Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Australian Westpac Leading Index for January increased by 0.3% monthly. Forex traders can compare this to the Australian Westpac Leading Index for December, which increased by 0.1%. The Japan Reuters Tankan Index for February was reported at 3. Forex traders can compare this to the Japan Reuters Tankan Index for January, reported at -1.

Japanese Machine Orders for December increased by 5.2% monthly and by 11.8% annualized. Economists predicted a decrease of 6.2% and 3.0%. Forex traders can compare this to Japanese Machine Orders for November, which increased by 1.5% monthly, and which decreased by 11.3% annualized.

The Japanese Trade Balance for January was reported at -¥323.9B. Economists predicted a figure of -¥600.0B. Forex traders can compare this to the Japanese Trade Balance for December, reported at ¥749.6B. The Japanese Adjusted Trade Balance for January was reported at ¥0.39T. Forex traders can compare this to the Japanese Adjusted Trade Balance for December, reported at ¥0.51T. Exports for January increased by 6.4% annualized, and Imports decreased by 9.5% annualized. Economists predicted an increase of 6.6% and a decrease of 6.0%. Forex traders can compare this to Exports for December, which increased by 2.0% annualized, and to Imports, which decreased by 11.6% annualized.

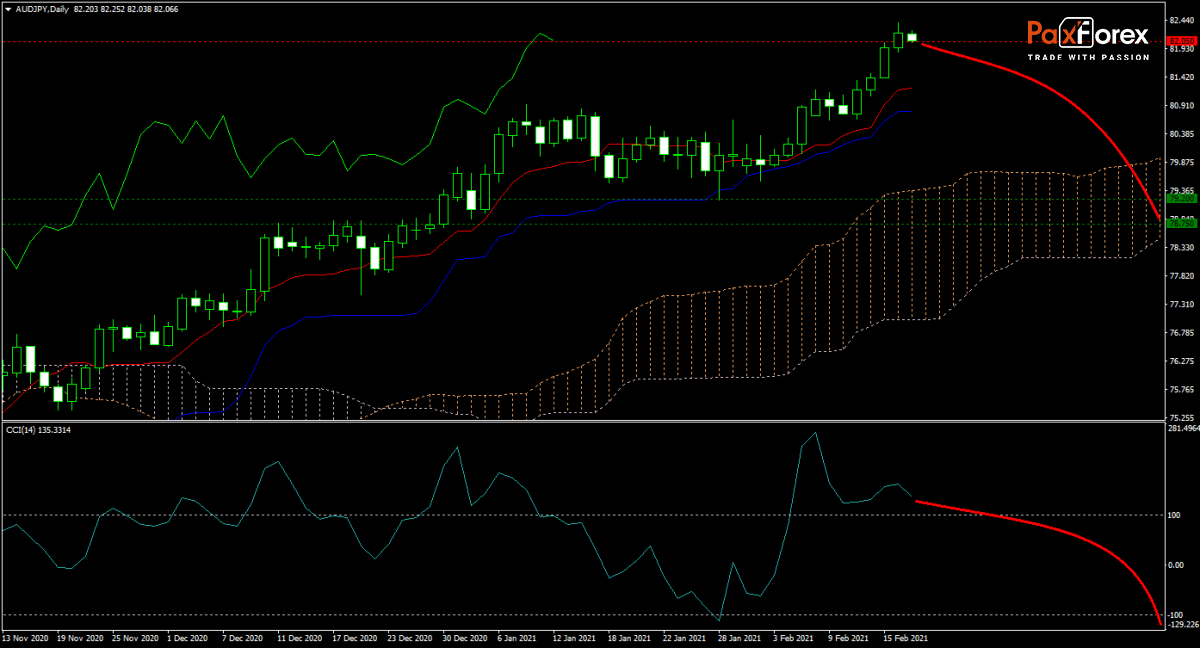

The forecast for the AUD/JPY is turning bearish amid overly bullish sentiment for risk assets globally. Most market participants ignore the threats and dark economic clouds on the horizon. Price action stalled, and the Kijun-sen started to move sideways, with the Tenkan-sen showing signs of exhaustion. The CCI continues to retreat from its peak and remains in extreme overbought territory. This currency pair is ripe for a correction into its ascending Ichimoku Kinko Hyo Cloud. Will bears pressure the AUD/JPY into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/JPY remain inside the or breakdown below the 81.850 to 82.400 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 82.050

- Take Profit Zone: 78.850 – 79.200

- Stop Loss Level: 83.000

Should price action for the AUD/JPY breakout above 82.400 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 83.000

- Take Profit Zone: 83.900 – 84.350

- Stop Loss Level: 82.400

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.