Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian Retail Sales for November increased by 7.0% monthly. Economists predicted a decrease of 0.6% monthly. Forex traders can compare this to Australian Retail Sales for October, which increased by 1.4% monthly.

The Advanced US GDP for the third quarter is predicted to increase by 33.1% annualized. Forex traders can compare this to the second-quarter GDP, which decreased by 31.4% annualized. Corporate Profits for the third quarter are predicted to increase by 27.5% annualized. Forex traders can compare this to second-quarter Corporate Profits, which decreased by 10.7% annualized. The GDP Price Index for the third quarter is predicted to increase by 3.7% annualized. Forex traders can compare this to the second quarter GDP Price Index, which decreased by 2.1% annualized. The PCE for the third quarter is predicted to increase by 3.7% annualized. Forex traders can compare this to the second quarter PCE, which decreased by 1.6% annualized. The Core PCE for the third quarter is predicted to increase by 3.5% annualized. Forex traders can compare this to the second quarter Core PCE, which decreased by 0.8% annualized.

US Consumer Confidence for December is predicted at 97.0. Forex traders can compare this to US Consumer Confidence for November, reported at 96.1. US Existing Home Sales for November are predicted to decrease by 1.0% monthly to 6.70M. Forex traders can compare this to US Existing Home Sales for October, which increased by 4.3% monthly to 6.85M.

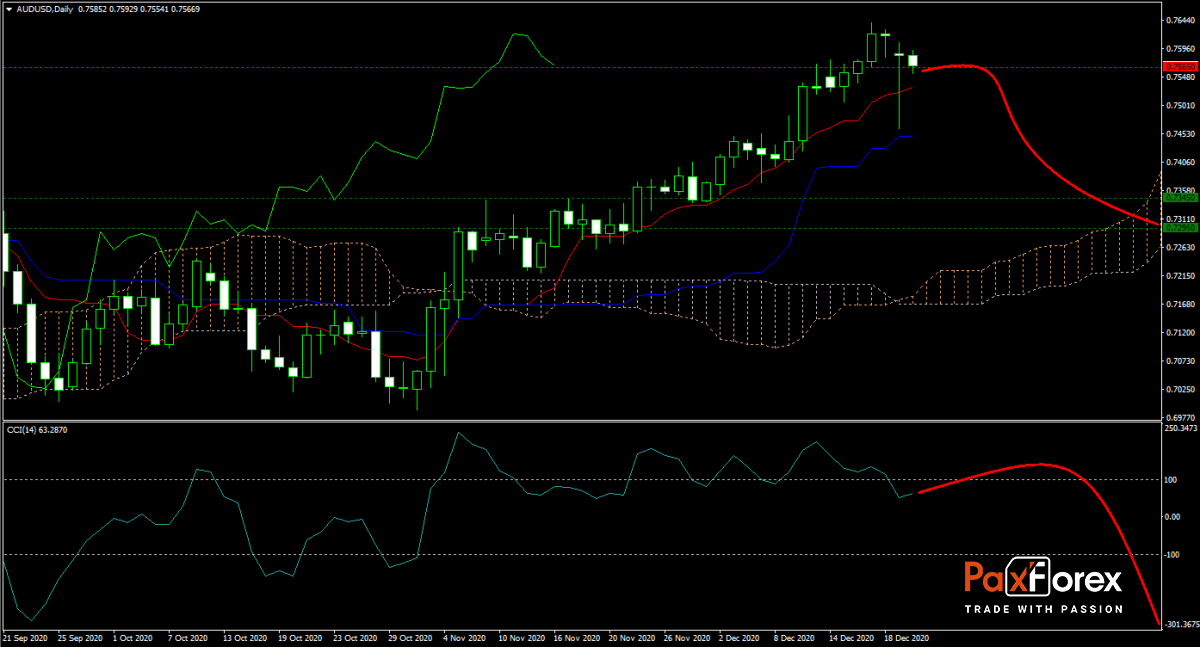

The forecast for the AUD/USD turned short-term bearish after failing to maintain its advance, but the long-term outlook remains bullish, driven by US Dollar weakness. With the Kijun-sen, Tenkan-sen, and the Ichimoku Kinko Hyo Cloud ascending, any temporary sell-off into its horizontal support area will eliminate excessive conditions in price action. The CCI moved out of extreme overbought territory and can accelerate to the downside amid an uncertain global economic outlook. Will bears capitalize on short-term weakness and force the AUD/USD to the downside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakdown below the 0.7530 to 0.7610 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7565

- Take Profit Zone: 0.7295 – 0.7345

- Stop Loss Level: 0.7630

Should price action for the AUD/USD breakout above 0.7610 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7630

- Take Profit Zone: 0.7685 – 0.7755

- Stop Loss Level: 0.7610

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.