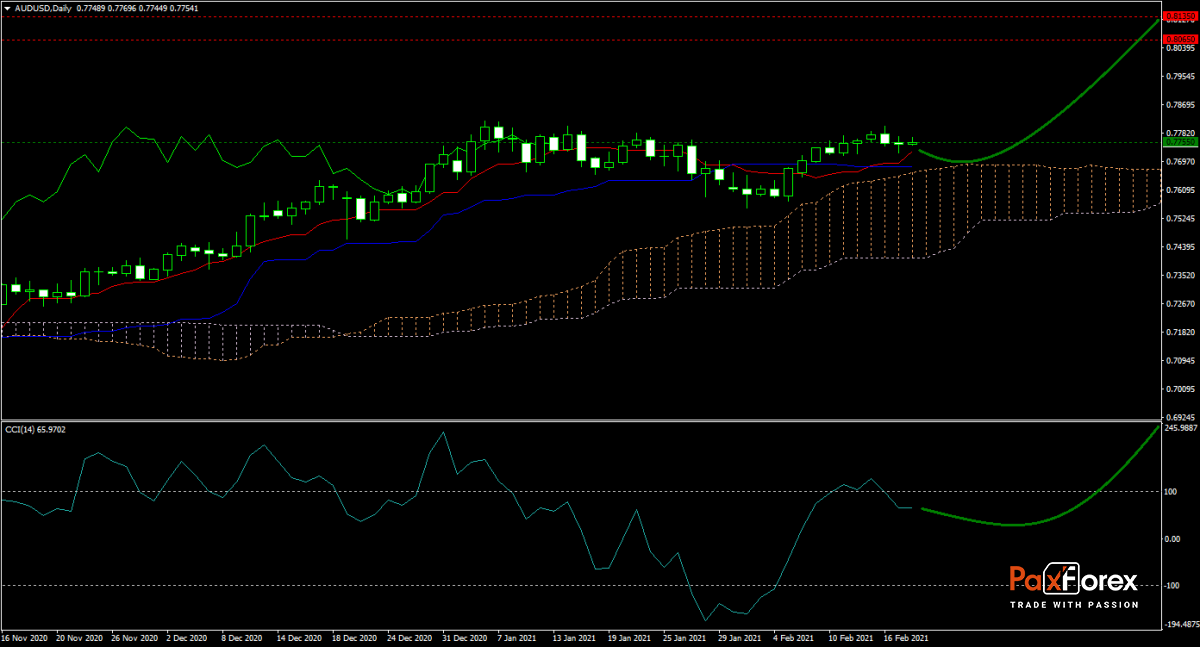

The forecast for the AUD/USD remains bullish despite the disappointment in the January employment report. Traders look forward to US initial jobless claims, which have also disappointed over the past two weeks. The Ichimoku Kinko Hyo Cloud started to narrow but supports more upside. With the Kijun-sen entering a sideways trend, the Tenkan-sen resumes its uptrend. The CCI moved out of extreme overbought territory but has more upside potential. Can bulls pressure the AUD/USD into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.7725 to 0.7790 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7755

- Take Profit Zone: 0.8065 – 0.8135

- Stop Loss Level: 0.7680

Should price action for the AUD/USD breakdown below 0.7725 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7680

- Take Profit Zone: 0.7540 – 0.7590

- Stop Loss Level: 0.7725

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.