The New Zealand Unemployment Rate for the first quarter was reported at 4.1%. Economists predicted an Unemployment Rate of 4.3%. Forex traders can compare this to the Unemployment Rate for the fourth quarter, which was reported at 4.0%. The Unemployment Change for the first quarter increased by 0.7%. Economists predicted a decrease of 0.3%. Forex traders can compare this to the Unemployment Change for the fourth quarter, which was reported flat at 0.0% quarterly. The Participation Rate for the first quarter was reported at 70.4%. Economists predicted a Participation Rate of 70.0%. Forex traders can compare this to the Participation Rate for the fourth, which was reported at 70.1%. The Labor Cost Index for the first increased by 0.3% quarterly and by 2.4% annualized. Economists predicted an increase of 0.4% and 2.5%. Forex traders can compare this to the Labor Cost Index for the fourth quarter, which increased by 0.6% quarterly and by 2.4% annualized.

Australian Retail Sales for March increased by 8.5% monthly. Economists predicted an increase of 8.2% monthly. Forex traders can compare this to Australian Retail Sales for February, which increased by 0.5% monthly. Australian Retail Sales, excluding Inflation, for the first quarter increased by 0.7% quarterly. Economists predicted an increase of 1.7% quarterly. Forex traders can compare this to Australian Retail Sales, excluding Inflation, for the fourth quarter, which increased by 0.5% quarterly.

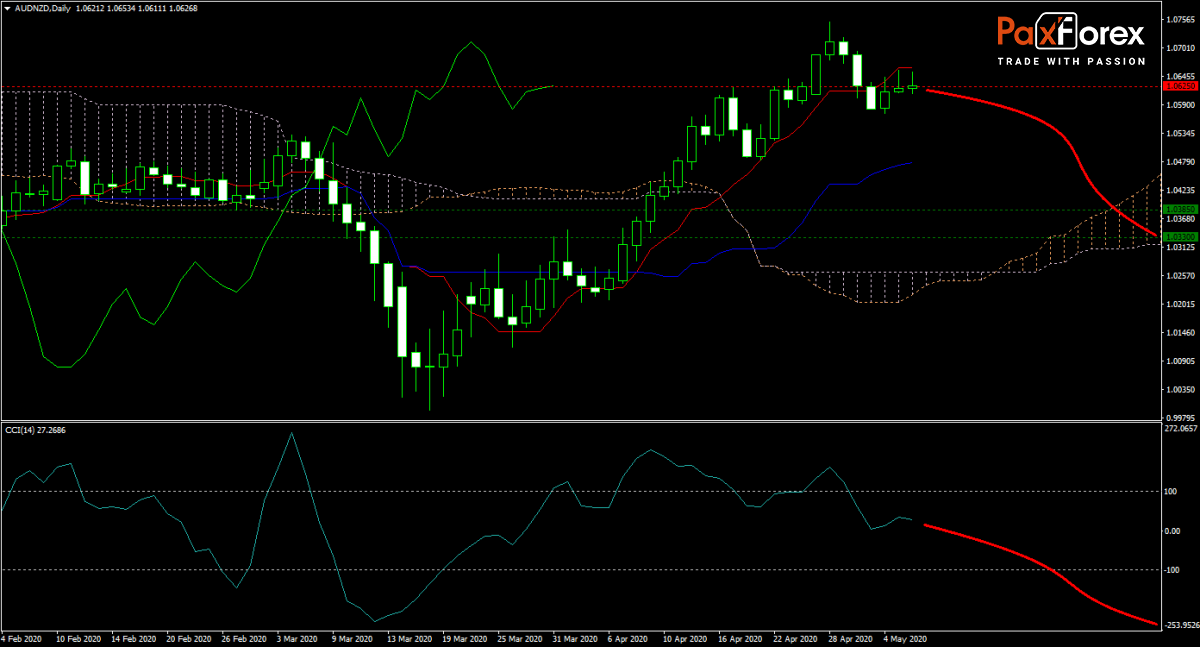

The AUD/NZD forecast has taken a bearish turn after price action moved below the Tenkan-sen, located just below its horizontal resistance area. Markets are cautiously monitoring the relationship between Australia and China, which could derail Australia’s medium and long-term prospects after Canberra took action to disrupt the fragile relationship. Will both sides smooth over their differences and move forward together, or will bears force this currency pair into the Ichimoku Kinko Hyo cloud? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/NZD remain inside the or breakdown below the 1.0600 to 1.0670 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0625

- Take Profit Zone: 1.0330 – 1.0385

- Stop Loss Level: 1.0720

Should price action for the AUD/NZD breakout above 1.0670 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0720

- Take Profit Zone: 1.0800 – 1.0865

- Stop Loss Level: 1.0670

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.