Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian TD Securities Inflation for November increased by 0.3% monthly. Forex traders can compare this to Australian TD Securities Inflation for October, which decreased by 0.1% monthly. Australian Private Sector Credit for October was reported flat at 0.0% monthly and increased by 1.8% annualized. Forex traders can compare this to Australian Private Sector Credit for September, which was reported flat at 0.0% monthly, and which increased by 2.0% annualized. Australian Housing Credit for October increased by 0.3% monthly. Forex traders can compare this to Australian Housing Credit for September, which increased by 0.4% monthly.

Australian Inventories for the third quarter decreased by 0.5% quarterly, and Australian Company Operating Profits increased by 3.2% quarterly. Economists predicted a decrease of 0.7% and an increase of 4.5%. Forex traders can compare this to Australian Inventories for the second quarter, which decreased by 2.9% quarterly, and to Australian Company Operating Profits, which increased by 15.8% quarterly. Company Pre-Tax Profits for the third quarter increased by 25.8% quarterly. Forex traders can compare this to Company Pre-Tax Profits for the second quarter, which increased by 6.3% quarterly.

The New Zealand ANZ Activity Outlook for November increased by 9.1%, and ANZ Business Confidence was reported at -6.9. Forex traders can compare this to the New Zealand ANZ Activity Outlook for October, which increased by 4.7%, and to ANZ Business Confidence, reported at -15.7.

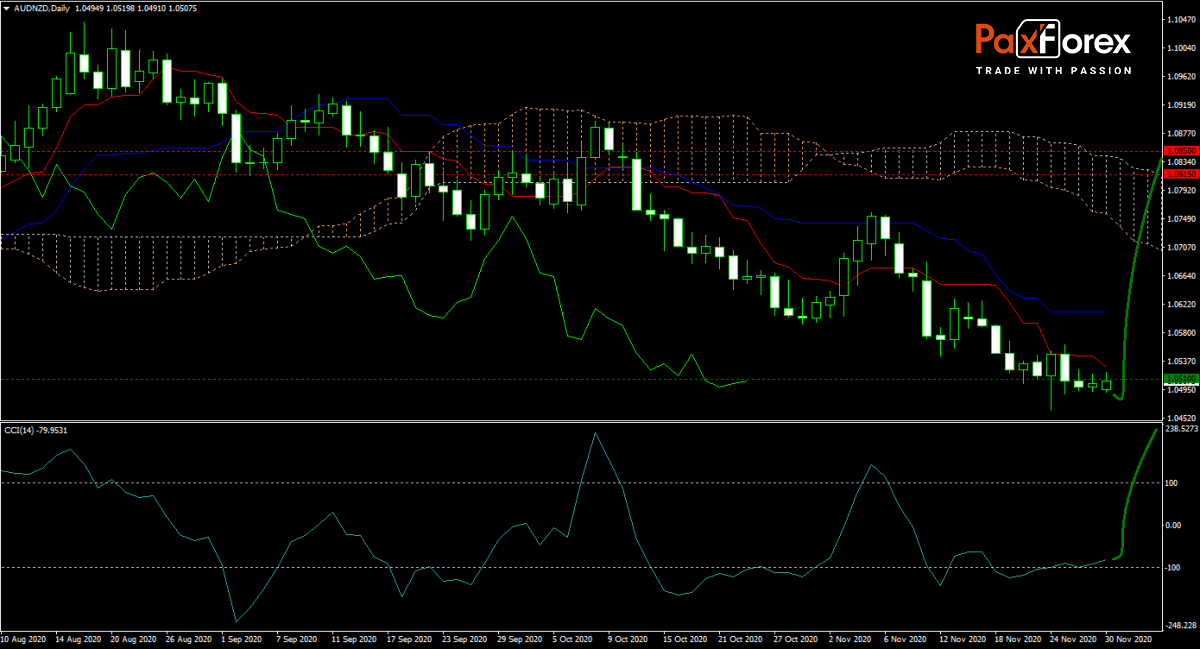

The forecast for the AUD/NZD turned bullish after the sell-off is losing momentum. With the Kijun-sen trending sideways, the Kijun-sen is expected to become the final indicator to flash a buy signal. It will allow price action to accelerate into its next horizontal resistance area on top of its Ichimoku Kinko Hyo Cloud. The CCI already exited extreme oversold territory, pointing towards more gains. Can bulls attempt a rally? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/NZD remain inside the or breakout above the 1.0465 to 1.0525 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0510

- Take Profit Zone: 1.0815 – 1.0850

- Stop Loss Level: 1.0450

Should price action for the AUD/NZD breakdown below 1.0465 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0450

- Take Profit Zone: 1.0400 – 1.0420

- Stop Loss Level: 1.0465

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.